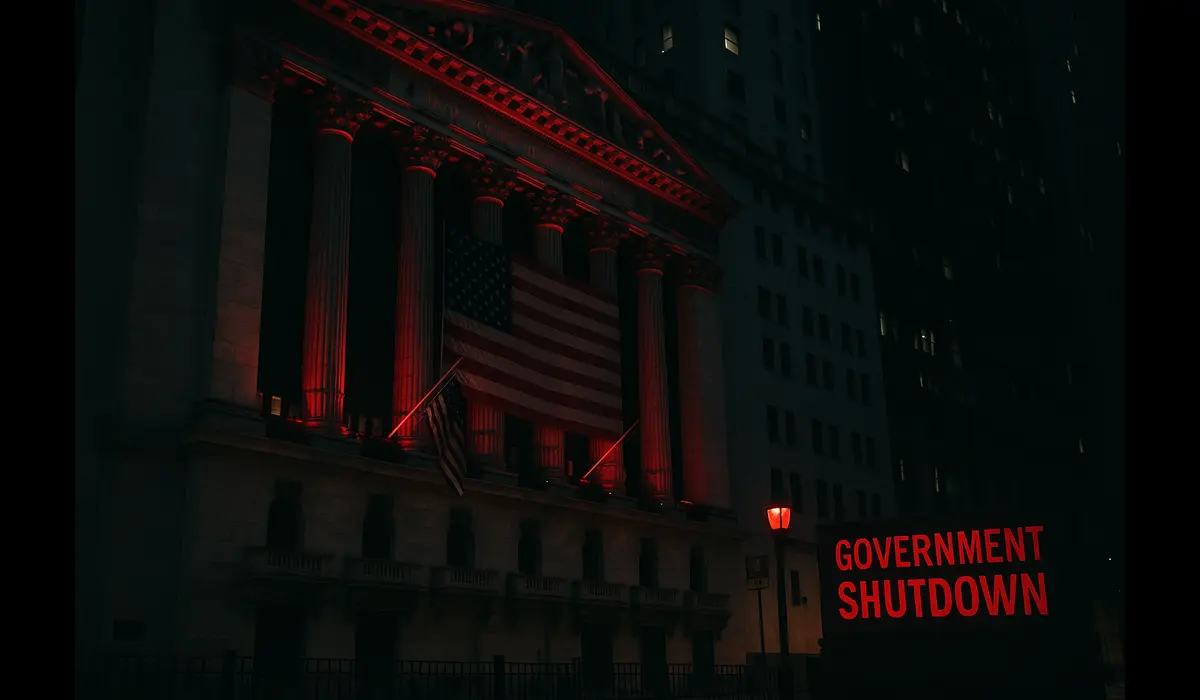

US Government Shutdown — 5 Shocking Market Impacts for Indian Investors

Discover the US government shutdown’s five shocking market impacts for Indian investors. This concise, research-driven teaser highlights risk factors, sector shifts, and the global signals shaping investment decisions in 2025.

US government shutdown latest developments for Indian investors are dominating global finance headlines. With Washington facing a funding impasse, markets have reacted with volatility, prompting caution among Indian investors with US-linked assets or global exposure.

US Government Shutdown Explained

A US government shutdown occurs when Congress fails to pass a budget or temporary funding measure. Federal agencies close non-essential services, delays affect paychecks, and market uncertainty spikes.

Latest Developments Impacting Indian Investors

- Debt Ceiling Standoff: Negotiations between US lawmakers stalled over spending cuts and fiscal priorities.

- Bond Market Response: US Treasury yields climbed as traders priced in risk, pressuring emerging market debt.

- Dollar-Rupee Volatility: USD strengthened early but corrected after Federal Reserve signaled liquidity support.

- Tech & Pharma Exposure: Nasdaq-listed companies with Indian outsourcing ties saw stock swings.

- Global Risk Sentiment: Equity indices across Asia dipped before partial rebound.

$750 Cash App Gift Card$750 Cash App Gift Card

Not everyone qualifies for this $750 Cash App gift card. Checking only takes a moment. You can check if you’re eligible.

How Indian Markets Reacted

- Sensex & Nifty: Mild correction as FIIs trimmed positions.

- Rupee: Brief depreciation past ₹84/USD before stabilizing.

- IT & Pharma Stocks: Mixed — some buying on dips but cautious global order flow outlook.

- Bond Yields: Domestic yields moved sideways as RBI maintained liquidity comfort.

Why This Matters to Indian Investors

- Foreign Portfolio Flows: A shutdown increases safe-haven flows to US Treasuries, pulling money from emerging markets.

- Currency Risk: Rupee can weaken if dollar demand spikes; hedging becomes important.

- Tech & Pharma Revenue: Payment delays or sentiment drop can weigh on US-facing exporters.

- Interest Rate Path: Prolonged shutdown may influence Fed policy, indirectly impacting RBI stance.

Portfolio Strategies Amid US Shutdown

- Stay Diversified: Maintain balanced exposure across asset classes.

- Hedge Currency Risk: Consider hedged funds or forward contracts if you hold dollar assets.

- Focus on Quality: Strong Indian blue chips less exposed to US volatility may offer stability.

- Avoid Panic Selling: Short-term volatility is normal; review but don’t overreact.

Indian Economy Outlook

Experts expect limited direct damage if the shutdown is short. Long disruptions could tighten global liquidity and weigh on risk appetite, indirectly affecting India’s capital inflows. Inflation and crude prices remain key watchpoints for RBI policy.

Key Takeaways

- US government shutdown latest developments for Indian investors center on volatility, currency swings, and portfolio caution.

- Short shutdown = limited impact; extended deadlock could dent global growth hopes.

- Smart hedging and disciplined allocation can protect portfolios.

$750 Amazon Gift Card

Not everyone qualifies for this $750 Amazon gift card. Checking only takes a moment. You can check if you’re eligible.

FAQs

1. What is the US government shutdown and why does it matter to Indian investors?

A US government shutdown happens when Congress fails to approve funding, halting non-essential federal services. It matters because it shakes global markets, affects foreign investor flows into India, and can move the dollar against the rupee.

2. How does the US government shutdown latest developments for Indian investors affect currency?

Dollar demand often spikes during uncertainty, making the rupee weaker. Short shutdowns have limited impact; longer ones can push USD/INR higher and hurt import costs.

3.Should Indian investors change their portfolios during a US government shutdown?

Avoid panic selling. Focus on diversification, hedge any heavy US dollar exposure, and stick to quality Indian equities or debt until clarity returns.

4.Will the shutdown impact Indian IT and pharma companies?

Yes, indirectly. Both sectors rely on US contracts and investor sentiment. Payment delays or reduced US spending can slow order flows and weigh on stock prices temporarily.

Conclusion

The US government shutdown latest developments for Indian investors underline how deeply connected global markets are today. Short-lived disruptions may cause only brief volatility, but a prolonged deadlock could push foreign capital away from emerging markets, move the dollar sharply, and pressure Indian stocks and bonds. Staying diversified, hedging currency exposure, and tracking policy cues from Washington and the Reserve Bank of India can help Indian investors ride out uncertainty with more confidence and stability.