Why New GST Rates for Cars Matter to Every Driver

Learn why new GST rates for cars are reshaping ownership costs, variant choices, and long-term value for every buyer. A concise, insight-driven preview for drivers assessing how the 2025 tax shift affects their next purchase.

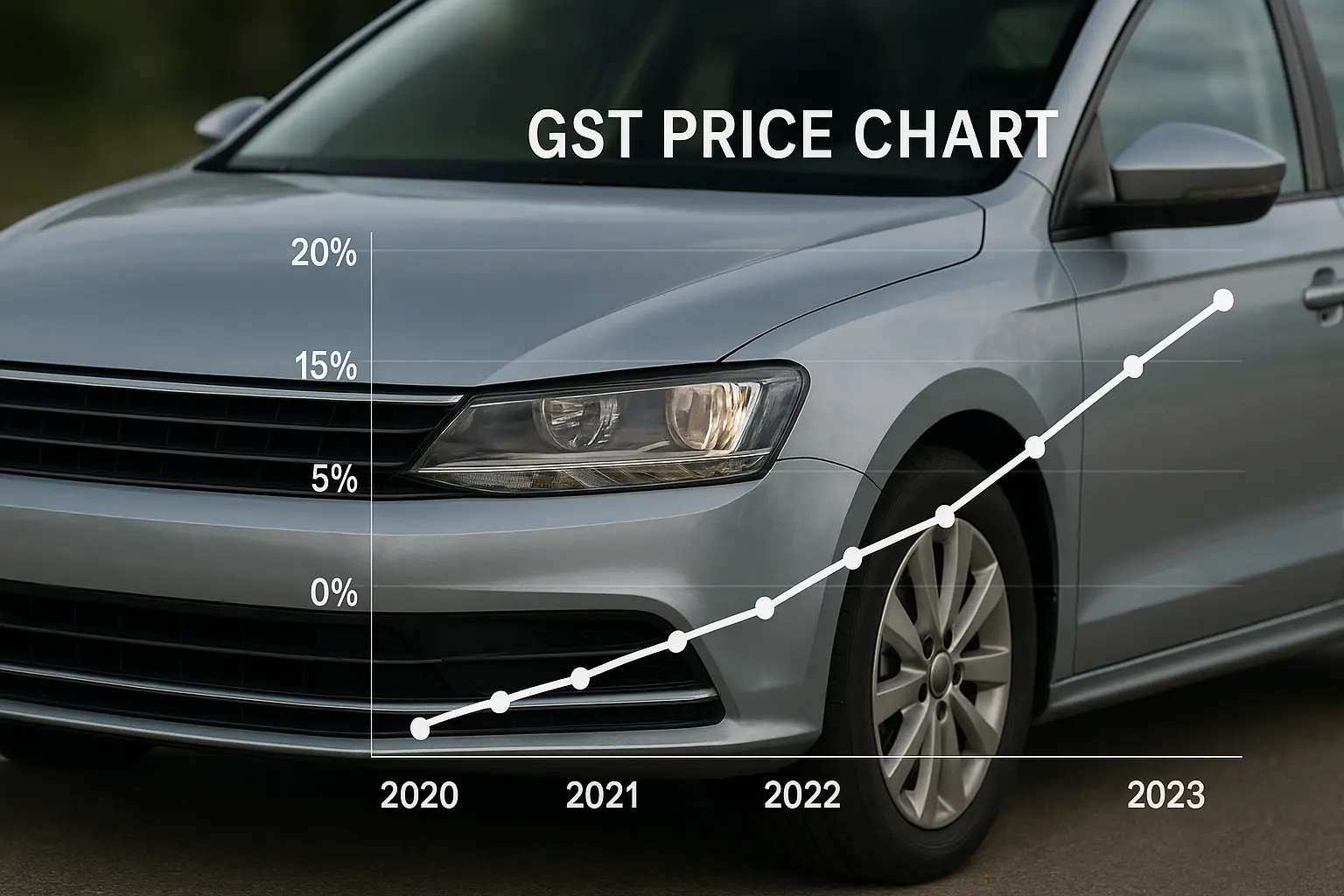

The new GST rates for cars are shaking up the Indian automobile market, and drivers want to know exactly how it affects their wallets. From revised taxation slabs to direct price shifts across segments, these updates could redefine buying decisions this year.

