What Is a Federal Student Loan and How to Apply for Federal Loans in America?

Federal student loans are government-backed education loans that help students pay for college with fixed interest rates and clear repayment rules. This article explains what they are, how the application process works, and what borrowing actually means before accepting aid.

What this means

A federal student loan is money provided by the U.S. government to help pay for approved education expenses such as tuition, fees, housing, and required supplies.

These loans are created, regulated, and enforced by the U.S. Department of Education and delivered through programs administered by Federal Student Aid.

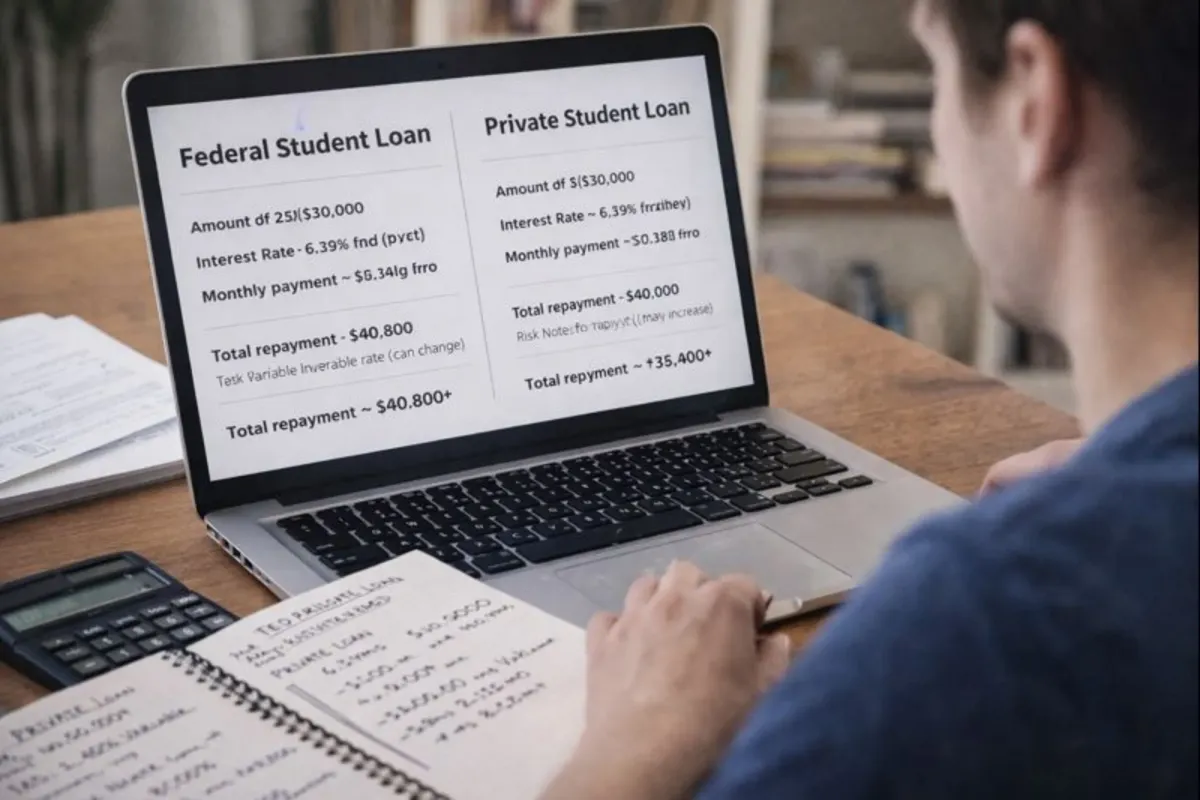

Unlike private loans, their interest rates, repayment rules, and borrower protections are set by federal law rather than by lenders.

The system is designed to expand access to education while limiting financial harm to borrowers.

Federal student loans are not one product but a group of related loan types, each serving a specific purpose.

Subsidized loans support undergraduates with financial need by pausing interest during school enrollment.

Unsubsidized loans are available regardless of need but accrue interest from the time they are issued.

PLUS loans allow parents or graduate students to borrow up to the cost of attendance when other aid is insufficient.

Consolidation loans exist to simplify repayment, not to reduce total debt.

