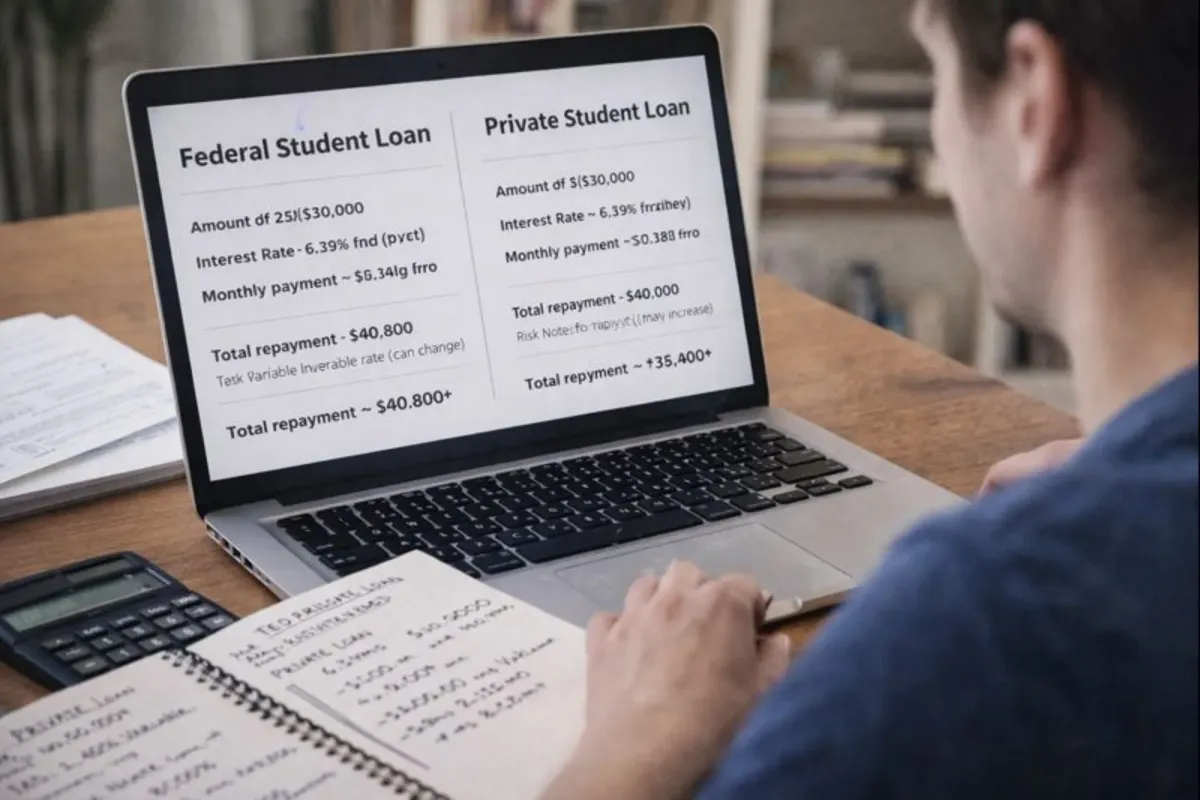

Federal vs Private Student Loans: Interest Comparison and Lifetime Cost

This article explains how federal and private student loans differ in interest structure and how those differences affect total repayment over time. Using clear examples, it shows why a lower starting rate does not always mean a lower lifetime cost.

The real question behind this

Most borrowers compare student loans by looking at a single number: the interest rate.

What they actually need to understand is how that rate behaves over time and how much money leaves their pocket in total.

The confusion comes from mixing fixed rates, variable rates, repayment length, and protections.

This article explains those mechanics using realistic numeric examples, not assumptions.

Federal vs Private Student Loans: Interest and Lifetime Cost (Illustrative Example)

Assumption for comparison:

$30,000 loan · 10-year repayment · borrower makes standard payments

| Feature | Federal Student Loan | Private Student Loan |

|---|---|---|

| Interest rate structure | Fixed for life; set by Congress | Fixed or variable; set by lender |

| Typical 2025–26 rates | 6.39% (undergrad) 7.94% (graduate) 8.94% (PLUS) | ~3%–18% depending on credit |

| Example rate used | 6.39% fixed | 5.0% variable (average credit) |

| Origination fee | ~1% (≈ $300 on $30k) | Often none |

| Monthly payment (10 yrs) | ≈ $340 | ≈ $318 (can change) |

| Total repaid over 10 years | ≈ $40,800 (incl. fee) | ≈ $38,200 if rate stays stable |

| Rate change risk | None | High if variable rate rises |

| If rate rises +2% | No change | Total repaid ≈ $42,000+ |

| Repayment protections | Income-driven, deferment, forbearance | Limited, lender-specific |

| Default risk during income loss | Lower due to protections | Higher due to fixed obligation |

$500 Walmart Gift Card

A $500 Walmart gift card may be available to select users. Checking eligibility is quick. You can check if you’re one of them.

