Top UPI Alternatives in the USA: Is Instant Digital Payment the Next Big Thing?

This guide to UPI alternatives in the USA explores emerging instant-payment options, their speed and reliability, and whether America is finally ready for a unified digital payment breakthrough similar to India’s UPI.

Introduction

The race to develop UPI alternatives in the USA is reshaping the future of American finance. While India’s Unified Payments Interface (UPI) became a global success story—handling over 14 billion monthly transactions in 2025—the United States has been catching up, introducing instant payment systems like FedNow, RTP, and Zelle.

But here’s the million-dollar question: Can America match UPI’s simplicity, speed, and mass adoption?

The answer lies in the technology, regulation, and user experience behind these platforms.

Quick Summary:

- FedNow, RTP, and Zelle lead the list of UPI alternatives USA.

- Instant digital payments are America’s next fintech frontier.

- Seamless, secure, and interoperable systems are driving adoption across consumers and businesses.

What Are UPI Alternatives in the USA?

“UPI alternatives USA” refers to payment systems and digital platforms in the U.S. that enable real-time, 24/7 fund transfers between bank accounts—similar to how India’s UPI works.

However, while UPI is a centralized government-backed platform, American systems are a mix of public and private initiatives.

$750 Amazon Gift Card

Some users qualify for a $750 Amazon gift card. You can check if you qualify.

