How India’s Microfinance Movement Can Reshape Lending in Rural America

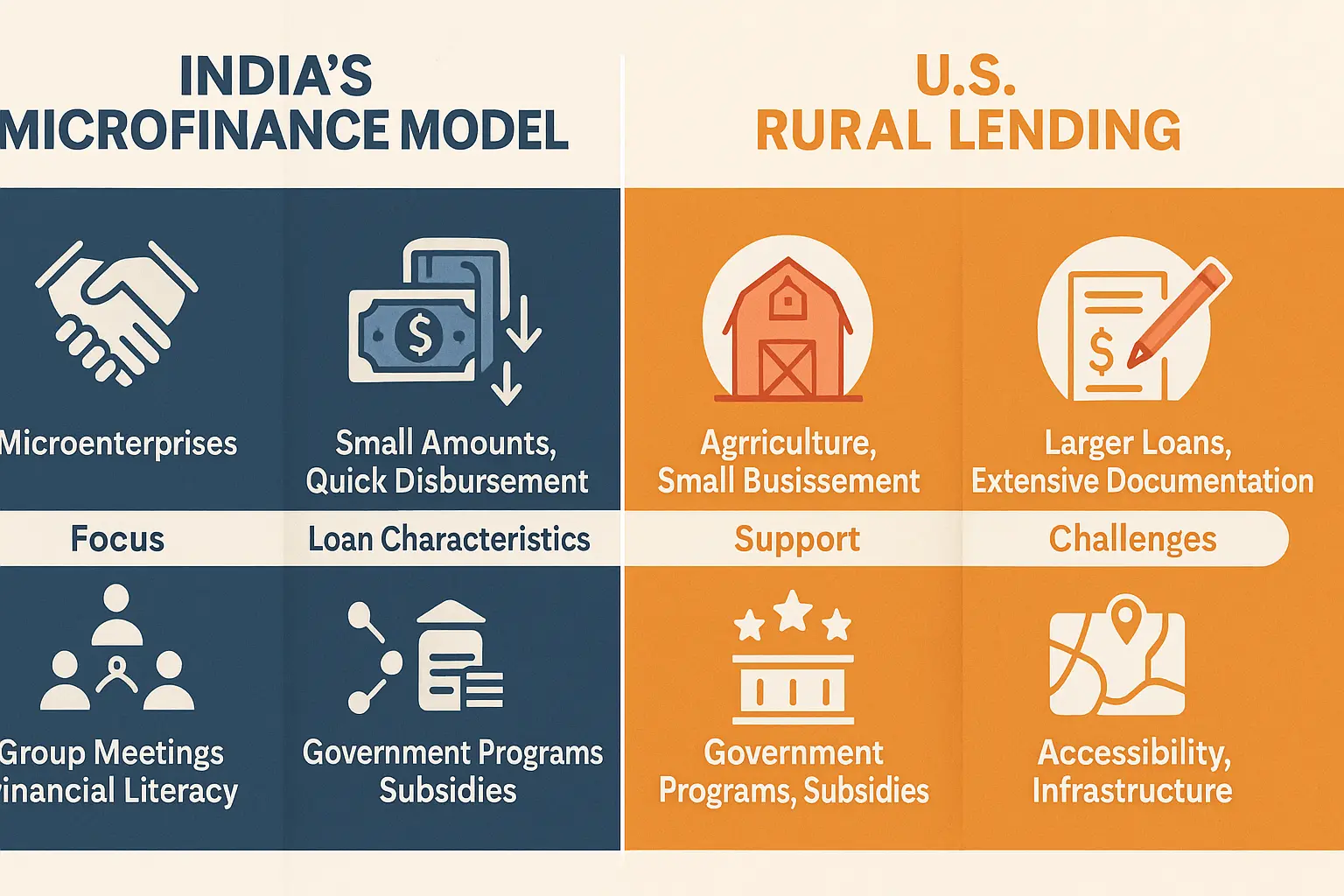

This analysis explores how the India’s microfinance movement offers a blueprint for expanding credit access, reducing rural financial gaps, and reshaping community lending models across rural America.

