What Is a Private Student Loan and How to Apply for Private Loans in America?

Private student loans are education loans from banks or private lenders used when other aid isn’t enough. This article explains what they are, how approval and interest rates work, and what borrowers should understand about risks and repayment before applying

The real question behind this

Most people do not start college planning with private student loans in mind.

They reach this option only when federal aid, grants, and scholarships fall short.

At that moment, the system feels less transparent and more financially risky.

The real question is how private student loans actually work and what responsibility they create over time.

Types of private student loans (comparison)

These types differ mainly in who carries the debt and how repayment risk is allocated.

| Loan category | Primary borrower | Core purpose | Structural risk |

|---|---|---|---|

| Student private loan | Undergraduate or graduate student | Cover unmet education costs | Credit approval often requires co-signer |

| Parent private loan | Parent or guardian | Finance dependent student’s education | Parent assumes full legal repayment |

| Career or certificate loan | Students in non-degree programs | Fund short-term or vocational study | Limited deferment and flexibility |

| Private refinance loan | Graduates with existing loans | Adjust interest or repayment structure | Credit-based approval, no federal protections |

What this means

A private student loan is education financing provided by a non-government lender, such as a bank, credit union, or private finance company.

These loans are governed by private contracts, not federal education law.

As a result, approval rules, interest rates, repayment terms, and protections differ by lender.

The defining feature is that private student loans are credit-driven, not need-based.

Private student loans are designed to supplement, not replace, other forms of education funding.

They exist to close funding gaps, but they transfer more financial risk to the borrower.

$750 Amazon Gift Card

Some users qualify for a $750 Amazon gift card. You can check if you qualify.

Key takeaways

Private student loans are designed to cover educational expenses and are available through banks, credit unions and online lenders.

Types of private student loans include degree-specific, parent, international student, bad credit, state-specific, income share agreements and refinancing options.

Comparing multiple lenders, assessing interest rates and reviewing repayment terms are crucial to securing the best deal.

How this works in practice

How private lenders evaluate risk

Private lenders assess applicants using standard credit underwriting models.

Key inputs include credit score, payment history, current income, employment stability, and debt obligations.

Students with limited credit history are frequently approved only with a co-signer.

The practical outcome is that approval reflects financial reliability, not academic enrollment alone.

Key point: Private loans treat education borrowing like consumer credit.

How the application process actually functions

Applications are submitted directly to the lender, not through a centralized system.

Borrowers provide personal details, financial information, and authorization for a credit check.

The lender verifies enrollment status and confirms the school’s certified cost of attendance.

Approval results in a loan disclosure that outlines rates, fees, repayment timing, and obligations.

Key point: Each lender operates independently, so terms are not uniform.

