What Does the GST Revision Mean for Fitness Services?

What does the GST revision mean for fitness services is the question as gyms and wellness centers adjust pricing. This analysis explains the updated tax slabs, how costs shift for consumers, and what the industry expects next.

Fitness industry price hike reasons after GST revision In 2025, India’s Goods and Services Tax (GST) Council announced a revised structure for health, wellness, and fitness services. While the nominal GST rate on gym memberships remains 18%, key backend tax credits and classification updates have altered cost recovery mechanisms for service providers.

The revision removed or reduced input tax credits (ITC) for many non-essential service providers — and unfortunately, fitness centers fall under that bracket.

So, while the consumer-facing tax rate didn’t rise, gyms can no longer offset expenses like imported equipment, interior renovations, or energy costs through tax credits — leading to an indirect cost increase.

Latest Update: New Pricing Trends Across India

As of October 2025, Indian fitness centers are implementing new pricing models:

| Gym Category | Old Monthly Fee (2024) | New Monthly Fee (2025) | Price Hike (%) |

|---|---|---|---|

| Local Gyms | ₹1,500–₹2,000 | ₹2,000–₹2,800 | +30% |

| Mid-Tier Fitness Chains | ₹2,800–₹3,800 | ₹4,000–₹5,000 | +25% |

| Premium Clubs | ₹7,000–₹9,000 | ₹9,500–₹12,000 | +20% |

Boutique fitness studios offering Pilates, Zumba, and functional training have also raised rates, citing “post-GST compliance expenses” and “trainer cost adjustments.

$750 Cash App Gift Card

A $750 Cash App gift card may be available to select users. Checking eligibility is quick. You can check if you’re one of them.

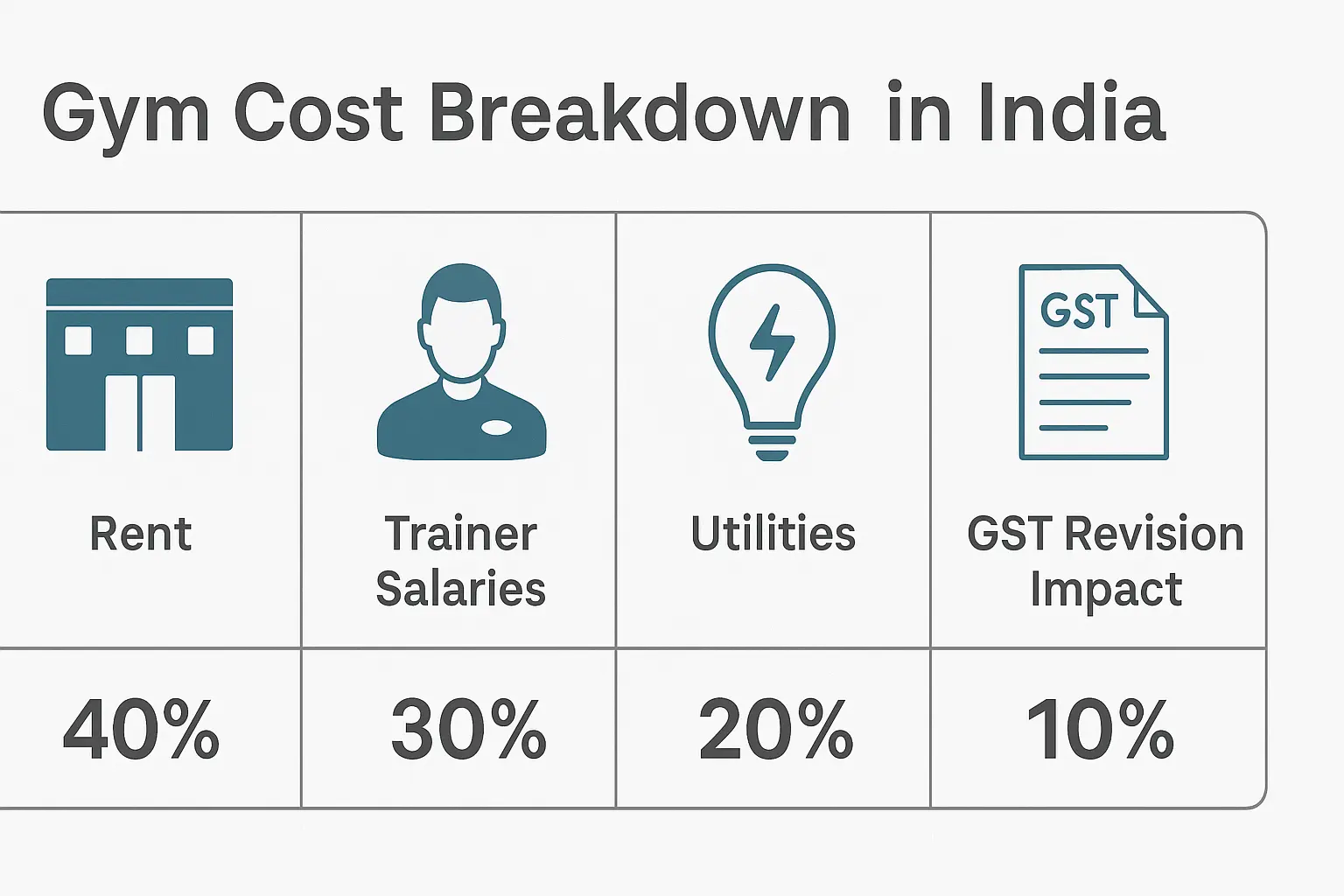

Key Factors Behind the Fitness Industry Price Hike

1. Reduced Input Tax Credit (ITC)

Before the revision, fitness centers could claim credits on imported machinery, flooring, sound systems, and utilities. The new structure classifies several of these as non-deductible.

