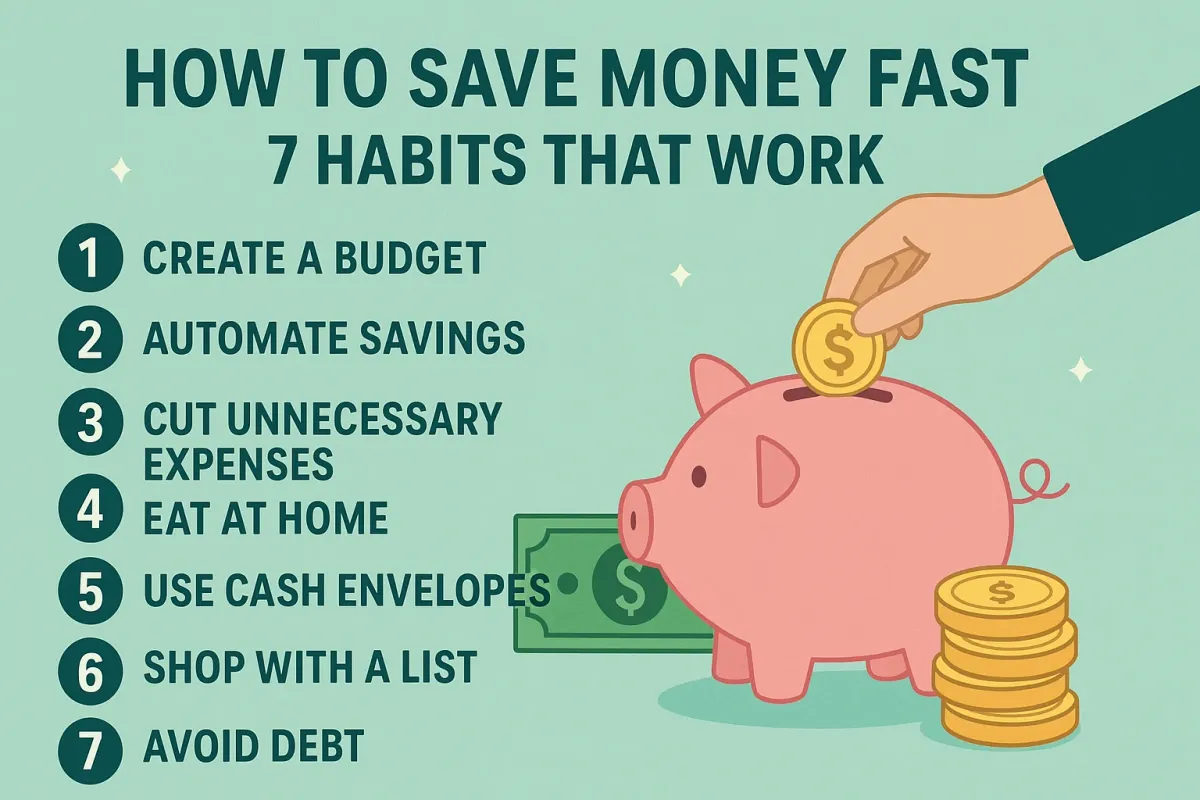

How to Save Money Fast: 7 Habits That Work

Learn practical, science-backed strategies in this how to save money fast guide, revealing seven habits that help you cut expenses, build discipline, and see results quicker than you expect.

Introduction

“Have you ever wondered how some people pay off their credit‑card debt in just months—while others seem stuck paying interest forever?” That’s the story of my friend Maya: one morning she decided to save $5,000 in just six months—and she did it. If you’ve ever wanted to change your save money fast story, you’re in the right place. Save Money Fast isn’t just a buzzword—it’s your tool for freedom: less stress, more options, and the power to say “yes” to what really matters in life.If you’re wondering how to save money fast, these 7 habits prove that small daily choices can create massive change.

What Does “How to Save Money Fast” Really Mean?

Defining Save Money Fast

At its core, Save Money Fast means building smart habits that let you keep more of what you earn—fast. It’s not the same as depriving yourself. Instead, it’s about making mindful choices that multiply your savings quickly. The benefits speak for themselves:Negotiating bills is one of the smartest ways to cut costs if you’re learning how to save money fast without stress.

- Quick wins reduce stress.

- Momentum builds confidence.

- Savings fuel bigger dreams—like vacations, education, or early retirement.

Why Building Fast Saving Habits Is a Game‑Changer

From Stress to Hope

When Maya paid off $3,000 in just two months, the look in her eyes changed. The weight of debt lifted, and she finally dared to dream. Studies even show that saving—even a little—boosts your mental health by reducing financial anxiety.By following these steps, anyone can master how to save money fast and take control of their finances.

Adapting Across the Globe

These habits work whether you live in New York, London, Sydney, or Delhi. Sure, prices and salaries differ—but smart saving is universal. It suits students, parents, freelancers, and anyone who wants more control over their money.

Habit 1: Automate Your Savings

Set It and Forget It

Choose a fixed amount—5%, 10%, $100—from each paycheck. Automate transfers to a separate savings account. When money moves out automatically, you never miss it. For example, Sara set hers to move ₹5,000 into a digital savings bolt every payday—and was surprised how quickly it added up.

