Retirement Planning in the USA: Can India’s PPF and NPS Models Work Here?

This breakdown of retirement planning in the USA examines whether India’s PPF and NPS systems could strengthen long-term savings, offering insights into what America can learn from these proven retirement models.

Introduction

Retirement Planning in the USA is reaching a tipping point. With over 50% of Americans having less than $100,000 in savings for their golden years, the search for sustainable and secure retirement models has never been more urgent. As U.S. policymakers and savers explore alternatives, two Indian success stories — the Public Provident Fund (PPF) and the National Pension System (NPS) — stand out as intriguing models.

Could India’s structured, low-risk, government-backed retirement systems work in the American landscape of 401(k)s, IRAs, and private funds?

Let’s explore what makes these systems unique and whether adapting them could solve America’s growing retirement crisis.

Key Takeaways

- India’s PPF and NPS offer government-backed, low-risk savings with steady returns.

- The U.S. system relies heavily on private markets, exposing retirees to volatility.

- A hybrid U.S.–India retirement model could create sustainable, inclusive financial security.

$500 Walmart Gift Card

Not everyone qualifies for this $500 Walmart gift card. Checking only takes a moment. You can check if you’re eligible.

What Is Retirement Planning in the USA?

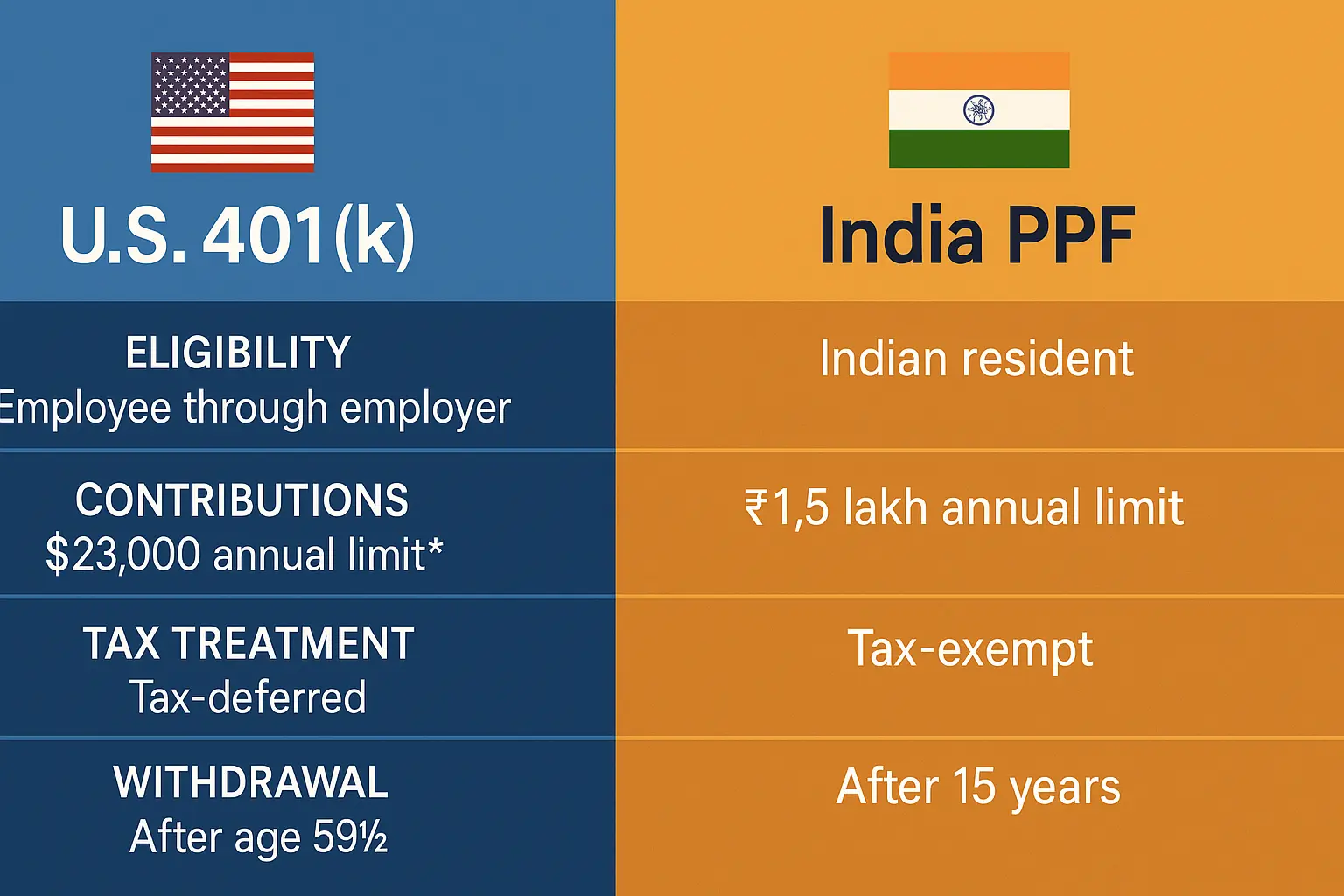

Retirement planning in the USA refers to preparing financially for the post-employment phase of life through savings, investments, and social benefits. The American system largely revolves around:

- 401(k) plans – employer-sponsored, tax-deferred accounts.

- IRAs (Traditional and Roth) – self-managed individual accounts.

- Social Security benefits – government-provided income support.

While these tools have helped millions, they come with significant challenges — market dependence, uneven access, and inadequate returns for lower-income earners.

Why It Matters

The U.S. faces a retirement readiness crisis. According to the Federal Reserve, one in four Americans has no retirement savings. Rising inflation and healthcare costs further erode the value of existing savings.

In contrast, India’s PPF and NPS emphasize long-term stability, guaranteed returns, and broad inclusion, providing a potential blueprint for reforming the U.S. approach to retirement planning.