What this means

Federal and private student loans differ in how interest is set, applied, and controlled over the life of the loan.

Federal loans use fixed rates defined by law and include repayment safeguards.

Private loans use credit-based pricing, often with variable rates tied to markets.

These structural differences change lifetime cost even when starting rates look similar.

How this works in practice

How interest turns into real money paid

Interest accrues daily on the outstanding balance for both loan types.

A $30,000 loan at 5.0% over 10 years results in about $38,200 total repaid.

The same $30,000 at 4.0% variable can stay lower—or rise significantly.

Even a 2% increase over time can add thousands to total repayment.

Key takeaway: Small rate changes compound into large lifetime costs.

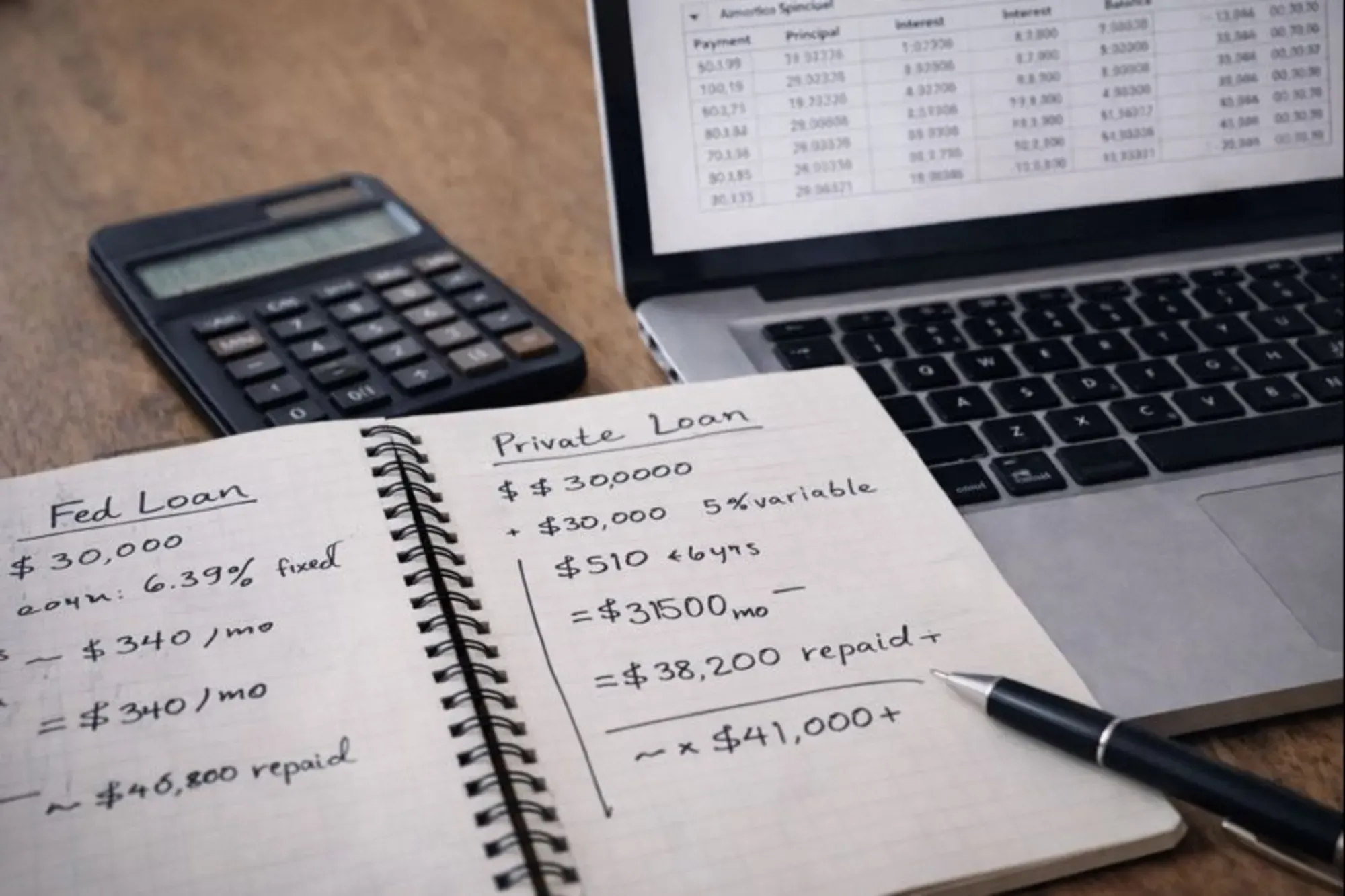

Lifetime Cost Example: Fixed vs Variable Interest

Assumption: $30,000 loan · 10-year repayment · standard amortization

| Scenario | Interest behavior | Approx. monthly payment | Total repaid (approx.) |

|---|---|---|---|

| Federal student loan | 5.0% fixed for full 10 years | ~$318 | ~$38,200 |

| Private loan (stable) | 4.0% fixed for full 10 years | ~$304 | ~$36,500 |

| Private loan (rate rises) | 4.0% → 7.0% variable over time | ~$304 → ~$348 | ~$41,000+ |

The private loan starts cheaper but can become more expensive if rates rise.

Key takeaway: Variable rates transfer market risk to the borrower.

How repayment flexibility changes cost

Federal loans allow income-driven repayment during low-income periods.

Lower payments increase interest paid but reduce default risk.

Private loans usually require fixed payments regardless of income.

Missed payments add fees and credit damage, increasing total cost indirectly.

Key takeaway: Flexibility affects both cash flow and long-term cost.

How borrowing limits protect borrowers

Federal loans cap annual and lifetime borrowing.

Private loans may allow borrowing up to full cost of attendance.

Borrowing an extra $10,000 at 6% over 15 years adds roughly $5,000 in interest.

Higher limits increase access but also amplify lifetime repayment.

Key takeaway: Limits reduce overborrowing risk.

Parents: Make school choice part of your New Year resolutions! Find an education that works best for your children: https://t.co/PLB6KaTvxh pic.twitter.com/T7K8ip4OZE

