Can Pakistan’s IMF Loans 2025 Save It from a Debt Meltdown?

Can Pakistan’s IMF loans 2025 prevent a debt meltdown is the high-stakes question shaping regional economic discussions. This analysis breaks down the loan terms, mounting fiscal pressures, and whether the bailout can truly stabilize the economy.

Pakistan IMF Loans 2025 and debt servicing challenges 2025 reveal a story of resilience, risk, and reform. Islamabad stands at a crossroads where each dollar borrowed carries the weight of a nation’s survival. Can Pakistan manage its towering debt while keeping its economy afloat — or has it already entered a cycle too hard to break?

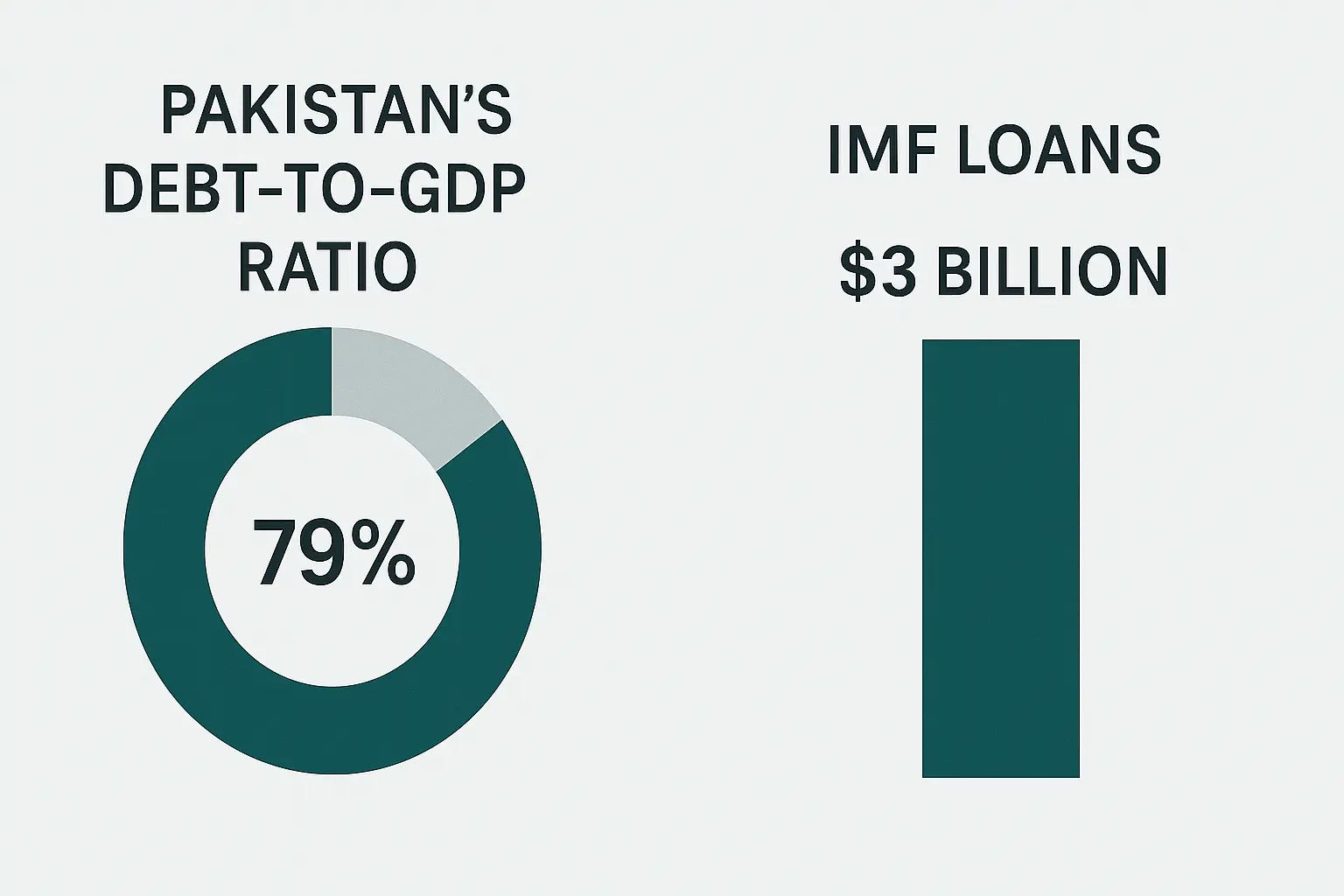

- Pakistan’s debt has soared to nearly 75% of GDP as 2025 unfolds.

- IMF loans worth billions aim to stabilize the economy but bring tough conditions.

- The challenge: balancing reforms, growth, and political will — all under global scrutiny.

What Are the Pakistan IMF Loans 2025 and Debt Servicing Challenges 2025?

The Pakistan IMF loans and debt servicing challenges 2025 refer to the financial tightrope Pakistan walks — managing its IMF loan repayments, meeting harsh reform requirements, and keeping enough foreign reserves to pay external creditors.

Pakistan has turned to the International Monetary Fund several times in recent years, making it one of the IMF’s top borrowers. Each program aims to restore fiscal stability but often leads to painful trade-offs: higher taxes, subsidy cuts, and public spending freezes.

$500 Walmart Gift Card

Not everyone qualifies for this $500 Walmart gift card. Checking only takes a moment. You can check if you’re eligible.

The Latest Financial Crossroads

As of late 2025, Pakistan’s external debt obligations are mounting faster than its export growth or tax revenue. Despite IMF support packages worth billions, the country faces a deepening foreign exchange crisis — forcing policymakers to choose between repayment or relief.