Introduction

India’s Microfinance Movement has empowered millions of low-income families, especially women, by providing small loans that change lives. From rural Bihar to Tamil Nadu, this system of community-based lending has become a powerful engine for grassroots entrepreneurship and financial inclusion.

Now imagine this: could the same principles that transformed rural India help solve America’s small-town credit crisis?

In the U.S., nearly 40 million adults in rural regions lack access to affordable credit. Traditional banks have withdrawn, leaving behind loan deserts. But India’s microfinance model — built on trust, social capital, and sustainability — might just offer the blueprint America needs.

Key Takeaways

- India’s microfinance model fosters community trust and empowerment over collateral.

- Rural America’s credit gaps could be bridged with localized, relationship-driven lending systems.

- Adapting self-help group (SHG) and microcredit frameworks may spark a new era of rural financial inclusion.

$750 Cash App Gift Card

Some users qualify for a $750 Cash App gift card. You can check if you qualify.

What Is India’s Microfinance Movement?

India’s microfinance movement is a grassroots financial revolution that began in the early 1990s. Its core mission is simple — to extend small loans (microcredit) to low-income individuals without requiring traditional collateral or credit scores.

Microfinance in India is often facilitated through:

- Self-Help Groups (SHGs) – small groups, usually women, pooling savings to lend within the community.

- Microfinance Institutions (MFIs) – regulated bodies providing structured loans and training.

- NGOs and cooperatives – linking communities with formal banking systems.

This movement has reached over 120 million people, many of whom were previously excluded from the financial mainstream.

Why It Matters

In India, microfinance didn’t just provide money — it provided dignity. It turned borrowers into micro-entrepreneurs, created social cohesion, and boosted local economies.

Similarly, rural America faces challenges that microfinance could help solve:

- Decline of local banks in small towns.

- Dependence on high-interest payday loans.

- Shrinking access to agricultural and business capital.

- Widening wealth inequality.

By localizing finance through trust-based lending models, communities can regain control over their economic future.

How Does Microfinance Work in India?

1. The Self-Help Group Model

Groups of 10–20 people (often women) contribute small savings each month. Members borrow from this collective fund for emergencies, farming, or small businesses.

2. Microfinance Institutions (MFIs)

Registered entities that provide loans averaging $200–$800 to rural borrowers. They rely on social collateral — the borrower’s reputation in the group — instead of physical assets.

3. Linkage with Banks

Through government-backed programs like SHG–Bank Linkage Scheme, groups receive formal credit access, building long-term financial literacy.

This hybrid of social trust and institutional oversight has made microfinance one of the most resilient financial models in emerging markets.

Could India’s Microfinance System Work in Rural America?

That’s the big question — and the answer looks promising.

Rural America, especially in states like Mississippi, West Virginia, and Arkansas, struggles with low credit availability. Many small towns have no physical banks, and local entrepreneurs depend on predatory lenders.

India’s model could offer three major advantages:

- Decentralized Lending Power

- Local groups manage funds and repayment collectively.

- Builds accountability and shared trust.

- Inclusive Access

- Loans for women, farmers, small shop owners, and craftspeople.

- Eliminates dependency on credit scores.

- Social Empowerment

- Creates community-driven financial ecosystems.

- Enhances social mobility and self-sufficiency.

Why Rural America Needs Microfinance Principles

- 1 in 4 rural Americans has limited access to credit.

- Over 10,000 rural bank branches have closed in the past 15 years.

- Traditional lenders often require collateral and credit history, disqualifying low-income borrowers.

Microfinance’s emphasis on trust, training, and social accountability could revolutionize rural America’s approach to small-scale credit.

How to Adapt Microfinance for Rural America

Step 1: Build Community Financial Cooperatives

Form local groups — similar to India’s SHGs — where members save small amounts regularly.

Step 2: Partner with Local NGOs and Credit Unions

NGOs can act as facilitators, training communities in bookkeeping, lending ethics, and business basics.

Step 3: Government and Philanthropic Support

Subsidies, matching funds, and seed capital can scale microfinance operations.