Habit 2: Track Every Expense

Visibility = Control

When you download an app or use a simple notebook to list every coffee, Uber ride, or snack—that’s when true savings begin. Knowing your spending habits means spotting leaks. For example:

- A ₹150 daily latte = over ₹4,500 a month → cut back a few times per week, and boom: instant savings.

Tip: Use categories—“eating out,” “subscriptions,” “transport”—and challenge yourself: “Can I do this for ₹100 less next month?”

Habit 3: Reconsider Recurring Costs

Trim Smartly

Subscriptions are sneaky. Maya found she was paying for three streaming services—using only one. So she canceled two and saved ₹900/month.

Steps:

- Audit bank statements.

- Cancel or pause unused services.

- Only keep what adds real value.

Habit 4: Use the 24‑Hour Rule

Delay Gratification

Impulse buys kill budgets. The 24‑Hour Rule says: wait a full day before purchasing non-essentials. Most times, you’ll realize you don’t actually need that fancy gadget or impulse dress.

In fact, one study showed waiting 24 hours cuts impulsive spending by over 30%. It’s like your budget’s time‑out!

Habit 5: Negotiate Everything—From Bills to Prices

You’d Be Surprised

Bills, rent, insurance—most can be negotiated. Maya politely asked her cable provider for a loyalty discount and slashed ₹300/month. It doesn’t take much:

- Google “lower electricity rates” or “how to negotiate rent”

- Make a polite call: “I’ve been a customer since 2020—can I get a better rate?”

Even small wins add up.

Habit 6: Cook More, Eat Out Less

Tasting Savings

Eating out is one of the Save Money Fast. A homemade meal may cost ₹100–150, while restaurant food often hits ₹400–500. Cook more, meal-prep on weekends, and save big.

Maya started prepping meals on Sunday: five lunches for work that cost £2 each—compared to £8 at the cafeteria. That’s £150 savings every month!

Habit 7: Pause and Review Weekly

Weekly Check‑Ins = Success

Every Sunday, spend 15 minutes reviewing:

- How much did you spend?

- How much did you Save Money Fast?

- Where did you overspend?

- What’s one quick win for next week?

These mini check-ins help you adjust, feel in control, and see progress. It’s like fine‑tuning your money habits.

Putting the 7 Habits Together in Real Life

Maya’s Journey

- Week 1: Automated ₹2,000, tracked expenses, canceled two subscriptions.

- Week 2: Used 24‑Hour Rule to skip one splurge, negotiated mobile plan.

- Week 3: Learned to cook three recipes, meal-prepped lunches.

- Week 4: Did her Sunday review—saved ₹5,000 that month.

In six months, Maya saved ₹50,000 and paid off a ₹30,000 credit‑card bill. She now has an emergency fund—something she never thought possible.

FAQs: – Frequently Asked Questions”

1. How fast can I save money with these habits?

It depends on income and goals—but many people save ₹5,000–₹10,000 (or $100–$200) in just the first month by adopting them.

Which habit is most important?

Automating savings is the foundation—it makes saving feel effortless. Tracking comes next—it shows where your leaks are.

3. What if I don’t know my own spending?

Start with tracking every transaction for a week. You’ll surprise yourself—it’s the first step toward control.

4. Are these habits adaptable worldwide?

Yes. Whether you earn dollars, pounds, euros, rupees, or pesos—you’re still choosing to move extra cash into savings instead of spending. The 7 habits work everywhere.

5. Should I invest as well?

Once you build a 3‑month emergency fund, you’re in a great spot to start low‑cost investments, like index funds or SIPs. These boost your money’s growth.

6. Can I automate small amounts too?

Absolutely. Even ₹500/month saved automatically adds up—₹6,000 in a year. Consistency matters more than the amount.

7. What’s a good weekly review routine?

Spend just 10–15 minutes on Sundays: open your spending tracker, note categories where you overspent, set one saving goal for the week. Easy and effective.

You May Also Like

- Bonds and Fixed-Income Investing

- Credit vs. Debit Cards

- Long-Term Wealth Building

- The Benefits of Automating Your Finances: A Complete Guide

- Manage a Side Hustle Income

- Smart Money Moves for Entrepreneurs

- Plan to Become Financially Independent

- Diversifying Your Investment Portfolio

- Avoid 15 Common Credit Card Mistakes

- How to Pay Off Debt Faster: Proven Strategies

- Passive Income

- Credit Score Basics

- Stock Market

- Building an Emergency Fund

- Personal Budget and Stick

- Delhi Crime Season 3 Release Date Shocks Fans

- BB19 Shehbaz Girlfriend Reaction Goes Viral

- Why BB19 Gaurav Khanna Is Hinting at ‘Unfair Evictions’ Now

- 17 Best Cities for Street Food Every Traveler Should Visit to Avoid Missing Out on Incredible Eats

- 17 Unbeatable Factors That Explain Why Spider-Man Remains the Most Loved Superhero Worldwide

- Why the Delhi Red Fort Blast Probe Now Hinges on a Missing Third Car

- 15 World’s Most Peaceful Places to Disconnect & Recharge — And 5 Overrated Destinations to Skip in 2026

- 17 Essential Travel Safety Tips for Solo Travelers to Avoid Dangerous Mistakes and Travel Confidently