Financial Literacy Lessons from India’s Youth for Building Wealth in the USA

This breakdown of financial literacy lessons from India’s youth shows how their disciplined saving, investing habits, and digital-first mindset can help Americans build long-term wealth with smarter, more consistent strategies.

The financial literacy lessons from India’s youth for building wealth in the USA might surprise many. While American Gen Z often leans on credit systems and instant consumption, a growing number of young Indians are mastering the art of saving, investing early, and building wealth through disciplined habits.

Recent data from India’s National Stock Exchange revealed that over 45% of new retail investors are under 30, signaling a generational shift toward smart money management. Meanwhile, a 2024 Bankrate survey found that only 26% of American adults have emergency savings covering six months of expenses.

So, what can the U.S. learn from India’s new wave of financially savvy youth? Let’s explore how their mindset, methods, and money philosophies can redefine wealth-building in America.

Key Takeaways

- India’s youth emphasize saving before spending, creating a buffer against debt.

- Early stock market participation and side investing are shaping their long-term wealth.

- Americans can apply these strategies to reduce credit dependence and achieve financial freedom faster.

$750 Amazon Gift Card

Not everyone qualifies for this $750 Amazon gift card. Checking only takes a moment. You can check if you’re eligible.

What Is Financial Literacy and Why Does It Matter Today?

Financial literacy is more than knowing how to budget or save — it’s understanding how money grows, moves, and multiplies.

It involves the ability to:

- Plan budgets and manage expenses.

- Understand debt and credit.

- Invest intelligently in assets like stocks, mutual funds, or real estate.

- Protect wealth through insurance and emergency funds.

In India, this literacy is increasingly taught through social media finance influencers, government-backed apps, and even college clubs. Contrast that with the U.S., where financial education still lags in school curriculums — leaving many young adults learning through trial and error.

Why Financial Literacy Lessons from India’s Youth Matter for the USA

Financial literacy isn’t bound by borders. What works in Mumbai can inspire strategies in Manhattan.

Here’s why India’s youth-driven money habits resonate globally:

- Inflation-Proof Thinking:

Indian households traditionally hedge against inflation by investing in gold, mutual funds, and small businesses — not just cash savings. - Low Debt Lifestyle:

Credit cards are less common among Indian youth compared to the U.S., leading to a mindset that avoids high-interest debt traps. - Side Hustle Culture:

Digital platforms like Zerodha, Groww, and Upstox have turned investing into a side gig for India’s Gen Z — a parallel to gig work in the U.S., but wealth-oriented. - Generational Mindset Shift:

Indian youth are rejecting old-school “save everything” ideologies for balanced investing — a blend of security and growth.

This hybrid approach offers a new model for Americans seeking financial stability in a volatile economy.

How Indian Youth Built Financial Literacy So Fast

1. The Rise of Digital Finance Apps

Mobile-first platforms have democratized finance. Apps like Groww, Kuvera, and Paytm Money allow anyone with ₹100 (~$1.20) to start investing.

This micro-investment model can inspire similar scalable systems in the U.S. for low-income youth.

2. Peer-Learning and Influencer Finance

Indian financial influencers such as CA Rachana Ranade and Pranjal Kamra have simplified complex financial concepts — much like the “FinTok” movement in the U.S. but with deeper educational intent.

3. Government Initiatives

Campaigns like Financial Literacy Week by the Reserve Bank of India (RBI) and Jan Dhan Yojana (banking inclusion program) have educated millions, teaching basic money management even in rural regions.

4. Early Exposure to Markets

The combination of free trading apps and low entry barriers made investing as normal as using Instagram. Compare that to U.S. youth who often associate investing only with large sums or retirement accounts.

What Can Americans Learn from India’s Youth?

Lesson 1: The Power of Delayed Gratification

Indian youth typically save before spending. The philosophy — “Buy it when you can afford it twice” — protects against impulsive purchases and credit card debt.

In contrast, U.S. consumerism thrives on buy-now-pay-later culture. By adopting India’s “earn first, indulge later” mindset, Americans could reduce credit dependency.

