How Student Loans Work in America

Student loans help students pay for college by borrowing money that must be repaid later with interest. This article explains where student loans come from, how federal and private loans differ, and why understanding repayment early helps avoid long-term financial stress.

The Real Question Behind This

Many students and families hear the term student loan long before they clearly understand what it involves.

Confusion often begins when tuition bills arrive and financial aid letters feel overwhelming.

People mainly want to know where the money comes from, who is responsible for paying it back, and how it affects life after college.

Key takeaways

Student loans allow borrowers to finance higher education expenses.

There are 2 main types of student loans—federal and private—each of which has different benefits and considerations.

Student loan repayment generally does not begin until after the student has graduated, though depending on the loan type, interest may start accruing before then.

What This Means

Student loans in America are borrowed funds used to pay for higher education costs such as tuition, housing, books, and daily expenses.

Most student loans are issued by the federal government, while others come from private lenders like banks.

The basic idea is simple: loans help students afford college now, but the money must be repaid later, usually with added interest.

How much is borrowed, the loan type, and repayment rules directly affect how manageable the debt is after graduation.

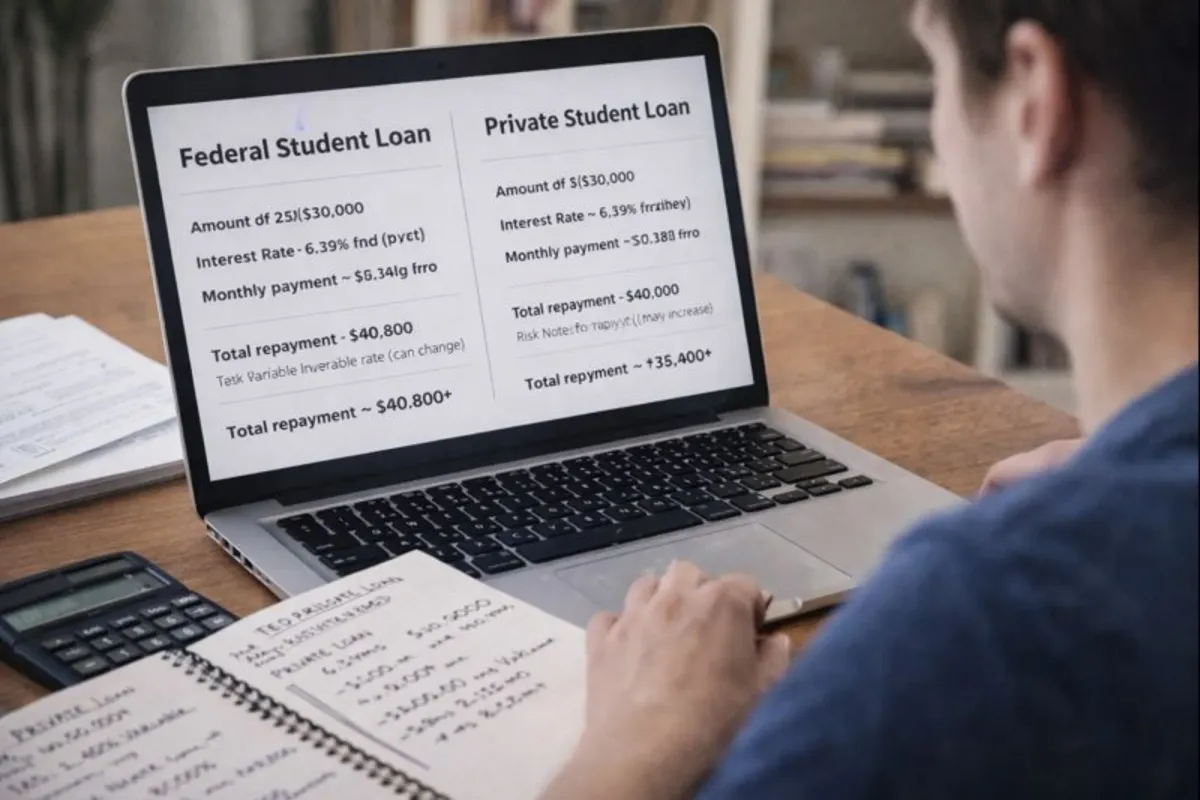

Types of Student Loans

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Source | U.S. Department of Education | Banks, credit unions, and online lenders |

| Credit Check | Usually not required (except for PLUS loans) | Required; often needs a co-signer |

| Interest Rates | Fixed rates set by Congress; generally lower | Fixed or variable; based on credit profile |

| Repayment Options | Flexible plans, including income-based options | Set by lender; limited flexibility |

| Loan Forgiveness | May qualify for programs like PSLF | Generally not eligible for forgiveness |

$750 Amazon Gift Card

A $750 Amazon gift card may be available to select users. Checking eligibility is quick. You can check if you’re one of them.

