Why the USA Needs Its Own UPI Moment for Everyday Banking Convenience

This insight into why the USA needs its own UPI moment explains how a unified, real-time payment system could transform everyday banking—offering faster transactions, lower costs, and seamless digital

The UPI Moment for Everyday Banking in the USA could redefine how Americans pay, save, and manage money. While India’s Unified Payments Interface (UPI) has transformed daily transactions for over a billion people, the U.S. banking experience remains fragmented, slow, and often costly for consumers and small businesses.

Despite being home to world-class financial institutions and Silicon Valley innovation, the U.S. still lacks a universal, real-time, no-fee payment system that rivals India’s UPI. The result? Friction, fees, and frustration — especially when sending money between banks or small vendors.

Key Takeaways

- India’s UPI offers instant, free, interoperable digital payments for all — something America lacks.

- The U.S. needs a unified payment infrastructure like UPI to make banking faster and fairer.

- A UPI-like system could revolutionize small business transactions and personal finance in America.

What Is a “UPI Moment for Everyday Banking” and Why Does It Matter?

A “UPI moment” refers to a breakthrough in digital payments where technology, policy, and innovation converge to create instant, seamless, and free financial transactions across all banks and apps.

Launched in 2016 by the National Payments Corporation of India (NPCI), UPI allows anyone to send or receive money instantly using their smartphone — without extra fees or waiting times.

For Americans, imagine being able to:

- Instantly pay anyone, from a friend to a small vendor, without Venmo limits or Zelle restrictions.

- Move money between banks in seconds — not days.

- Enjoy total interoperability between payment apps, banks, and merchants.

That’s what India’s UPI has achieved — and it’s what the U.S. urgently needs.

$750 Amazon Gift Card

A $750 Amazon gift card may be available to select users. Checking eligibility is quick. You can check if you’re one of them.

Why the UPI Moment in the USA Matters

The U.S. financial system, while advanced, is outdated at the consumer level. Domestic bank transfers still rely on ACH systems that take 1–3 days, while card payments charge merchant fees up to 3%.

India, by contrast, enables instant, zero-cost transfers directly between bank accounts. As a result:

- India now processes over 12 billion digital payments monthly.

- UPI transactions exceed Visa and Mastercard volumes domestically.

- Every citizen — from gig workers to CEOs — participates in a single, unified digital economy.

If America embraced its own “UPI moment,” the impact could be transformative — cutting transaction costs, driving inclusion, and stimulating innovation in financial services.

What’s Holding the U.S. Back from Its UPI Moment?

Despite its technological prowess, the U.S. faces structural and cultural hurdles that delay a UPI-like transformation.