— U.S. Department of Education (@usedgov) January 2, 2026

Common misunderstandings clarified

- A lower starting rate does not guarantee a lower total cost

- Variable rates reward strong credit but penalize long timelines

- Monthly payment size hides lifetime interest accumulation

- Protections matter as much as interest rates

Quick understanding summary

Federal and private student loans differ in how interest behaves and how cost accumulates over time.

Federal loans use fixed rates and include repayment protections that reduce financial risk.

Private loans may offer lower initial rates but often use variable pricing and fewer safeguards.

Lifetime cost depends on interest behavior, repayment length, and total amount borrowed—not just the starting rate.

Common mistakes to avoid

Many borrowers compare loans using only the first advertised rate.

Some ignore how variable rates change over long repayment periods.

Others extend repayment without understanding added interest cost.

Borrowing the maximum allowed often creates unnecessary lifetime debt.

Future trends and predictions

Federal loan interest structures are likely to remain fixed and standardized.

Private lending is increasingly tied to market benchmarks and risk-based pricing.

Disclosure tools are improving, but cost understanding remains borrower-dependent.

Lifetime cost comparisons will become more important as average loan balances rise.

$750 Cash App Gift Card

Some users qualify for a $750 Cash App gift card. You can check if you qualify.

FAQs

Is a lower private interest rate always better?

No. Variable rates can increase total repayment beyond fixed federal loans.

What increases lifetime cost the most?

Longer repayment terms and rising interest rates.

Can federal loans cost more overall?

Yes, if extended repayment is used, but protections reduce default risk.

Do protections affect cost?

Indirectly, yes—by preventing penalties, defaults, and credit damage.

Should borrowers mix loan types?

Sometimes, but only with clear understanding of risk exposure.

Conclusion

Interest rate behavior, not just the rate itself, determines lifetime loan cost.

Understanding how federal and private loans accumulate interest helps borrowers choose based on total financial impact, not surface numbers.