Why Multibagger Small Cap Colab Platforms’ Bold US AI Bet Might Be the Next Major Breakthrough

Discover why multibagger small cap Colab Platforms’ bold US AI bet might be the next major breakthrough. This concise, research-driven teaser highlights the strategy, market positioning, and innovation pathways shaping its high-growth potential.

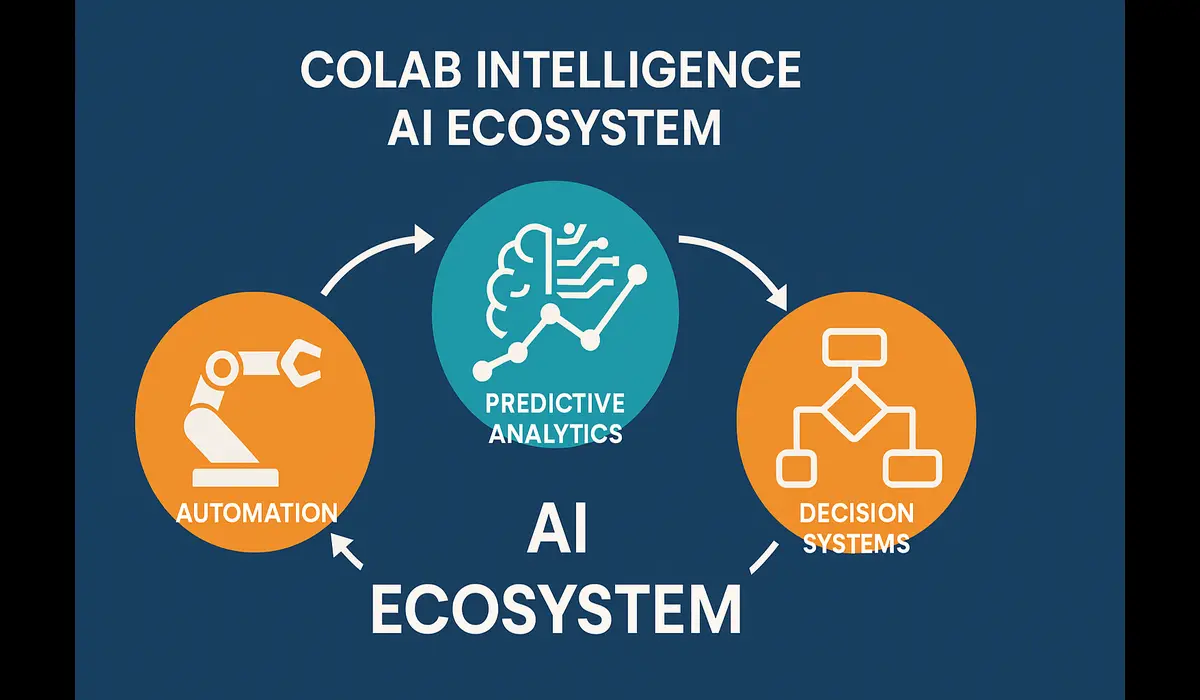

Multibagger small cap Colab Platforms has announced a new US-based AI subsidiary, signaling a major leap in its global technology expansion. The company aims to leverage artificial intelligence for automation, data analytics, and business transformation.

- New subsidiary: Colab Intelligence Inc. (US)

- Objective: Strengthen presence in global AI ecosystem

- Investor sentiment: Strong due to consistent stock rallies

What is Colab Platforms?

Colab Platforms is a multibagger small cap company known for its rapid diversification in digital and technology ventures. Operating in esports, digital media, and software infrastructure, it has evolved into a growth-driven enterprise with minimal debt and strong financial performance.

The recent incorporation of its AI-focused US subsidiary marks a decisive move into the booming global artificial intelligence market, valued at over $200 billion in 2025.

$750 Cash App Gift Card$750 Cash App Gift Card

Some users qualify for a $750 Cash App gift card. You can check if you qualify.

Latest Post

Latest Update: Colab’s US AI Subsidiary

The board of Colab Platforms approved the establishment of Colab Intelligence Inc., a 100% owned subsidiary in the United States. The company will develop AI-powered systems focused on:

- Predictive analytics and data modeling

- Intelligent automation and process optimization

- Collaborative AI for enterprise solutions

- Decision-support systems integrating human–machine collaboration

This development aims to expand Colab’s technical footprint, align it with international AI standards, and strengthen its innovation pipeline for long-term scalability.