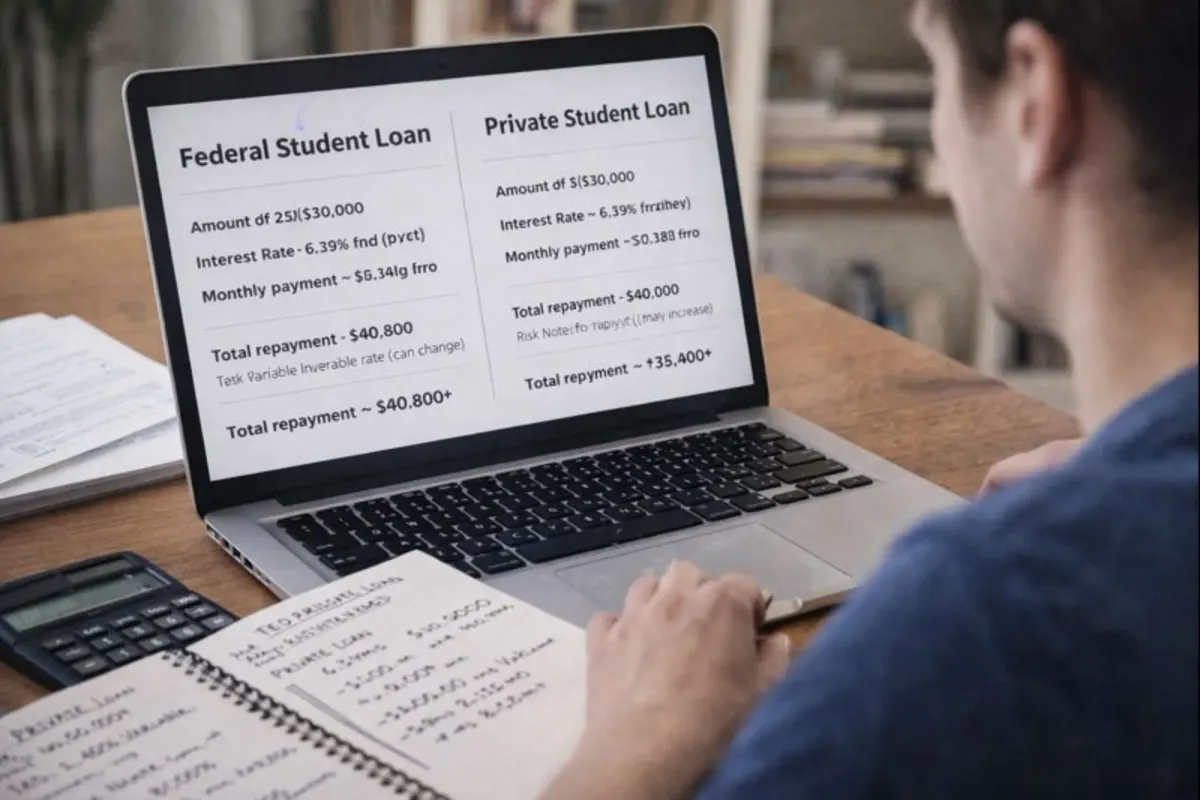

How interest rates are structured

Private student loans may offer fixed or variable interest rates.

Fixed rates remain constant, while variable rates fluctuate with market benchmarks.

Rates are determined by credit profile and broader financial conditions at approval.

Over long repayment periods, variable rates can significantly increase total cost.

Key point: Interest structure affects long-term affordability more than initial approval.

How repayment terms influence financial outcomes

Repayment options vary widely between lenders.

Some allow in-school payments, others defer until graduation, and some require immediate interest payments.

Private loans generally lack income-based repayment guarantees.

Missed payments can trigger fees, credit damage, and co-signer liability.

Key point: Repayment flexibility is contractual, not guaranteed.

How borrowing limits shape long-term debt

Private loans may allow borrowing up to the full cost of attendance after other aid.

There are no federally imposed annual or lifetime caps.

This flexibility can increase access but also increase debt exposure.

Responsible borrowing depends on realistic income expectations after graduation.

Key point: Higher limits increase choice but also amplify risk.

Important Considerations

- Cost: Private loans can be more expensive than federal loans.

- Liability: If you use a co-signer, they are equally responsible for the debt.

- Rates: A good credit score (typically 670 or higher) is usually required to get the best rates.

Comparisons and alternatives

- Private student loans are credit-based, while federal loans are eligibility-based

- Private loans lack standardized protections such as income-driven repayment

- Co-signers are legally responsible for missed payments

- Federal loans typically offer clearer long-term safety nets

These differences explain why private loans are usually considered after federal options.

Quick Understanding Summary

A private student loan is education funding provided by banks or private lenders rather than the government.

Approval depends on creditworthiness, often requiring a co-signer, and loan terms vary by lender.

These loans can cover funding gaps but include fewer protections than federal loans.

Understanding interest structure, repayment flexibility, and long-term obligations is essential before borrowing.

Common mistakes to avoid

Many borrowers assume private loans follow the same rules as federal loans.

Others focus only on approval and overlook variable interest rate exposure.

Borrowing the maximum allowed without income planning increases repayment strain.

Underestimating co-signer responsibility often leads to long-term financial conflict.

$750 Cash App Gift Card

A $750 Cash App gift card may be available to select users. Checking eligibility is quick. You can check if you’re one of them.

FAQs

Are private student loans regulated by the government?

They are regulated as financial products, but not standardized like federal student loans.

Do private student loans require repayment while in school?

This depends on lender terms and repayment plan selected.

Can private student loans be discharged or forgiven?

Forgiveness is rare and depends entirely on lender policy.

Is a co-signer always required?

Not always, but it is common for students without strong credit.

Do private loans affect credit scores?

Yes. Payment history directly impacts borrower and co-signer credit.

Conclusion

Private student loans provide access to education funding when other options fall short.

Understanding how they work helps borrowers balance flexibility with long-term financial responsibility.