1. Fragmented Payment Systems

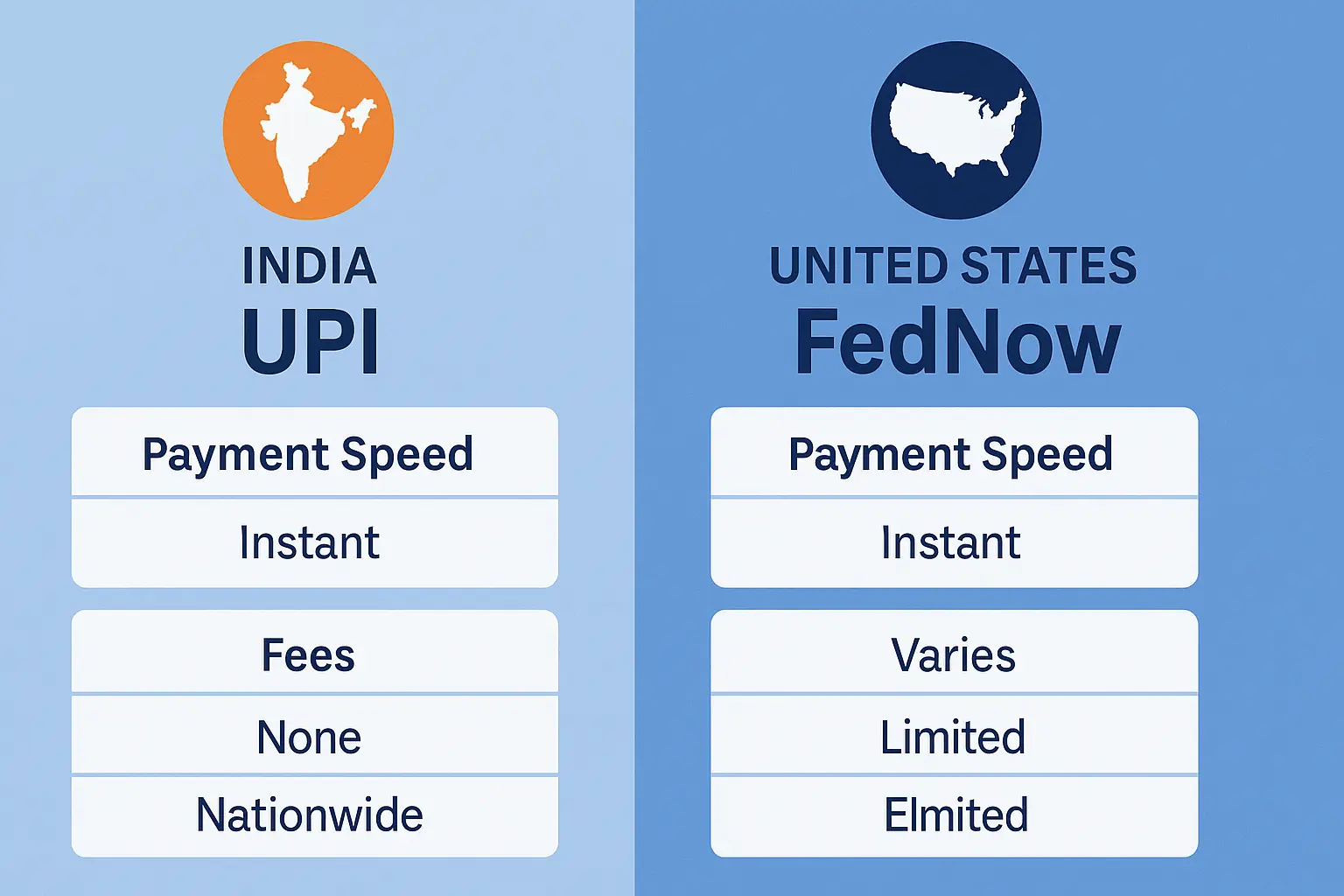

The U.S. relies on multiple private players — Zelle, Venmo, Cash App, PayPal, and now FedNow — each operating in silos. This fragmentation prevents universal interoperability.

2. Fee-Driven Infrastructure

Card networks and intermediaries thrive on transaction fees. Free, open access threatens existing business models tied to processing charges.

3. Regulatory Complexity

India’s fintech ecosystem benefited from public-private collaboration. In contrast, U.S. regulations are decentralized — split between federal and state authorities — complicating reform.

4. Consumer Behavior

Many Americans are accustomed to credit-based payments, unlike India’s mobile-first, real-time payment culture. Changing habits takes time and education.

Can the U.S. Really Build Its Own UPI?

Yes — but it requires a policy-backed digital public infrastructure that prioritizes inclusion over profit.

The Federal Reserve’s FedNow system, launched in 2023, is a promising start. It enables real-time payments between banks 24/7. However, unlike UPI, FedNow is not consumer-facing; it’s a backend tool for banks.

To achieve a true UPI moment in the USA, the system must:

- Be interoperable across all banks and fintech apps.

- Offer zero-cost transactions to users and merchants.

- Include a universal digital identity for verification (similar to Aadhaar in India).

- Enable API-driven innovation so private players can build on public infrastructure.

Without these pillars, America risks missing the chance to create a frictionless financial ecosystem.