Types of Federal Student Loans — Practical Comparison

| Loan Type | Who Can Borrow | Financial Need Required | Interest While in School | Annual Borrowing Limit* | Key Use Case | Important Limitations |

|---|---|---|---|---|---|---|

| Direct Subsidized Loan | Undergraduate students | Yes | No (government pays interest during enrollment and grace period) | Up to $5,500 depending on year and dependency | Best for students with demonstrated need who want lower total repayment | Limited availability; not offered to graduate students |

| Direct Unsubsidized Loan | Undergraduate, graduate, and professional students | No | Yes (interest accrues immediately) | Up to $20,500 for graduate students; lower limits for undergraduates | Common baseline loan when need-based aid is insufficient | Balance grows during school if interest is unpaid |

| Direct PLUS Loan | Parents of dependent undergraduates; graduate/professional students | No (but basic credit check required) | Yes | Up to full cost of attendance minus other aid | Covers remaining costs after other aid is used | Higher interest rates and origination fees |

| Direct Consolidation Loan | Borrowers with existing federal student loans | Not applicable | Depends on underlying loans | No annual limit | Simplifies repayment by combining multiple loans | Can extend repayment term and increase total interest |

$500 Walmart Gift Card

Not everyone qualifies for this $500 Walmart gift card. Checking only takes a moment. You can check if you’re eligible.

How this works in practice

How eligibility is established

Eligibility is based on enrollment in an approved U.S. institution, citizenship or eligible residency status, and satisfactory academic progress.

Financial need affects which loan types are available, but not whether a student can access federal loans at all.

Schools calculate eligibility using standardized federal formulas rather than discretionary judgment.

The key outcome is eligibility to be offered loans, not a requirement to accept them.

How the application system functions

All federal student loans are accessed through one application: the Free Application for Federal Student Aid.

This form collects financial and household information to determine aid eligibility.

Submitting it allows schools to calculate and offer federal loans as part of a financial aid package.

The key outcome is choice: students may accept, reduce, or decline the loan amounts offered.

How interest and repayment are structured

Federal loan interest rates are fixed when the loan is issued and remain stable over time.

Some loans delay interest while the student is in school, while others do not.

Repayment typically begins after graduation or reduced enrollment, often following a grace period.

This structure provides predictability and access to flexible repayment options if income changes.

How borrowing limits affect planning

Federal loans include annual and lifetime limits based on dependency status and education level.

These limits are designed to reduce the risk of excessive long-term debt.

When costs exceed federal limits, families must consider other funding options.

The takeaway is that federal loans are a support tool, not unlimited financing.

Comparisons and alternatives

- Applying for federal student loans does not mean you are required to borrow.

- Federal loans differ from private loans in repayment protections and eligibility rules.

- Lower interest rates do not remove the responsibility to repay the loan.

- Federal loans are designed for education access, not for covering every expense.

Quick understanding summary

A federal student loan is government-backed education funding with standardized terms, fixed interest rates, and built-in borrower protections.

Students apply through a single federal system, which determines eligibility for different loan types.

Borrowing is optional, limits apply, and repayment follows clear rules designed to balance access to education with long-term financial responsibility.

To consolidate or not to consolidate? 🤔

— Federal Student Aid (@FAFSA) December 31, 2025

If you have more than one federal student loan, weigh the pros and cons of this option.

For more details, visit https://t.co/FXsHRlw2fz pic.twitter.com/FRxhJhMOi9

Common mistakes to avoid

Many borrowers assume they must accept the full loan amount offered, even if they need less.

Others misunderstand when interest begins accruing and underestimate total repayment.

Missing application deadlines can reduce access to federal aid.

Confusing federal loans with private loans often leads to unrealistic expectations about repayment flexibility.

For years, we’ve continued the status quo of growing the federal education bureaucracy, despite declining test scores and worse outcomes for our students.

— U.S. Department of Labor (@USDOL) December 30, 2025

Under President Trump’s leadership, the status quo is no longer acceptable.

We’re working with our partners at @usedgov… pic.twitter.com/SA2uNoj7DZ

Future outlook

Federal student loan systems are expected to continue improving transparency around repayment and servicing.

Digital account management and clearer disclosures are becoming more common.

While repayment policies may change, the core structure of federal loans is designed for long-term stability rather than short-term policy shifts.

$500 PayPal Gift Card

Not everyone qualifies for this $500 PayPal gift card. Checking only takes a moment. You can check if you’re eligible.

FAQs

Is a federal student loan considered financial aid?

Yes, but it is a form of aid that must be repaid, unlike grants or scholarships.

Do I have to repay a federal student loan if I leave school early?

In most cases, yes, though repayment usually begins after a short grace period.

Can graduate students apply for federal loans?

Yes, graduate and professional students may qualify for unsubsidized and PLUS loans.

Does applying for federal loans affect credit scores?

Completing the application does not affect credit, though repayment history matters later.

Can federal student loans be combined?

Yes, eligible federal loans can be consolidated into a single loan for repayment simplicity.

Conclusion

Federal student loans are designed to make education accessible while limiting financial risk.

Understanding how they work before borrowing helps students and families make informed decisions.