Could India’s PPF and NPS Models Work in the USA?

1. Understanding the Indian PPF Model

The Public Provident Fund (PPF) is a government-backed, long-term savings plan introduced in 1968. It allows individuals to invest small amounts annually and enjoy tax-free, guaranteed returns, with a 15-year lock-in period.

Key Features:

- Safe and stable: Backed by the Indian government.

- Tax benefits: Exempt under India’s income tax law.

- Fixed interest rates: Averaging 7–8% annually.

- Accessibility: Open to all citizens regardless of employer.

If the U.S. adopted a similar model, it could offer a universal, government-secured retirement account to citizens without employer-sponsored plans — especially gig workers and small business owners.

2. The National Pension System (NPS): A Modern Hybrid

The NPS is a market-linked pension scheme launched in 2004, blending government oversight with private fund management. It allows participants to choose investment mixes across equity, government securities, and corporate bonds.

Key Features:

- Flexible contribution amounts.

- Portable across jobs.

- Low management costs (<0.02%).

- Partly guaranteed through regulated funds.

In many ways, the NPS mirrors a low-cost, transparent 401(k) — but with national portability and partial safety nets.

3. Adapting PPF and NPS to the American Context

If America were to integrate Indian principles into its system, it could take shape as:

- U.S. Universal Provident Fund (UPF): A government-backed savings plan with tax-free returns and guaranteed interest for low-risk savers.

- National Pension Advantage (NPA): A restructured public-private pension system emphasizing transparency, lower fees, and sustainable returns.

Such models could especially benefit gig workers, freelancers, and small-business employees, who are often excluded from 401(k) benefits.

How Would a PPF or NPS-Type Model Benefit Americans?

| Feature | Current U.S. System | PPF/NPS Approach |

|---|---|---|

| Risk Profile | Market-dependent | Stable, partly guaranteed |

| Accessibility | Employer-based | Universal access |

| Costs | High management fees | Minimal fees |

| Taxation | Complex & limited benefits | Simplified & consistent |

| Inclusivity | Uneven (excludes self-employed) | Open to all citizens |

Why the U.S. Needs a New Retirement Paradigm

- Gig Economy Boom: Over 60 million Americans work independently without employer-sponsored retirement plans.

