GST 2.0: A Game-Changer for Indian Consumers

See how GST 2.0 reshapes everyday expenses with a clear look at what’s becoming cheaper, what’s costlier, and how consumers will feel the shift. A concise, insight-driven preview for readers tracking the 2025 tax overhaul.

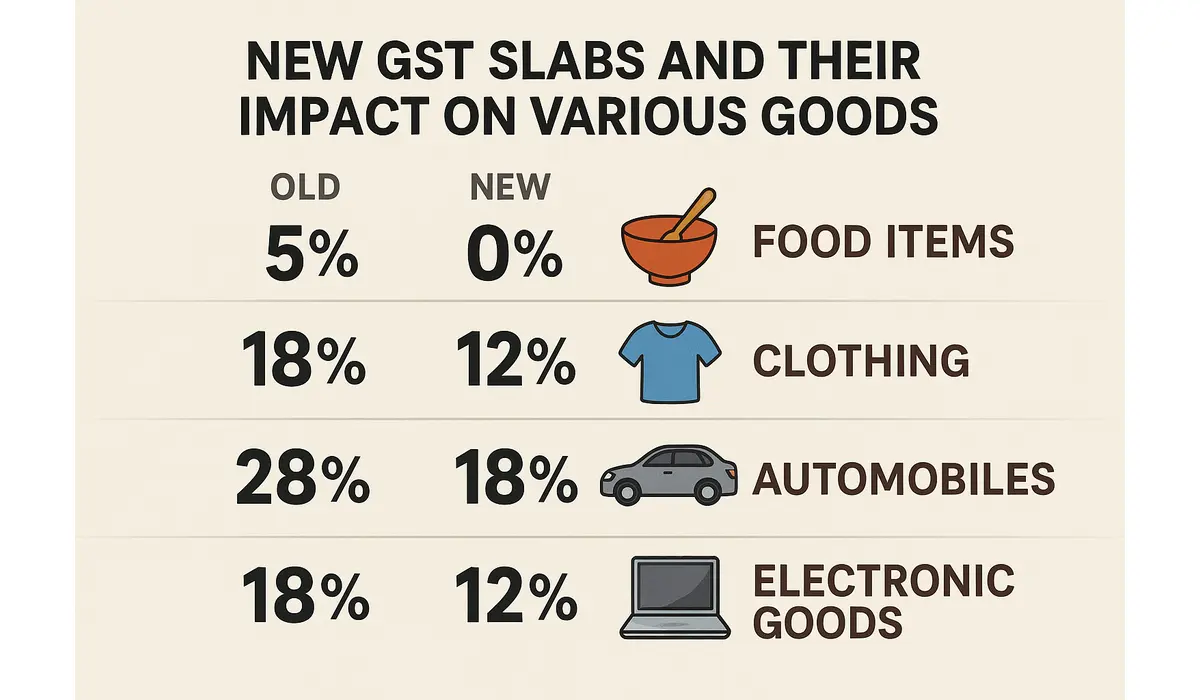

India has ushered in a significant tax reform with the introduction of GST 2.0, New GST rates 2025 effective from September 22, 2025. This overhaul simplifies the Goods and Services Tax structure, aiming to make everyday goods more affordable and streamline the tax system.

Key Takeaways:

- Simplified Tax Structure: GST 2.0 introduces a two-slab system: 5% and 18%, replacing the previous complex multi-slab structure.

- Price Reductions: Many essential items, including food and electronics, have seen a reduction in tax rates, leading to lower prices for consumers.

- Increased Tax on Luxury Goods: Luxury and sin goods now attract a higher tax rate of 40%, making them more expensive.

What’s New in GST 2.0?

The GST Council has restructured the tax slabs to simplify the taxation system:

- 5% Slab: Applies to essential items like food products, dairy, and healthcare.

- 18% Slab: Covers most goods and services, including electronics and automobiles.

- 40% Slab: Targets luxury and sin goods such as tobacco products, high-end vehicles, and online gaming.

This restructuring aims to reduce the tax burden on common man essentials while imposing higher taxes on non-essential luxury items.

$500 PayPal Gift Card

A $500 PayPal Gift card may be available to select users. Checking eligibility is quick. You can check if you’re one of them.

What’s Cheaper Now in New GST rates 2025?

With the new GST rates, several items have become more affordable:

- Food Products: Items like paneer, roti, and khakra are now tax-exempt, reducing their prices significantly.

- Electronics: GST on items like air conditioners, televisions above 32 inches, and dishwashers has been reduced from 28% to 18%, leading to lower prices.

- Healthcare: Life-saving medicines and medical equipment have seen a reduction in tax rates, making healthcare more accessible.

- Automobiles: Small cars and two-wheelers have moved from the 28% to the 18% tax bracket, resulting in price reductions.

These changes are expected to boost consumer spending and stimulate demand in various sectors.

What’s More Expensive?

While many items have become cheaper, some have seen an increase in prices due to the new GST rates:

- Luxury Goods: High-end automobiles and premium electronics now attract a 40% tax, making them significantly more expensive.

- Tobacco Products: Items like cigarettes, beedis, and pan masala have moved to the 40% tax slab, increasing their prices.

- Online Gaming: Online gaming and betting platforms are now taxed at 40%, leading to higher costs for consumers.

These changes are part of the government’s strategy to discourage consumption of non-essential and harmful goods.

Sector-Wise Impact

The implementation of GST 2.0 has had varying impacts across different sectors:

- FMCG Sector: With reduced tax rates on essential items, the FMCG sector is expected to see increased sales and consumer demand.

- Automobile Industry: The reduction in GST for small cars and two-wheelers is likely to boost sales in the automotive sector.

- Healthcare Sector: Lower taxes on medicines and medical equipment will make healthcare more affordable for the public.

- Luxury Goods Market: The increased tax on luxury goods may lead to a decline in sales in this segment.

Overall, the new GST structure aims to promote consumption of essential goods while discouraging non-essential luxury items.

What Should You Do?

To navigate the changes brought about by GST 2.0:

- Review Your Purchases: Check the new GST rates on items you frequently purchase to understand the impact on your expenses.

- Plan Big Purchases: If you’re considering buying luxury items, be aware of the increased tax rates and plan accordingly.

- Stay Informed: Keep updated with the latest GST notifications to ensure compliance and take advantage of any benefits.

By staying informed and planning your purchases wisely, you can make the most of the new GST structure.

$500 Walmart Gift Card

A $500 Walmart gift card may be available to select users. Checking eligibility is quick. You can check if you’re one of them.

FAQs

Q1: When did the new GST rates come into effect?

A1: The new GST rates were implemented on September 22, 2025.

Q2: Which items have become tax-free under the new GST rates?

A2: Essential items like paneer, roti, and khakra are now tax-exempt.

Q3: How has the automobile sector been affected by the new GST rates?

A3: Small cars and two-wheelers have moved from the 28% to the 18% tax bracket, leading to price reductions.

Q4: Are luxury goods more expensive now?

A4: Yes, luxury goods now attract a 40% tax, making them more expensive.

Conclusion

The introduction of GST 2.0 marks a significant shift in India’s tax landscape. By simplifying the tax structure and adjusting rates, the government aims to make essential goods more affordable and encourage responsible consumption. As consumers, it’s crucial to stay informed about these changes to make cost-effective decisions.