Step 4: Digital Microfinance Platforms

Use mobile apps and fintech tools to record savings, track repayments, and offer credit scoring based on behavioral data rather than FICO scores.

Step 5: Education and Financial Literacy

Continuous learning ensures responsible borrowing and sustainable entrepreneurship.

Common Myths About Microfinance

Myth 1: Microfinance only works in developing countries.

Truth: The U.S. already has micro-lending programs (like Kiva and Opportunity Fund) — but scaling them locally could multiply their impact.

Myth 2: Borrowers won’t repay without collateral.

India’s repayment rates average 96–98%, proving social accountability can be more effective than credit scores.

Myth 3: It’s only for women or poor communities.

While women form the backbone of microfinance, it’s designed for anyone underserved by traditional banking — including rural artisans, small shopkeepers, and farmers.

Expert Views and Case Studies

Case Study 1: The Grameen Bank Parallel

Founded by Nobel laureate Muhammad Yunus, Grameen inspired India’s microfinance model. Its focus on trust-based lending and community solidarity reduced poverty in Bangladesh — principles that could thrive in U.S. rural settings.

Case Study 2: Bandhan Bank, India

What started as a microfinance NGO evolved into a major Indian bank serving over 25 million customers, demonstrating scalability and sustainability.

Case Study 3: Appalachian Community Lenders (USA)

This regional network already uses community-based microloans to support small businesses, hinting that microfinance principles can indeed succeed in rural America.

Expert Insight:

“If India could bring banking to its remotest villages through trust-based lending, there’s no reason small-town America can’t do the same,”

— Dr. Nita Ramaswamy, Development Economist, Columbia University.

What Challenges Could the U.S. Face in Adopting Microfinance?

- Regulatory Hurdles:

Financial regulations differ across states and could complicate local lending operations. - Cultural Barriers:

Unlike India, U.S. rural communities are more individualistic — collaboration in finance might take time to build. - Digital Divide:

Many rural areas still lack strong internet access for mobile finance. - Initial Funding:

Without subsidies or grants, microfinance initiatives might struggle to reach scale quickly.

How Microfinance Could Transform Rural Economies

| Impact Area | India’s Results | Potential in the U.S. |

|---|---|---|

| Financial Inclusion | 120M+ people brought into formal banking | 40M+ rural adults could gain credit access |

| Women Empowerment | 80% SHGs led by women | Women-led co-ops in small towns |

| Entrepreneurship Growth | 15% rise in rural microenterprises | Boost to small farms, crafts, and services |

| Community Development | Strengthened social trust networks | Rebuilding of local social capital |

$500 PayPal Gift Card

A $500 PayPal Gift card may be available to select users. Checking eligibility is quick. You can check if you’re one of them.

FAQs

1. How can India’s microfinance movement help rural America?

By creating community-based lending groups that provide affordable loans without collateral, fostering financial inclusion and entrepreneurship.

2. Is microfinance profitable for lenders?

Yes. When managed efficiently, microfinance institutions achieve high repayment rates and long-term sustainability.

3. Can technology enhance microfinance in the U.S.?

Absolutely. Digital wallets, fintech apps, and blockchain could make lending transparent and accessible even in remote areas.

4. What’s the main lesson from India’s microfinance success?

That trust and social accountability can outperform traditional banking in reaching underserved populations.

Key Takeaways

- India’s Microfinance Movement proves that financial inclusion starts with trust, not credit scores.

- Its principles — community lending, local empowerment, and accountability — can thrive in rural America.

- By combining digital tools with social trust, the U.S. can close the rural credit gap.

- Empowering small-town borrowers through microfinance can reignite grassroots economic growth.

Conclusion

The story of India’s Microfinance Movement isn’t just an economic case study — it’s a human story about trust, collaboration, and shared prosperity.

If America’s rural heartlands embraced these same principles, millions of citizens could gain access to fair, community-driven finance — reshaping the landscape of small-town lending forever.

When people invest in each other, they don’t just create businesses — they create resilient communities. That’s the power of microfinance, and it may be the next great chapter in rural America’s financial revival.