Lesson 2: Early and Consistent Investing

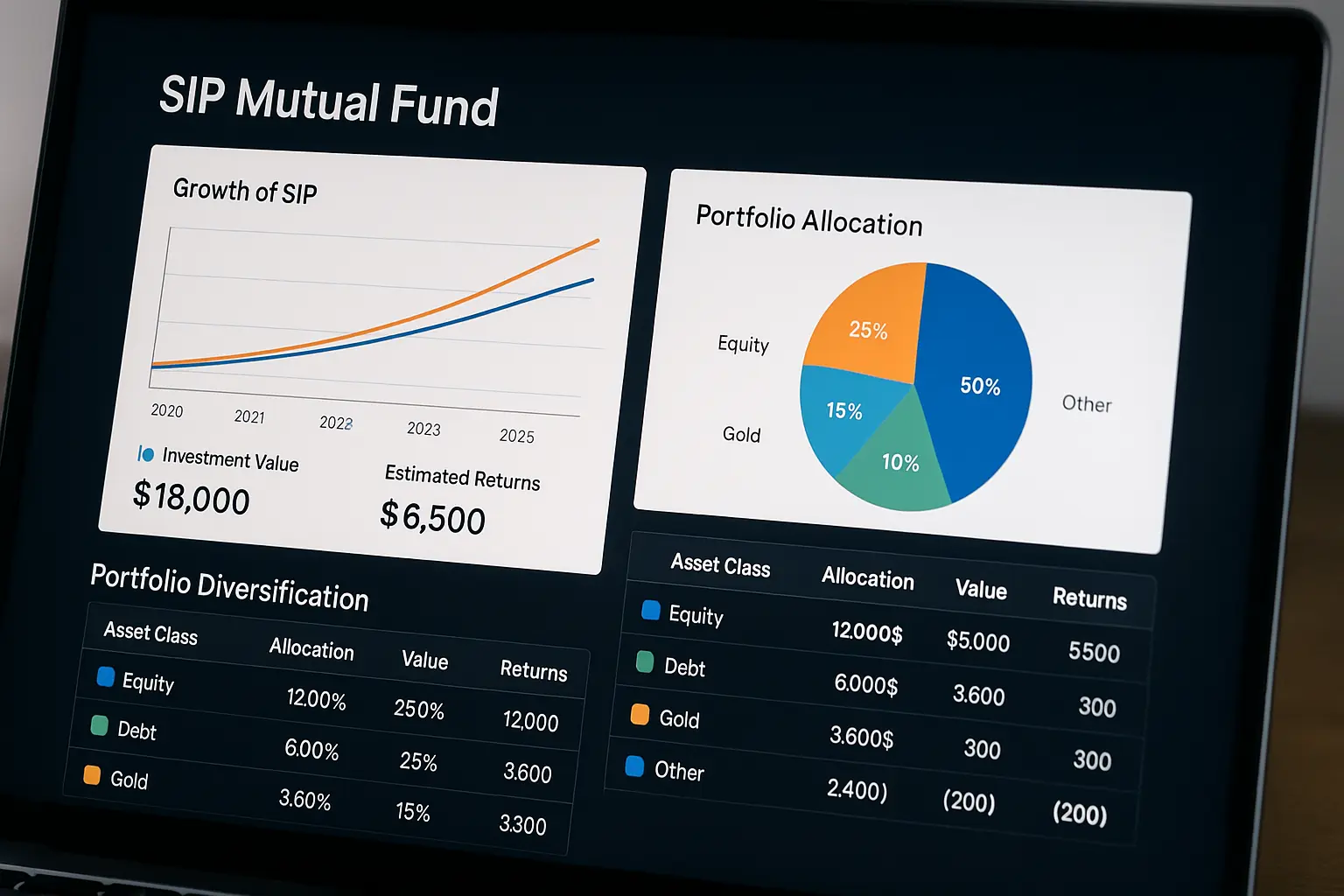

In India, millennials and Gen Zs are turning to Systematic Investment Plans (SIPs) — automated monthly contributions to mutual funds.

The U.S. equivalent would be automating 401(k), IRA, or ETF investments.

The principle: “Consistency beats timing.”

Even $100 invested monthly from age 22 can snowball into substantial wealth over decades — something Indian youth grasp early.

Lesson 3: Community-Based Financial Learning

In India, money discussions are increasingly normalized among young people — through online forums, YouTube, or finance clubs.