The IMF’s 2025 program extends crucial financial support but comes with stringent conditions — including removal of energy subsidies, expansion of the tax net, and restructuring of loss-making state enterprises. These are reforms long promised but rarely fulfilled.

Pakistan’s outstanding obligations under multiple IMF facilities have now crossed $8 billion, placing it among the largest active IMF borrowers globally.

The Anatomy of Pakistan’s Debt Burden

Pakistan’s debt burden isn’t just large — it’s structurally risky.

| Category | Estimated Share (2025) | Key Pressure Points |

|---|---|---|

| Public Debt | ~75% of GDP | Interest payments consuming 45% of revenue |

| External Debt | ~40% of total debt | Currency depreciation risk |

| IMF Obligations | $8+ billion | Repayment pressure + conditionality |

| Fiscal Deficit | ~7% of GDP | Expanding despite austerity |

| Reserves | ~$9 billion | Insufficient to cover 3 months’ imports |

This imbalance creates a vicious cycle: borrowing to repay older loans, eroding reserves, and reducing fiscal space for investment in growth sectors like energy, education, and infrastructure.

Why It Matters: The Human and Economic Cost

The Pakistan IMF loans and debt servicing challenges 2025 go far beyond macroeconomic jargon — they shape the daily lives of millions.

- Inflation’s Silent Tax:

High fuel and electricity costs from subsidy removals ripple into food prices, shrinking purchasing power for the middle and lower classes. - Austerity Meets Unemployment:

Budget tightening limits public hiring, freezes salaries, and reduces development projects — slowing job creation. - Currency Erosion:

As the rupee weakens, imported goods become costlier, further feeding inflation and widening the trade deficit. - Investor Confidence:

Frequent IMF dependence signals instability, deterring long-term investment that could have generated sustainable revenue.

In short, Pakistan’s debt story isn’t just about spreadsheets — it’s about livelihoods.

Expert View: What Analysts Are Saying

Dr. Saad Mehmood, Economist at the Pakistan Institute of Development Studies, says:

“IMF programs are like medicine — bitter but necessary. The real challenge is not getting the loan, but using it to build self-sustaining reforms that prevent the next crisis.”

Anita Chaudhry, Senior Research Fellow at South Asia Economic Forum, adds:

“Pakistan’s debt problem isn’t new — it’s cyclical. Without structural reforms, every IMF package becomes a pause button, not a solution. 2025 could be the year Pakistan either reforms decisively or repeats history.”

Both experts highlight a crucial truth: the IMF can stabilize but not transform. The responsibility lies with Pakistan’s fiscal leadership.

A Pattern of Borrow, Reform, Repeat

This is not Pakistan’s first tango with the IMF — and likely won’t be the last. Since joining the Fund in 1950, Pakistan has entered over 20 IMF programs. Each promised stability, but most ended with unmet targets.

The pattern looks like this:

- Borrow under IMF pressure.

- Implement temporary reforms.

- Face political backlash.

- Roll back reforms.

- Return to IMF.

In 2025, the stakes are higher because global conditions — higher interest rates, energy shocks, and currency volatility — make refinancing costlier. The window for half-hearted measures is closing fast.

Comparisons: Pakistan vs Other IMF-Dependent Economies

| Country | Outstanding IMF Debt (2025) | Key Issue | Reform Status |

|---|---|---|---|

| Pakistan | $8.3 billion | Fiscal deficit, weak tax base | Ongoing reforms |

| Egypt | $12.4 billion | Currency devaluation | Gradual improvement |

| Argentina | $32 billion | Inflation, fiscal imbalance | Repeated slippages |

| Kenya | $4.1 billion | Debt distress, currency fall | IMF monitoring |

This comparison places Pakistan among economies walking the tightrope between fiscal survival and reform fatigue.

What Readers Should Know and Do

- Understand the Trade-Off: IMF loans buy time — not growth. Their benefits depend on how governments use that breathing space.

- Track Fiscal Reforms: Follow how subsidy reforms, taxation policies, and state-owned enterprise restructuring evolve in 2025.

- Expect Short-Term Pain: Inflation and austerity are likely to persist until reforms strengthen the economy’s fundamentals.

- Look for Long-Term Signals: Increased exports, growing reserves, and reduced fiscal deficits will be the real signs of success.

$750 Amazon Gift Card

A $750 Amazon gift card may be available to select users. Checking eligibility is quick. You can check if you’re one of them.

FAQs

Q1. Why does Pakistan keep returning to the IMF?

Pakistan’s recurring fiscal deficits, low tax collection, and heavy import dependence force it to seek IMF bailouts to maintain stability.

Q2. How much debt does Pakistan owe the IMF in 2025?

As of 2025, Pakistan’s outstanding IMF loans exceed $8 billion, making it one of the top IMF debtors globally.

Q3. What conditions come with the 2025 IMF program?

Key reforms include cutting energy subsidies, expanding the tax base, and restructuring state enterprises to reduce fiscal losses.

Q4. Can Pakistan avoid future IMF programs?

Yes — but only if it implements sustained fiscal reforms, improves tax compliance, and grows exports faster than borrowing.

Key Takeaways

- Pakistan IMF loans and debt servicing challenges 2025 highlight structural weaknesses in revenue and policy execution.

- Heavy external debt and IMF dependence underline the urgent need for credible reforms.

- The IMF offers a lifeline — not a rescue. Pakistan must leverage it for lasting stability.

- Without reform, the debt cycle may continue into the next decade.

Conclusion

The Pakistan IMF loans and debt servicing challenges 2025 tell a story of repeated lessons unlearned. IMF support may keep the economy breathing, but sustainable growth depends on political courage and reform execution.

In 2025, Pakistan stands not just at a financial turning point — but at a moment of national accountability. Whether it emerges stable or remains trapped in its debt spiral will define the next decade.