Key Facts and Financial Overview

- Market Cap: ₹3,000+ crore

- Debt: Negligible (approx. ₹0.03 crore)

- Revenue (FY26 Q1): ₹21.79 crore (up 95% YoY)

- Net Profit: ₹1.20 crore (up 167% YoY)

- Stock Performance: 13,000% returns since listing; 2,100% in one year; ~848% YTD in 2025

- Sector: Technology, AI, Digital Media

The multibagger small cap Colab Platforms stock has consistently hit upper circuits, reflecting strong investor optimism toward its strategic AI expansion.

Why This Move Matters

1. Entry into a $200 Billion Market

Artificial intelligence is among the fastest-growing global sectors, projected to reach $1.8 trillion by 2030. Colab Platforms’ new subsidiary opens access to advanced research, partnerships, and AI deployment opportunities.

2. Global Investor Confidence

Creating a US-based entity demonstrates global ambition. It positions Colab Platforms among forward-looking Indian small caps entering high-tech sectors traditionally dominated by larger firms.

3. Financial Resilience

With nearly zero debt and consistent profit growth, Colab has the financial bandwidth to invest in R&D and expansion without immediate funding risks.

4. Long-Term Valuation Potential

AI adoption could boost its earnings multiples. If executed well, this move can justify a valuation rerating for the multibagger small cap Colab Platforms stock.

Strategic Comparison

| Aspect | Colab Platforms | Typical Small Cap Peer |

|---|---|---|

| Debt Load | Extremely low | Moderate to high |

| AI Focus | Dedicated US subsidiary | Limited R&D exposure |

| Global Expansion | Active entry into US market | Domestic operations only |

| Growth Potential | High (AI-driven) | Moderate |

| Investor Confidence | Rising | Fluctuating |

This positioning provides Colab Platforms with a competitive advantage among small caps aiming for global technology integration.

Expert Perspective

Industry analysts believe that multibagger small cap Colab Platforms could set a new benchmark for Indian tech firms eyeing US expansion. The focus on AI automation and analytics aligns with major enterprise transformation trends worldwide.

However, experts caution that execution remains key. Sustainable growth will depend on product deployment, client acquisition, and maintaining consistent financial transparency.

What Investors Should Do

- Monitor Subsidiary Progress:

Track official updates on Colab Intelligence’s AI product launches and client partnerships. - Review Financial Reports:

Watch for revenue contribution from the AI business over the next 2–3 quarters. - Diversify Holdings:

Avoid overexposure; balance your portfolio with other tech or mid-cap stocks. - Evaluate Risk:

Note that small caps can be volatile, especially during global tech corrections.

$500 PayPal Gift Card$500 PayPal Gift Card

Not everyone qualifies for this $500 PayPal gift card. Checking only takes a moment. You can check if you’re eligible.

FAQs

Q1: What is the new AI subsidiary of Colab Platforms?

The company has formed Colab Intelligence Inc., a US-based subsidiary focusing on artificial intelligence, analytics, and automation.

Q2: Why is Colab Platforms called a multibagger small cap?

It earned multibagger status after delivering over 13,000% returns since listing and consistent upper-circuit performances throughout 2025.

Q3: Does Colab Platforms have high debt?

No. The company maintains negligible debt levels, enhancing investor trust and capital efficiency.

Q4: What sectors will Colab Intelligence target?

It will focus on enterprise AI solutions, predictive analytics, and automation for technology, finance, and logistics industries.

Key Takeaways

- Multibagger small cap Colab Platforms is expanding globally through a US-based AI subsidiary.

- The company’s zero-debt structure and 95% revenue growth enhance financial stability.

- Investors see strong potential, but execution in AI remains critical.

- The move reflects a growing trend of Indian small caps entering high-tech global markets.

Conclusion

The multibagger small cap Colab Platforms venture into artificial intelligence through its new US subsidiary demonstrates ambition and strategic clarity. If it delivers on AI innovation and market entry, the company could redefine its growth narrative within small-cap technology stocks.