Lessons America Can Learn from India’s Fintech Revolution

1. Government-Backed Infrastructure Works

UPI succeeded because it was built as public digital infrastructure — not a private platform. The U.S. can mirror this by supporting open, non-profit payment systems under government oversight.

2. Inclusion Drives Innovation

India’s model brought the unbanked into the digital economy. Similarly, the U.S. could empower low-income communities and small businesses excluded by high banking fees.

3. Interoperability Is Essential

UPI connects every bank and wallet under one protocol. The U.S. needs a common API layer that allows Venmo, Zelle, Cash App, and traditional banks to talk to each other seamlessly.

4. Real-Time Means Real Growth

Instant transactions improve cash flow for small businesses and freelancers. A UPI-like network in the U.S. could add billions in productivity gains annually.

How the U.S. Can Build Its Own UPI Moment

To replicate UPI’s success, America should follow a phased roadmap.

Step 1: Build an Open Digital Payment Framework

Adopt a national payment protocol supported by banks, fintechs, and the government — just like UPI’s NPCI structure.

Step 2: Make Interoperability Mandatory

Ensure all payment apps integrate into one unified system — breaking down barriers between private wallets and banks.

Step 3: Guarantee Zero-Cost Transfers

Remove transaction fees for P2P and small business payments to encourage adoption.

Step 4: Integrate Digital Identity

Use verified digital IDs (like driver’s license-linked profiles) to enable secure, instant KYC across platforms.

Step 5: Encourage Public-Private Collaboration

Fintech companies, banks, and regulators must work together — sharing APIs, data standards, and innovation incentives.

Common Myths About a UPI-Like System in the U.S.

Myth 1: “America already has Venmo and Zelle.”

Fact: These are private apps that don’t interoperate freely and often charge fees or have transfer limits.

Myth 2: “Instant payments are risky.”

Fact: With proper encryption, real-time payments can be as secure — or safer — than card-based systems.

Myth 3: “The U.S. economy doesn’t need this.”

Fact: A unified payment system would save billions in transaction fees annually and improve financial inclusion.

Expert Views and Reports

- IMF (2024): “India’s UPI has set a global standard for inclusive digital finance. The U.S. can benefit from adopting similar frameworks.”

- McKinsey (2025): “Real-time, fee-free payments could save American consumers over $20 billion annually.”

- Federal Reserve (2024): “FedNow’s success depends on consumer integration and open collaboration with fintech players.”

- World Bank: “Digital public infrastructure like UPI accelerates GDP growth by enabling small-scale commerce.”

$500 PayPal Gift Card

Some users qualify for a $500 PayPal gift card. You can check if you qualify.

FAQs

1. What is the UPI moment in the USA?

It refers to the potential creation of a unified, instant, and free payment system across all U.S. banks and fintech apps, inspired by India’s UPI.

2. How would a UPI-like system benefit Americans?

It would make payments instant, remove fees, and improve financial access for consumers and small businesses.

3. Is FedNow America’s version of UPI?

Not yet. FedNow supports real-time transfers between banks but isn’t consumer-facing or interoperable across fintechs.

4. What challenges stand in the way?

Fragmented systems, regulatory complexity, and entrenched business models dependent on fees.

5. When could the U.S. see its own UPI moment?

With collaboration among regulators, banks, and fintech innovators, a functional model could emerge by the late 2020s.

Key Takeaways

- The UPI moment in the USA would revolutionize banking convenience and inclusion.

- America needs interoperable, instant, and fee-free digital payments similar to India’s UPI.

- A unified system could boost economic productivity and reduce inequality.

- Public-private collaboration and open digital infrastructure are essential.

- The U.S. has the tools — it just needs the vision to create its own “UPI moment.”

Conclusion

The UPI moment in the USA is not a dream — it’s an opportunity waiting to happen. By learning from India’s fintech revolution and reimagining its own digital infrastructure, America can finally make everyday banking truly convenient, instant, and inclusive.

The future of finance won’t be about competition between banks and fintechs — it will be about collaboration for common prosperity. And when that moment comes, it will redefine not just payments, but participation in the digital economy itself.