Crypto vs. Digital Rupee: What India’s Experiment Teaches the USA About CBDCs

This analysis of crypto vs digital rupee uncovers what India’s CBDC experiment can teach the USA about security, adoption, and the future of government-backed digital money—offering insights policymakers can’t ignore.

The Crypto vs. Digital Rupee debate is reshaping how nations think about money itself. India’s bold experiment with its Central Bank Digital Currency (CBDC) — the Digital Rupee — is offering a real-world case study on what happens when a country integrates blockchain-inspired systems into traditional finance.

Meanwhile, the United States is cautiously observing, exploring the potential for a Digital Dollar while navigating the complexities of privacy, innovation, and control.

Key Takeaways

- India’s Digital Rupee offers a centralized, regulated version of digital money built for trust and control.

- Cryptocurrencies offer decentralization, freedom, and innovation — but also volatility and risk.

- The U.S. can learn from India’s CBDC rollout to balance innovation with financial stability.

$500 PayPal Gift Card

Some users qualify for a $500 PayPal gift card. You can check if you qualify.

What Is the Digital Rupee and How Is It Different from Crypto?

At its core, the Digital Rupee (e₹) is India’s official Central Bank Digital Currency, issued by the Reserve Bank of India (RBI). Unlike crypto assets like Bitcoin or Ethereum, it’s government-backed, centrally controlled, and pegged 1:1 to the Indian Rupee.