How this works in practice

Federal student loans

Federal loans are issued by the U.S. government and are the most common option for students.

They usually have fixed interest rates, flexible repayment plans, and protections like income-based payments.

Interest may be paused while a student is in school, depending on the loan type.

Effective understanding: These loans are designed to reduce risk for students who may not earn high incomes right away.

Don’t let your state’s FAFSA deadline pass you by! Many states have a limited amount of aid.

— Federal Student Aid (@FAFSA) November 28, 2025

Find your state’s deadline: https://t.co/T1cFHVYQfC pic.twitter.com/4e1Ko7NOAD

Private student loans

Private loans come from banks, credit unions, or online lenders.

Interest rates can be higher and may change over time, and repayment protections are limited.

Approval often depends on credit history or a co-signer.

Effective understanding: These loans fill gaps but can become expensive if used without careful planning.

Repayment after college

Repayment usually begins several months after leaving school.

Monthly payments are based on loan balance, interest rate, and chosen repayment plan.

Missing payments can increase debt quickly through added interest and penalties.

Effective understanding: Choosing the right repayment plan early helps prevent long-term financial stress.

Interest and long-term cost

Interest is the extra money paid for borrowing.

Even small interest rates can add thousands of dollars over many years.

The longer repayment takes, the more the loan costs overall.

Effective understanding: Paying attention to interest matters more than focusing only on monthly payments.

Comparisons and alternatives

- Federal loans vs private loans: Federal loans offer more flexibility and safety, while private loans are stricter.

- Grants vs loans: Grants do not need repayment, while loans always do.

- Work-study vs borrowing: Earning during college reduces how much must be borrowed later.

These alternatives change how much debt a student carries after graduation.

The Student Loan Process Explained

Fill out the FAFSA

The FAFSA collects financial details to decide eligibility for federal grants, work-study, and student loans. Schools and the government use this form to calculate aid.

Receive financial aid offers

Colleges send aid letters showing scholarships, grants, and loans. Comparing these helps students choose aid that needs the least repayment.

Accept aid and complete the Master Promissory Note (MPN)

The MPN is a legal promise to repay borrowed money. It explains loan terms, interest, and borrower responsibilities.

Funds are disbursed to the school

Loan money is sent directly to the college to cover tuition and fees. Any remaining amount may be refunded to the student for living expenses.

Parents: Make school choice part of your New Year resolutions! Find an education that works best for your children: https://t.co/PLB6KaTvxh pic.twitter.com/T7K8ip4OZE

— U.S. Department of Education (@usedgov) January 2, 2026

Repayment begins after school

Payments usually start after graduation or leaving school, following a grace period. Interest may grow during this time, especially on unsubsidized loans.

Choose a repayment plan and make payments

Borrowers select a plan based on income and budget. Federal loans offer flexible options, while private loans follow lender rules.

Quick Understanding Summary

Student loans help students pay for college by borrowing money that must be repaid later with interest. Federal loans offer more protection and flexibility, while private loans carry higher risk. Understanding loan types, interest, and repayment early helps avoid long-term financial strain.

Common mistakes to avoid

Many students borrow the maximum amount without considering future income.

Others ignore interest growth while still in school.

Delaying repayment planning often increases total debt.

Understanding loan terms before borrowing helps avoid these problems.

To consolidate or not to consolidate? 🤔

— Federal Student Aid (@FAFSA) December 31, 2025

If you have more than one federal student loan, weigh the pros and cons of this option.

For more details, visit https://t.co/FXsHRlw2fz pic.twitter.com/FRxhJhMOi9

Future trends and changes

Student loan policies continue to evolve, with discussions around repayment flexibility and forgiveness programs.

Digital tools now help borrowers track balances and adjust payments more easily.

While loan systems may change, the need to understand repayment responsibility remains constant.

$500 Walmart Gift Card

A $500 Walmart gift card may be available to select users. Checking eligibility is quick. You can check if you’re one of them.

FAQs

Do all students qualify for federal loans?

Most students qualify, but the amount depends on enrollment status and financial need.

Can student loans be forgiven?

Some federal loans may qualify under specific programs, but forgiveness is not guaranteed.

What happens if I cannot repay on time?

Missed payments can lead to penalties and credit damage, but federal loans offer options to adjust payments.

Is it better to pay loans early?

Paying early can reduce interest costs, but it depends on personal financial stability.

Conclusion

Student loans are a common way Americans pay for college, but they come with long-term responsibility.

Understanding where the money comes from, how interest works, and how repayment fits future income helps students make informed decisions that last beyond graduation.