9 Best Cashback and Rewards Credit Cards in the USA for 2025 — Stop Wasting Your Spending Power

Discover the best cashback and rewards credit cards in the USA for 2025 and stop leaving money on the table. This expert-backed guide spotlights top picks that maximize savings, perks, and everyday spending power.

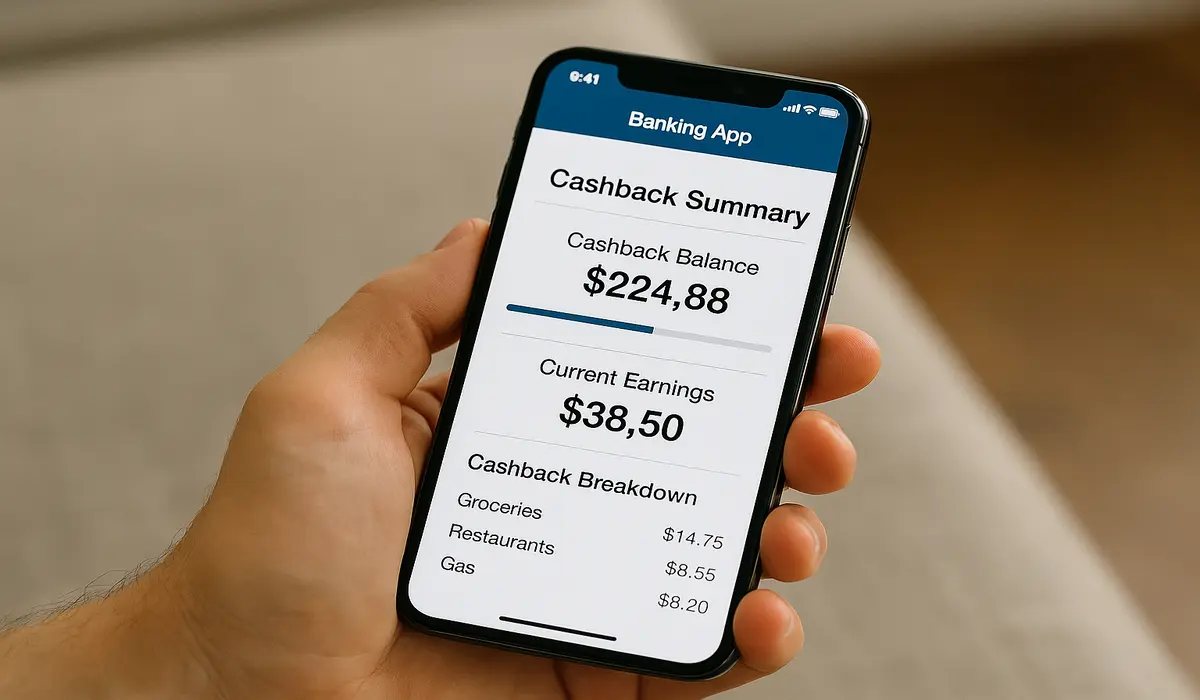

The best cashback and rewards credit cards in USA can help you turn everyday purchases into savings. According to the Federal Reserve, the average American household spends over $70,000 annually, much of which can yield rewards if paid with the right credit card.

From groceries to gas and streaming subscriptions, using a rewards card strategically can earn you hundreds of dollars in cashback or travel points each year — all without changing your spending habits.

- Top rewards cards offer 1.5%–6% cashback depending on category.

- Focus on no annual fee cards if you’re new to cashback optimization.

- Combine flat-rate and category-based cards for maximum return.

What Are Cashback & Rewards Credit Cards?

A cashback or rewards credit cards allows cardholders to earn a percentage of every purchase back as cash, points, or miles. These rewards can be redeemed for statement credits, travel, or gift cards.

Two main types include:

- Flat-rate cashback credit cards – offer the same rate on all purchases (e.g., 2% back).

- Category-based rewards cards – give higher cashback in specific areas (like gas, dining, or groceries).

Cashback and rewards programs are popular because they reward daily spending rather than encouraging extra purchases.

$750 Cash App Gift Card$750 Cash App Gift Card

Some users qualify for a $750 Cash App gift card. You can check if you qualify.

Why best cashback and rewards credit cards Matter

Credit cards that offer cashback or rewards go beyond convenience — they function as tools for smarter spending.

Key reasons they matter:

- Inflation Offset: Cashback helps neutralize rising living costs.

- Flexible Redemptions: Redeem for cash, travel, or statement credits.

- Financial Incentive: Encourages responsible, reward-based credit use.

- Improved Budgeting: Cashback tracking increases spending awareness.

In 2025, Americans are leaning toward reward-based credit habits rather than accumulating debt — a major shift toward financial literacy and intentional spending.

Top 10 Best Cashback & Rewards Credit Cards in USA (2025)

Below are the top-performing cards ranked by reward value, annual fee, and flexibility.

1. Chase Freedom Unlimited®

- Best for: Everyday spending

- Rewards: 1.5% on all purchases + 3% on dining + 5% on travel via Chase Ultimate Rewards

- Annual Fee: $0

- Intro Offer: $200 bonus after $500 spend in 3 months

- Why It Stands Out: Excellent all-around card for flat-rate and category rewards.

2. Citi Custom Cash℠ Card

- Best for: Dynamic category spenders

- Rewards: 5% on top eligible spend category (up to $500/month)

- Annual Fee: $0

- Why It Stands Out: Automatically adjusts to your highest spend area monthly.

3. Capital One SavorOne Rewards

- Best for: Dining and entertainment

- Rewards: 3% on dining, entertainment, streaming, groceries

- Annual Fee: $0

- Intro Offer: $200 bonus on $500 spend in 3 months

- Why It Stands Out: High rewards in lifestyle categories without annual cost.