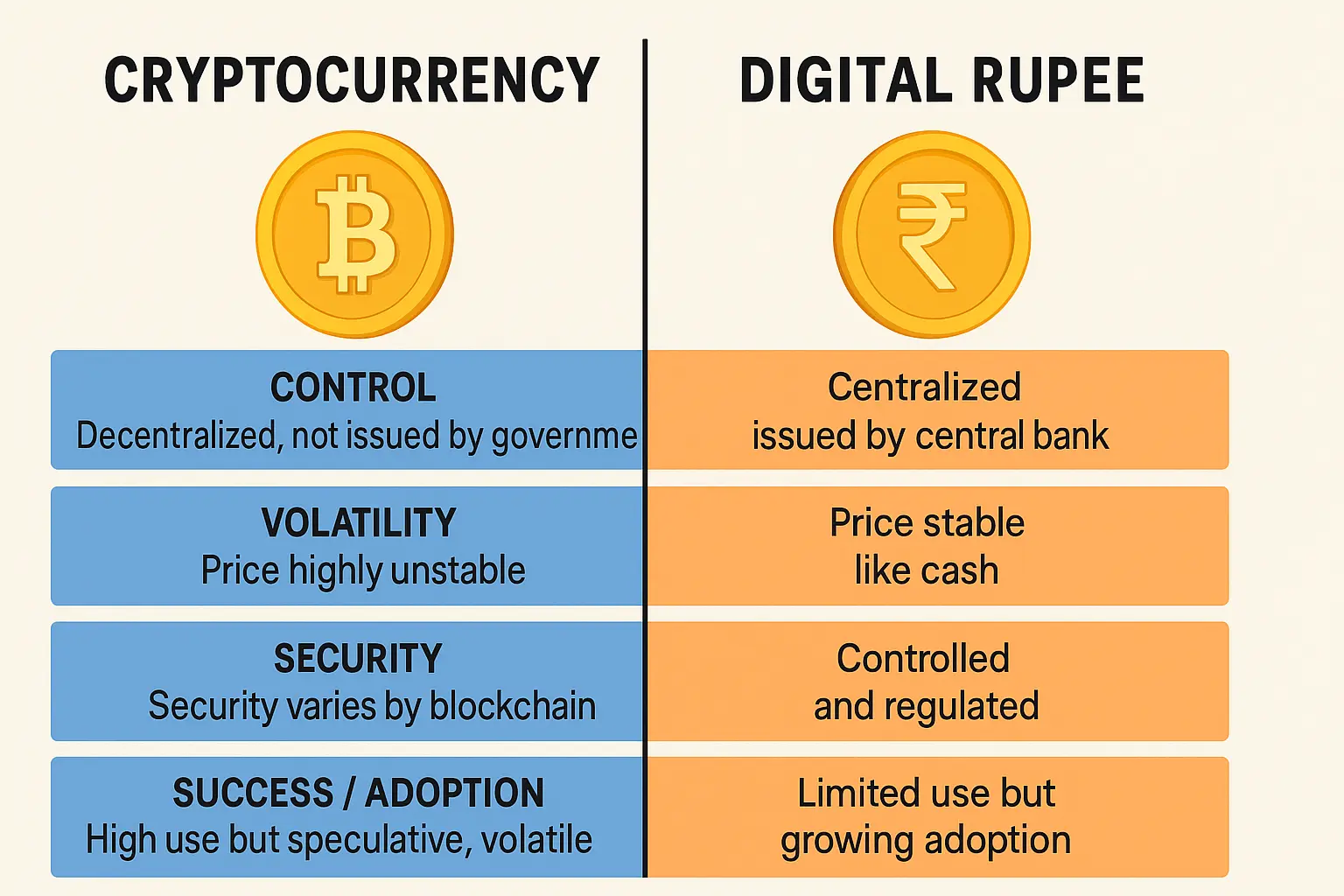

Crypto vs. Digital Rupee: Key Differences

| Feature | Cryptocurrencies | Digital Rupee (CBDC) |

|---|---|---|

| Issuer | Private / decentralized | Central Bank (RBI) |

| Control | Decentralized (peer-to-peer) | Centralized |

| Volatility | High | None (stable value) |

| Anonymity | Partial / full | Controlled |

| Purpose | Investment & decentralization | Digital legal tender |

| Technology | Public blockchain | Permissioned ledger |

In essence, crypto represents financial freedom and decentralization, while the Digital Rupee symbolizes security, compliance, and state-backed trust.

Why the Digital Rupee Matters Globally

India’s Digital Rupee is more than a domestic innovation — it’s a geopolitical experiment in reimagining monetary systems for the 21st century.

1. Financial Inclusion

The Digital Rupee is bridging gaps for millions of unbanked Indians by enabling low-cost, digital-first transactions without relying on commercial banks.

2. Reduced Dependence on Cash

India, historically cash-heavy, is moving toward a cash-lite economy powered by fintech and digital identity systems like Aadhaar and UPI.

3. Global Leadership in Fintech

By piloting its CBDC early, India positions itself as a policy and innovation leader — a valuable lesson for Western economies like the U.S.

What Can the U.S. Learn from India’s Digital Rupee?

1. The Importance of Digital Infrastructure

India’s success stems from Digital Public Infrastructure (DPI) — Aadhaar for identity, UPI for payments, and now the Digital Rupee for monetary flow.

The U.S. lacks a comparable unified system, relying instead on fragmented networks of private payment providers.

Lesson: Build open, interoperable, government-supported digital infrastructure before launching a CBDC.

2. Balancing Privacy and Control

India’s Digital Rupee maintains transparency with traceable transactions, but this raises privacy concerns. The U.S., where data privacy is paramount, can’t afford overreach.

Lesson: Any U.S. CBDC must embed privacy-first architecture — allowing lawful oversight without surveillance.

3. Public Education Is Key

India invested heavily in awareness and digital literacy. Many citizens still confuse the Digital Rupee with cryptocurrency.

Lesson: The U.S. must educate the public about what a Digital Dollar is — and isn’t — to foster adoption and trust.

4. Private Sector Collaboration

India’s central bank worked with commercial banks and fintech startups to test its e₹ pilot.

The U.S. Federal Reserve can similarly partner with major fintech players and blockchain developers to ensure scalability.

Lesson: Collaboration between policymakers, banks, and innovators is essential for success.

Can a Digital Dollar Compete with Crypto?

That depends on how it’s designed.

A Digital Dollar could revolutionize payments — instant settlements, lower costs, and financial inclusion — but if it’s overly restrictive, crypto will continue to dominate decentralized finance (DeFi).

Key Difference:

Crypto offers freedom from intermediaries, while a Digital Dollar could ensure universal access to secure, stable money.

To strike balance, the U.S. needs:

- Transparency in how digital money is governed.

- Innovation-friendly policies that don’t stifle crypto or blockchain startups.