Americans can benefit by replacing financial secrecy with peer accountability and open conversations around saving, debt, and goals.

Lesson 4: Living Below Means to Live Above Debt

In India, frugality isn’t seen as deprivation but empowerment.

Minimalism and resourcefulness allow flexibility — crucial during economic downturns. Americans can draw from this to manage inflation and housing costs better.

Lesson 5: Diversified Asset Thinking

From gold ETFs to real estate co-ownership, Indian youth diversify even small portfolios.

This contrasts with U.S. investors who heavily rely on stock markets. Balanced diversification is a core takeaway for wealth stability.

How to Apply These Financial Literacy Lessons in the USA

Here’s how Americans can practically adopt these strategies:

1. Start Micro-Investing

Use platforms that allow investing in fractional shares or ETFs. Start small but stay consistent — like India’s SIP model.

2. Automate Financial Goals

Set up auto-transfers for savings, bills, and investments to build wealth passively.

3. Learn Before You Earn

Follow educational finance creators who simplify tax, insurance, and investing — and focus on actionable learning, not hype.

4. Build an Emergency Fund

Aim for 6 months of expenses in a high-yield savings account. This mirrors India’s cash-first approach before risky investments.

5. Diversify Early

Blend traditional and modern investments — real estate, index funds, digital gold, and even green tech startups.

Common Myths About Financial Literacy and Wealth

| Myth | Reality |

|---|---|

| “You need high income to invest.” | Small, consistent investments can outperform sporadic lump sums. |

| “Debt builds credit, so it’s good.” | Only managed, low-interest debt builds healthy credit; revolving debt drains wealth. |

| “Financial literacy is boring.” | Today’s gamified apps and micro-investing tools make it interactive. |

| “Only experts understand markets.” | Free online courses and simulated trading make learning accessible to all. |

Expert Views and Real-World Examples

Case Study 1: India’s SIP Revolution

By 2025, Indian SIPs exceeded ₹20,000 crore (~$2.4 billion) monthly — proving consistent small investments create massive collective wealth.

Case Study 2: U.S. Comparison – 401(k) Gaps

Despite widespread access, over 40% of American workers don’t contribute to retirement plans. India’s youth investing habits demonstrate how early participation compounds even at low income levels.

Expert Opinion

According to Morgan Stanley economist Ridham Desai, “India’s young investors are reshaping the nation’s financial culture — disciplined, digital, and data-driven. The U.S. can emulate this blend of prudence and risk appetite.”

$500 PayPal Gift Card

A $500 PayPal Gift card may be available to select users. Checking eligibility is quick. You can check if you’re one of them.

FAQs

Q1. What are the best financial literacy lessons from India’s youth for building wealth in the USA?

Their focus on saving first, investing early, and avoiding debt are key lessons U.S. youth can adopt to grow wealth sustainably.

Q2. How can Americans apply India’s saving habits?

Start small, automate savings, and prioritize necessity over luxury until financial goals are secured.

Q3. Are Indian youth really better investors than Americans?

They’re not “better” — just more cautious and community-oriented. Their balance of thrift and tech-driven investing offers inspiration.

Q4. How can U.S. schools improve financial literacy?

Introduce real-life money simulation projects, teach compound interest early, and use gamified apps to sustain engagement.

Q5. Is frugality still relevant in high-income economies?

Yes. Living modestly ensures surplus cash for investing and shields against financial shocks — regardless of income level.

Key Takeaways

- The financial literacy lessons from India’s youth for building wealth in the USA show how smart saving, consistent investing, and minimal debt can build resilience.

- U.S. youth can learn to save before spending, invest small but regularly, and discuss money openly.

- Digital education, micro-investing, and community accountability are the next big tools for global financial empowerment.

- Wealth isn’t built by luck — it’s crafted through literacy, patience, and purpose.

Conclusion

The financial literacy lessons from India’s youth for building wealth in the USA underline a universal truth — financial freedom is a mindset, not a market.

By blending India’s disciplined, tech-driven saving habits with America’s entrepreneurial energy, a new model of global financial resilience can emerge.

The future of wealth won’t belong to those who earn the most — it will belong to those who understand money best.