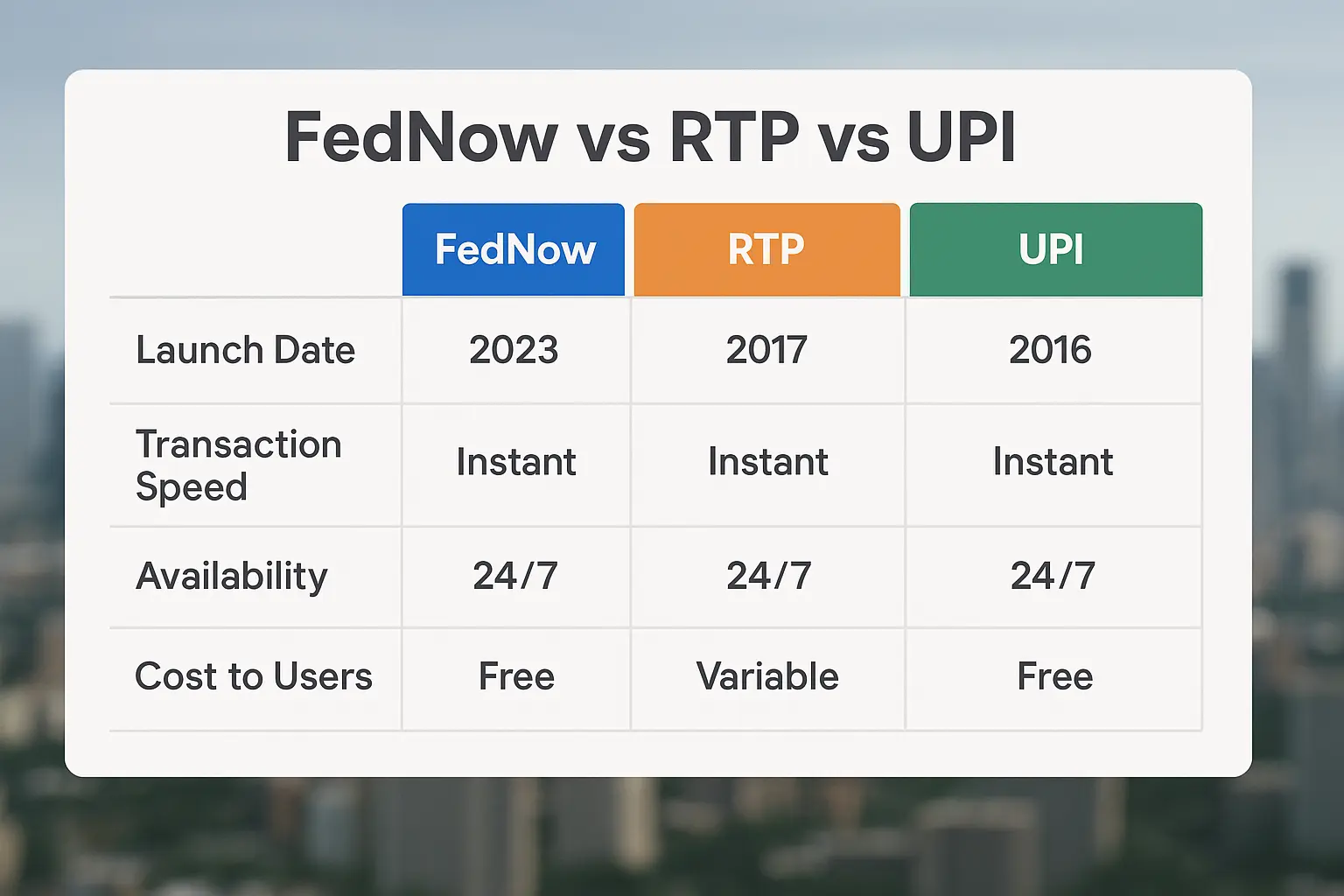

Here’s how they compare:

| Feature | India (UPI) | USA (FedNow / RTP / Zelle) |

|---|---|---|

| Launch Year | 2016 | 2017–2023 |

| Operated By | NPCI (Govt-backed) | Federal Reserve, Private Banks |

| Availability | Nationwide | Select banks, expanding |

| Transaction Time | Instant | Instant (24/7 for FedNow) |

| Merchant Access | QR-based | App & account-based |

| Cross-border | Yes (limited) | Not yet universal |

In essence, America’s UPI-like systems aim to replicate UPI’s convenience—just with different infrastructure and market dynamics.

Why Instant Digital Payments Matter

- Consumer Behavior Shift: Americans increasingly prefer instant peer-to-peer and merchant transfers.

- Business Efficiency: Real-time settlements enhance cash flow and reduce processing lags.

- Global Influence: With India’s UPI gaining international attention, U.S. fintech leaders are under pressure to match that scale.

- Innovation Trigger: Instant digital payments encourage open banking, cross-border fintech, and AI-driven fraud detection.

By 2024, the U.S. processed over $800 billion in instant transactions, up 37% from 2023 (source: Federal Reserve data).

Core Systems Competing as UPI Alternatives in the USA

1. FedNow — The U.S. Central Bank’s Instant Payment System

Launched: July 2023 by the Federal Reserve.

What it does: Enables 24/7 instant transfers between banks, credit unions, and merchants.

Adoption: Over 800 institutions are already live.

How It Compares to UPI:

- FedNow is infrastructure, not an app—banks build on top of it.

- It enables transfers directly between bank accounts, similar to UPI’s core.

- Transactions clear in seconds, available every day of the year.

Key Limitation:

- Adoption depends on banks integrating FedNow APIs into consumer apps.

2. RTP (Real-Time Payments) Network — The Private Sector Rival

Owner: The Clearing House (TCH)

Launched: 2017

RTP is a private-sector equivalent to FedNow, designed for banks to offer instant payment features to users and businesses.

Highlights:

- Available across 65% of U.S. deposit accounts.

- Supports “Request for Payment” (similar to UPI pull requests).

- Used by major banks like JPMorgan, Citi, and Wells Fargo.

Why It Matters: RTP’s interoperability and speed make it a direct “UPI-like” experience—minus QR codes.

3. Zelle — The Peer-to-Peer Powerhouse

Launched: 2017

Integrated With: 1,700+ U.S. banks

Zelle is America’s most widely used P2P instant transfer app. Unlike UPI, it’s bank-owned—but provides similar ease for person-to-person transactions.

Pros:

- Built into bank apps, secure, no fees for users.

- Transactions clear in minutes.

Cons:

- Not merchant-friendly (limited QR or in-store use).

- No cross-border support yet.

Still, Zelle handles billions of P2P transactions yearly, proving America’s appetite for instant cash movement.

4. Cash App & Venmo — The Fintech Experience Layer

Both Cash App (by Block Inc.) and Venmo (by PayPal) bring social payments and digital wallets into mainstream use.

Why They Matter:

- Offer instant P2P transfers.

- Enable small business payments.

- Add features like crypto, debit cards, and direct deposits.