The Latest GST Updates for Cars

The government recently revised GST rates for cars to balance revenue with industry growth. Here’s a summary of the new slabs:

- Small Cars (Petrol under 1200cc, Diesel under 1500cc): 28% GST + 1%–3% cess → Effective 29%–31%

- Mid-size Cars: 28% GST + 15% cess → Effective 43%

- SUVs (length >4m, engine >1500cc, ground clearance >170mm): 28% GST + 22% cess → Effective 50%

- Luxury & Premium Cars: 28% GST + 20%–22% cess → Effective 48%–50%

- Electric Vehicles (EVs): 5% GST (unchanged, no cess)

These changes aim to support eco-friendly adoption while keeping high-end buyers contributing more tax.

Key Details of the GST Changes

- No change for EVs — The 5% GST rate continues to promote electric adoption.

- SUVs and Luxury Cars remain costlier — Effective rates touch 50%, making them premium purchases.

- Mid-size cars see a sharper impact — Their effective rate of 43% raises average costs by ₹30,000–₹60,000.

- Small cars get minor relief — Slight cess adjustments mean a marginal difference in final prices.

$750 Amazon Gift Card

Some users qualify for a $750 Amazon gift card. You can check if you qualify.

Why the New GST Rates Matter

The Indian auto market thrives on affordability. With nearly 70% of buyers in the small to mid-size category, even minor tax changes ripple across demand. Higher rates on SUVs and luxury cars may limit growth in premium segments but push middle-class buyers toward compact cars and EVs.

On the flip side, unchanged GST for EVs signals stronger government support for clean mobility, potentially making 2025 a big year for electric adoption.

Comparing Old vs New GST Rates

| Car Category | Old Effective Rate | New Effective Rate |

|---|---|---|

| Small Cars | 29%–31% | 29%–31% (no major change) |

| Mid-size Cars | 40% | 43% |

| SUVs | 50% | 50% (same) |

| Luxury Cars | 48% | 48%–50% |

| EVs | 5% | 5% (same) |

Verdict: The major shift is in mid-size cars, while EV buyers remain the biggest winners.

Expert Opinions on the GST Update

According to the Society of Indian Automobile Manufacturers (SIAM), these changes could moderate demand for mid-size sedans while boosting EV penetration. Analysts also highlight that manufacturers may introduce more sub-4m compact models to bypass higher cess brackets.

What Car Buyers Should Do Now

- Compare segments carefully: With higher mid-size GST, check if compact or EV alternatives fit your budget.

- Watch for discounts: Automakers may offer festival season deals to absorb part of the GST burden.

- Consider EV incentives: States offer subsidies and lower running costs, making EVs attractive.

- Plan before year-end: Prices may climb further if automakers transfer full GST costs.

$750 Cash App Gift Card

Some users qualify for a $750 Cash App gift card. You can check if you qualify.

FAQs on New GST Rates for Cars

Q1. How do the new GST rates for cars affect prices?

Prices for mid-size and luxury cars will rise, while small cars and EVs remain relatively stable.

Q2. What is the GST rate for SUVs in 2025?

SUVs attract 28% GST plus 22% cess, making the effective rate 50%.

Q3. Are electric vehicles affected by the GST revision?

No. EVs continue at a 5% GST rate with no compensation cess.

Q4. Will automakers adjust to reduce the GST burden?

Yes, many are planning sub-4m models and EV launches to attract cost-sensitive buyers.

Key Takeaways

- The new GST rates for cars mainly impact mid-size buyers.

- SUVs and luxury models remain expensive at up to 50% tax.

- EVs stay at 5%, cementing them as the most cost-effective option long term.

- Buyers should time purchases and explore incentives for savings.

Conclusion

The new GST rates for cars are a mixed bag — heavier on mid-size and luxury, lighter on small cars, and neutral for EVs. For buyers, the smartest move is to explore compact and electric models before costs climb further.