- Market Volatility: Recessions can wipe out decades of savings.

- Longevity: People are living longer, increasing retirement income needs.

- Inequality: The wealthiest 10% hold 70% of retirement assets.

A government-backed, accessible, and guaranteed system — inspired by India’s PPF/NPS — could serve as a stabilizer against market uncertainty and inequality.

What Are the Barriers to Implementation in the USA?

- Cultural Resistance: Americans are accustomed to private-market retirement vehicles.

- Policy Complexity: Introducing a universal, government-backed savings fund would require massive bipartisan consensus.

- Fiscal Implications: Guaranteeing returns could pressure federal budgets.

- Financial Lobbying: Private fund managers might resist competition from public models.

Still, public demand for secure, inflation-proof savings could drive momentum toward reform.

How to Build a PPF- or NPS-Inspired Retirement Plan in the U.S.

Step 1: Establish Government-Backed Accounts

Launch a voluntary “Universal Savings Account” similar to PPF, offering guaranteed, tax-free returns up to a limit.

Step 2: Simplify Enrollment

Allow automatic account creation tied to Social Security numbers for accessibility.

Step 3: Offer Tiered Investment Choices

Like NPS, provide risk-based portfolios (conservative, balanced, aggressive) managed by both public and private entities.

Step 4: Incentivize Long-Term Savings

Add matching contributions or tax credits for lower-income participants to promote retention.

Step 5: Integrate Digital Access

Use fintech platforms for real-time balance updates, portability, and automated contributions.

Common Myths About Adopting Foreign Pension Models

Myth 1: “Government-Backed Funds Always Lose Money.”

In reality, India’s PPF has delivered steady, inflation-beating returns for 50+ years — proving that well-regulated public funds can thrive.

Myth 2: “The U.S. System Is Already Efficient.”

Administrative costs in 401(k) plans can reach 1–2% annually, eroding long-term returns — compared to India’s NPS cost below 0.02%.

Myth 3: “Americans Won’t Trust Government-Run Funds.”

Social Security remains one of the most trusted federal programs — suggesting that trust isn’t the issue, performance is.

Expert Views and Case Studies

Case Study 1: India’s NPS Performance

Between 2010 and 2024, NPS funds delivered 9–11% annualized returns, outperforming many active mutual funds while maintaining strict oversight.

Case Study 2: U.S. Auto-IRA Programs

States like Oregon and California introduced state-run retirement programs with positive early outcomes — proving that Americans are open to hybrid models.

Expert View:

Dr. Arun Bhattacharya, economist and pension researcher, notes:

“A PPF-style universal savings framework could reduce retirement inequality in the U.S. while encouraging disciplined long-term investing.”

FAQs

1. How could PPF work for retirement planning in the USA?

A U.S. version of PPF could act as a federal savings program with guaranteed returns and tax-free growth for citizens without employer plans.

2. Is the NPS similar to the U.S. 401(k)?

Yes, but NPS offers more flexibility and lower costs while maintaining regulated oversight to protect investors.

3. Would PPF and NPS reduce dependence on Social Security?

Yes. These models could supplement Social Security by providing personalized savings growth and pension-like income.

4. Can Americans currently invest in India’s NPS or PPF?

No, these systems are exclusive to Indian citizens. But their concepts could inspire American policy reforms.

Key Takeaways

- Retirement Planning in the USA can benefit from India’s PPF and NPS principles — stable, inclusive, and transparent systems.

- These models could fill the gaps left by 401(k)s and IRAs, especially for gig workers.

- Implementing a universal, low-cost, government-backed savings program would improve long-term financial security.

- Public trust and smart design are key to adapting India’s success to the American context.

Conclusion

Retirement Planning in the USA is at a crossroads. The Indian models — PPF and NPS — showcase how disciplined, inclusive, and low-risk systems can sustain millions of retirees without market anxiety.

While no system is perfect, adapting their structure could create a more equitable and sustainable American retirement ecosystem — one that prioritizes security, simplicity, and shared prosperity.