They serve as UPI-like consumer interfaces—bridging banks, wallets, and merchants.

5. Apple Pay & Google Pay — The Hybrid Wallet Ecosystem

While not direct payment rails, these apps integrate with banks, enabling contactless instant transactions at millions of U.S. locations.

Their advantage lies in consumer familiarity and smartphone integration—similar to how PhonePe or Paytm ride on UPI rails in India.

Are UPI Alternatives in the USA Ready for Mass Adoption?

The short answer: not yet, but soon.

Here’s why adoption still lags behind India:

- Fragmented Systems: Multiple providers (FedNow, RTP, Zelle) mean scattered user experience.

- Merchant Integration: QR-based universal payment acceptance is limited.

- Public Awareness: Many users still rely on credit/debit cards.

- Fees and Limits: Some banks charge small transaction fees for “instant” services.

However, 2025 is pivotal—U.S. regulators and fintechs are actively collaborating to create interoperable instant payment frameworks, much like UPI’s open design.

How to Use These Systems Effectively (Best Practices)

- Link Verified Bank Accounts: Ensure your app supports FedNow or RTP-enabled banks.

- Use Official Apps: Prefer bank-native or verified apps like Zelle or Cash App.

- Enable Two-Factor Authentication: Secure all real-time transactions.

- Cross-Border Transfers: Use fintech bridges like Wise or Remitly until UPI-like integrations expand.

- Avoid Scams: Instant transfers are irreversible—verify recipient details carefully.

- Monitor Limits: Many apps cap instant payments (e.g., Zelle $3,000/day).

Common Myths & Misconceptions

- Myth 1: Zelle is the American UPI.

False. Zelle connects banks but lacks QR codes, merchant payments, and public APIs. - Myth 2: FedNow replaces all other systems.

FedNow is an infrastructure layer, not a consumer app. - Myth 3: Instant means free.

Not always—banks may charge for certain FedNow or RTP transactions. - Myth 4: UPI and U.S. systems can’t connect.

Emerging cross-border pilots are testing UPI-FedNow and UPI-RTP bridges.

Expert Views & Market Insights

- Federal Reserve (2025): FedNow aims for “nationwide ubiquity by 2026,” mirroring UPI’s scalability model.

- JPMorgan Payments Research: “RTP volume growth of 30% YoY shows Americans are ready for instant payments.”

- McKinsey Fintech Report 2024: Predicts U.S. real-time transactions to exceed 5.2 billion annually by 2026.

- Comparative Insight: India’s UPI succeeded due to open APIs and zero-fee model—U.S. systems are learning fast.

$750 Cash App Gift Card

Some users qualify for a $750 Cash App gift card. You can check if you qualify.

FAQs

Q: What are the top UPI alternatives in the USA?

FedNow, RTP, Zelle, Cash App, and Venmo are leading UPI alternatives USA for instant payments.

Q: Is FedNow like UPI?

Yes, in function—both enable real-time fund transfers, but FedNow is bank-based while UPI is public infrastructure.

Q: Are instant payments available 24/7 in the U.S.?

Yes, both FedNow and RTP operate round-the-clock, unlike legacy ACH systems.

Q: Can Indians use UPI in the USA?

Not directly, but select cross-border integrations with U.S. banks and apps are in progress.

Q: Is instant digital payment the next big thing in America?

Absolutely. With FedNow and RTP scaling, real-time transactions are set to redefine U.S. consumer payments.

Key Takeaways

- UPI alternatives USA like FedNow, RTP, and Zelle are rapidly expanding.

- America’s payment ecosystem is shifting from card-first to instant-first.

- FedNow’s public rail could unify real-time transactions across banks.

- Merchant adoption and interoperability remain the key challenges.

- Instant digital payments are not a trend—they’re America’s next transformation.

Conclusion

The rise of UPI alternatives USA signals a major shift in how Americans move money. While UPI revolutionized India, the U.S. is evolving its own ecosystem—more complex but potentially just as powerful.

Instant digital payment is no longer a luxury; it’s the new normal. And with government-backed initiatives like FedNow, private rails like RTP, and consumer apps like Zelle, the U.S. may soon have its own version of the UPI revolution—just built the American way.