This means the GST that gyms pay on supplies and imports now becomes a real expense, pushing up membership fees.

2. Higher Compliance and Filing Costs

The GST simplification process ironically increased compliance complexity for multi-location fitness chains. Branches must now file regional-level GST returns, requiring more manpower and audit support.

3. Imported Equipment and Depreciating Rupee

Over 70% of gym equipment in India — from treadmills to resistance systems — is imported. A weaker rupee and higher import duties have raised costs by 10–15%. Combined with loss of ITC, this has magnified the price burden.

4. Energy and Maintenance Expenses

Power, water, and cooling costs form nearly 20% of gym operational expenses. With GST now fully applicable on maintenance services, many gyms have revised their base prices.

5. Trainer Wages and Retention

India’s certified fitness professionals are demanding higher salaries, reflecting global inflation. Post-GST revisions, trainers are now classified under the “wellness service” category — meaning gyms must charge GST on their service fees too.

Why It Matters: The Consumer Perspective

For fitness enthusiasts, this price rise feels like déjà vu after the pandemic recovery.

- Affordability Challenge: With prices rising 20–30%, many urban Indians are reconsidering annual memberships.

- Shift to Short-Term Plans: Monthly and quarterly memberships are surging as consumers prefer flexibility.

- Demand for Transparency: People are questioning where the extra costs are going, especially in the name of “tax adjustments.”

At the same time, gyms are defending the hikes, citing cost pressures beyond their control.

Expert View: Inside the Industry

Rachit Sharma, CFO of FitNation India, explains:

“The GST revision has hit our input tax credits hard. For every ₹100,000 we spend on imported or domestic supplies, we recover less tax credit now. That directly cuts into our margins.”

Anita Verma, Senior Economist at the Indian Wellness Federation, adds:

“The government’s goal was to simplify taxation, but for fitness services, the effect is inverse. Businesses are shifting costs downstream, and the customer ends up paying more.”

These expert insights confirm a broader truth — India’s fitness economy is growing, but also becoming costlier and more complex.

Comparing Gym vs Yoga vs Wellness Costs Post-GST

| Sector | Avg. GST Rate | Price Change (2025) | Key Reason |

|---|---|---|---|

| Gym/Fitness Club | 18% | +20–30% | ITC loss, equipment imports |

| Yoga & Pilates | 12% | +15–25% | Staff cost, compliance |

| Spa/Wellness Centers | 18% | +10–20% | Service reclassification |

| Online Fitness Apps | 18% | +5–10% | Digital service tax alignment |

While the rates appear similar, loss of input tax credit and rising energy costs hit physical centers harder than digital fitness platforms.

The Hidden Chain Reaction in the Fitness Ecosystem

The GST revision has ripple effects beyond just pricing:

- Smaller Gyms Shutting Down: Many independent gyms are struggling to absorb tax losses and are closing or merging with larger chains.

- Corporate Fitness Partnerships Rising: Companies are subsidizing gym memberships for employees to maintain wellness programs.

- Consumer Shift to Hybrid Workouts: People are balancing gym visits with home workouts using smart fitness apps.

In short, the industry is reorganizing itself to survive higher operational taxes and compliance costs.

Practical Takeaways: What Gym Members Should Do

- Ask for Transparent Billing: Ensure you know how much of your fee is GST and how much is the base price.

- Lock in Annual Rates Early: Many gyms offer pre-revision renewal deals — take advantage before another round of hikes.

- Compare Packages Wisely: Look beyond price; choose gyms offering value (personal training, recovery rooms, AI-tracking).

- Explore Hybrid Fitness Options: Mixing offline gym workouts with online fitness apps can help manage costs.

$500 Walmart Gift Card

Not everyone qualifies for this $500 Walmart gift card. Checking only takes a moment. You can check if you’re eligible.

FAQs

Q1. Why did the fitness industry raise prices after the GST revision?

Because the 2025 GST update reduced input tax credits and reclassified fitness-related services, increasing operational costs.

Q2. Does GST apply to all gyms and wellness centers?

Yes, any commercial fitness service with an annual turnover above the GST threshold must charge GST to members.

Q2. Does GST apply to all gyms and wellness centers?

Yes, any commercial fitness service with an annual turnover above the GST threshold must charge GST to members.

Q3. How much has the average gym fee increased?

Between 20–30% in most metro cities, depending on rent, equipment costs, and brand scale.

Q4. Is online fitness affected by GST too?

Yes, digital fitness subscriptions are taxed at 18%, but they face fewer overheads compared to physical gyms.

Key Takeaways

- The fitness industry price hike reasons after GST revision are rooted in reduced tax credits and rising import, energy, and staffing costs.

- Gyms are adjusting to sustain profitability amid higher compliance burdens.

- Consumers should expect continued price fluctuations as the new tax framework stabilizes.

Conclusion

The fitness industry price hike reasons after GST revision highlight how taxation changes can reshape entire service sectors. While India’s fitness ecosystem continues to expand, rising prices threaten accessibility for the average consumer.

For both gym owners and members, 2025 marks a pivotal moment — adapt to the new cost reality or risk being priced out of the wellness wave.