4. Discover it® Cash Back

- Best for: Rotating categories

- Rewards: 5% cashback on quarterly categories (up to $1,500), 1% elsewhere

- Annual Fee: $0

- Unique Feature: Cashback Match doubles all rewards in the first year.

5. American Express Blue Cash Everyday®

- Best for: Families and groceries

- Rewards: 3% on groceries (up to $6,000/year), 3% on gas, 3% on online retail

- Annual Fee: $0

- Why It Stands Out: Strong grocery category rewards for households.

6. Wells Fargo Active Cash® Card

- Best for: Simple 2% flat-rate cashback

- Rewards: 2% on all purchases

- Annual Fee: $0

- Intro Offer: $200 bonus after $500 spend

- Why It Stands Out: No categories, no limits — just consistent rewards.

7. Bank of America® Customized Cash Rewards

- Best for: Tailored earning categories

- Rewards: 3% in chosen category + 2% at grocery stores, 1% elsewhere

- Annual Fee: $0

- Unique Feature: Boosts rewards up to 25–75% for Preferred Rewards members.

8. Capital One Venture Rewards

- Best for: Travel rewards

- Rewards: 2 miles per dollar spent

- Annual Fee: $95

- Intro Offer: 75,000 miles after $4,000 spend in 3 months

- Why It Stands Out: Flexible travel redemptions and strong partner ecosystem.

9. Chase Sapphire Preferred®

- Best for: Frequent travelers

- Rewards: 5x on travel, 3x on dining, 2x on all other travel

- Annual Fee: $95

- Why It Stands Out: Premium travel perks at an accessible fee.

10. American Express Blue Cash Preferred®

- Best for: Maximizing grocery and streaming

- Rewards: 6% on groceries (up to $6,000/year) and 6% on streaming

- Annual Fee: $95

- Why It Stands Out: Industry-leading grocery cashback rate.

Which Credit Card Type Fits You Best?

| User Type | Recommended Card | Key Benefit |

|---|---|---|

| Everyday spender | Wells Fargo Active Cash® | Simple, flat 2% cashback |

| Frequent diner | Capital One SavorOne | High dining & entertainment rewards |

| Family shopper | Amex Blue Cash Everyday | Top grocery & gas cashback |

| Flexible user | Citi Custom Cash | Adapts to spending habits |

| Frequent traveler | Chase Sapphire Preferred | Travel-focused rewards |

How to Choose the Best Cashback Credit Card

- Identify Spending Habits:

Review monthly expenses—focus on high-frequency categories (gas, dining, groceries). - Compare Reward Rates:

Look for cards offering 3%+ in your top categories. - Evaluate Fees:

Choose a no-annual-fee card if rewards won’t exceed costs. - Check Redemption Options:

Some cards restrict redemptions to travel portals or gift cards. - Look for Signup Bonuses:

Bonuses of $200–$300 are common and can jump-start earnings. - Assess APR (If You Carry a Balance):

Cashback is only profitable if you avoid paying high interest.

Common Mistakes to Avoid with Rewards Cards

- Chasing Bonuses Without Budgeting: Don’t overspend just to meet reward thresholds.

- Ignoring Category Caps: Many 5% offers have limits (e.g., $1,500 per quarter).

- Redeeming Points Poorly: Cash or statement credits often yield higher value than gift cards.

- Neglecting Annual Fee Math: Always ensure rewards exceed the yearly cost.

- Missing Payments: Late payments can nullify bonuses and damage credit score.

Expert Insights & Reports

- NerdWallet 2025 Report: Average U.S. cardholder earned $312 in cashback annually when using optimized cards.

- CNBC Financial Survey: 67% of users prefer flat-rate cards for simplicity.

- Expert View – Michelle Lewis, CFP®: “The real power of cashback cards lies not in high rates but in consistent use and timely payments. A 2% flat-rate card often beats a 5% category card if spending is unstructured.”

Case Example:

David, a 35-year-old teacher from Ohio, combined the Citi Custom Cash (5%) and Wells Fargo Active Cash (2%) to earn over $650 in cashback annually without changing his budget.

$500 PayPal Gift Card$500 PayPal Gift Card

Some users qualify for a $500 PayPal gift card. You can check if you qualify.

FAQs about best cashback and rewards credit cards in USA

1. What is the best cashback and rewards credit card in USA right now?

The Chase Freedom Unlimited® and Wells Fargo Active Cash® are top choices for 2025 due to no annual fee and versatile reward rates.

2. Which credit card gives the most cashback on groceries?

The American Express Blue Cash Preferred® offers 6% cashback on groceries up to $6,000 annually.

3. Are cashback credit cards worth it if I have a low credit score?

Yes, but start with entry-level cards like Discover it® or Capital One QuicksilverOne® to build credit first.

4. Do rewards credit cards hurt your credit score?

No, responsible use can improve your score by lowering credit utilization and establishing history.

5. Should I get multiple cashback cards?

Yes, pairing a flat-rate and a category-based card helps maximize coverage across all spending types.

Key Takeaways : best cashback and rewards credit cards in USA

- The best cashback and rewards credit cards in USA offer 1.5%–6% back on common expenses.

- Always consider your spending habits before selecting a card.

- Combining a flat-rate card with a category card ensures consistent returns.

- Never pay interest — carry a balance, and your rewards lose value.

- Reassess your card lineup annually to adapt to spending changes.

Conclusion : best cashback and rewards credit cards in USA

Choosing the best cashback and rewards credit cards in USA can turn routine expenses into long-term financial benefits. Whether you prioritize simplicity, dining perks, or travel flexibility, the key is to match your lifestyle with the right product.

By applying responsible spending, automated payments, and smart redemption strategies, you can transform your credit card from a payment tool into a financial asset.