- Interoperability with global digital currencies, including India’s e₹ and China’s e-CNY.

How CBDCs Could Shape the Future of Global Trade

1. Cross-Border Transactions

CBDCs could make international settlements faster and cheaper, bypassing traditional intermediaries like SWIFT.

Imagine U.S. importers paying Indian exporters directly in digital currencies, instantly converted between e₹ and Digital Dollar.

2. Monetary Sovereignty

Countries adopting CBDCs gain tighter control over capital flows, reducing dependence on foreign payment rails.

For the U.S., this is crucial to maintaining dollar dominance in an increasingly digital world.

3. Financial Security

A Digital Dollar could strengthen resilience against cyber fraud and reduce black-market activity by ensuring traceable, auditable transactions.

How the U.S. Can Design Its CBDC the Right Way

Step 1: Define Purpose Clearly

Is the goal efficiency, inclusion, or competition with crypto? A focused objective helps avoid mission creep.

Step 2: Build an Open Yet Secure Architecture

Leverage blockchain’s transparency while ensuring national security and financial compliance.

Step 3: Pilot in Controlled Environments

India’s e₹ started with retail pilots in select cities, testing real-world usability. The U.S. should adopt a similar approach before national rollout.

Step 4: Partner with the Private Sector

Fintechs can enhance the user experience — from wallet design to integration with existing digital payment systems.

Step 5: Educate Citizens

Public trust is everything. Clear communication will determine whether the Digital Dollar becomes a success or another policy experiment.

Common Myths About CBDCs

Myth 1: CBDCs will replace physical cash.

Fact: CBDCs complement cash, not replace it — offering flexibility for both offline and digital payments.

Myth 2: CBDCs are just like crypto.

Fact: Crypto is decentralized and speculative; CBDCs are stable, state-backed currencies.

Myth 3: CBDCs threaten privacy completely.

Fact: Privacy depends on design — hybrid models can ensure both transparency and user protection.

Expert Views and Global Perspectives

- IMF (2025): “India’s CBDC pilots demonstrate scalability and compliance benefits that could guide global implementation.”

- Bank for International Settlements (BIS): “CBDCs should prioritize interoperability and data privacy to support cross-border trade.”

- Federal Reserve Board (2024): “The U.S. will proceed cautiously, ensuring a digital dollar strengthens — not disrupts — financial stability.”

- RBI Governor (2025): “The Digital Rupee isn’t competing with crypto — it’s building digital trust.”

$500 Walmart Gift Card

Not everyone qualifies for this $500 Walmart gift card. Checking only takes a moment. You can check if you’re eligible.

FAQs

1. What does Crypto vs. Digital Rupee mean?

It compares decentralized cryptocurrencies with India’s centralized digital currency, the Digital Rupee (CBDC).

2. Is the Digital Rupee a type of cryptocurrency?

No. It’s a central bank–issued, fully regulated form of digital legal tender.

3. How can the U.S. benefit from studying India’s CBDC?

By adopting its scalable framework, interoperability principles, and pilot-based approach.

4. What are the risks of a Digital Dollar?

Privacy erosion, data security concerns, and potential over-centralization.

5. Will CBDCs replace crypto in the long run?

Not entirely. Both will coexist — CBDCs for regulation and stability, crypto for innovation and decentralization.

Key Takeaways

- The Crypto vs. Digital Rupee debate highlights two financial futures: freedom vs. control.

- India’s Digital Rupee shows how CBDCs can enhance inclusion and trust.

- The U.S. can learn from India’s model to build a Digital Dollar that balances privacy and innovation.

- CBDCs will shape global trade, monetary policy, and national competitiveness.

- The world’s next financial revolution won’t be about paper money — it will be about programmable, transparent digital currencies.

Conclusion

The Crypto vs. Digital Rupee experiment is more than a technological rivalry — it’s a glimpse into the future of money.

As India advances its CBDC agenda, the United States stands at a crossroads: will it lead the next financial era with a secure, inclusive Digital Dollar, or play catch-up in a global economy already going digital?

By learning from India’s successes — and its challenges — the U.S. can craft a system that blends innovation with trust, ensuring its leadership in the digital age of finance.