Top Tips for Building an Emergency Fund: Your Guide to Financial Security

Learn how to build an emergency fund with these top tips. From saving strategies to realistic goals, secure your financial future today.

Picture this: one morning, your car won’t start. Without building an emergency fund, such unexpected expenses can throw your budget into chaos.

Life is unpredictable, and financial surprises like this are common. This is where an emergency fund becomes crucial.

Building an emergency fund is one of the most important steps toward financial stability.

For many, the idea of saving a large amount of money for ‘just in case’ moments feels daunting.

Where should you start? How much is enough? And how can you avoid dipping into the fund unnecessarily?

In this article, we’ll explore the *Top Tips for Building an Emergency Fund*, covering everything from realistic savings goals to practical strategies for growing your fund quickly and maintaining it over time.

Understanding the Importance of an Emergency Fund

Why an Emergency Fund Matters

Emergencies come in many forms: job loss, medical bills, car repairs, or even home maintenance issues. These unexpected costs can derail your financial plans if you’re not prepared. Having an emergency fund is a financial safety net that helps you weather these storms without going into debt or derailing your long-term savings goals.

Imagine having the peace of mind that comes from knowing you can handle life’s financial curveballs. That’s the power of a solid emergency fund. The question is, how do you build one?

How to Start Building an Emergency Fund Quickly

Set a Realistic Savings Goal

The first step in building an emergency fund is knowing how much to save. The common recommendation is three to six months’ worth of living expenses.

This should cover essentials like rent, utilities, food, and transportation in case of sudden income loss.

For many, a realistic starting point might be $1,000 to handle small emergencies. From there, aim for 3–6 months of expenses, adjusted to your lifestyle

What is a realistic emergency fund amount? For many, a realistic starting goal might be $1,000 to cover small emergencies. From there, you can work towards saving enough to cover 3-6 months of living expenses, adjusting based on your lifestyle and financial situation.

Start small but stay consistent when building an emergency fund that actually lasts.

Thinking about saving thousands at once can feel overwhelming. Instead, start small. Save $10, $20, or $50 a week consistently.

Over time, these small contributions add up. Automate transfers from your checking to a high-yield savings account.

Automation ensures you won’t skip a month and keeps the habit effortless.

Cut Back on Non-Essentials

Temporarily reducing non-essential spending can give your fund a quick boost.

Cutting back on dining out, unused subscriptions, or luxury purchases frees money for savings. Even short-term sacrifices speed up your goal.

Redirect every saved dollar directly into your emergency fund.

Best Practices for Building an Emergency Fund and Keeping It Strong

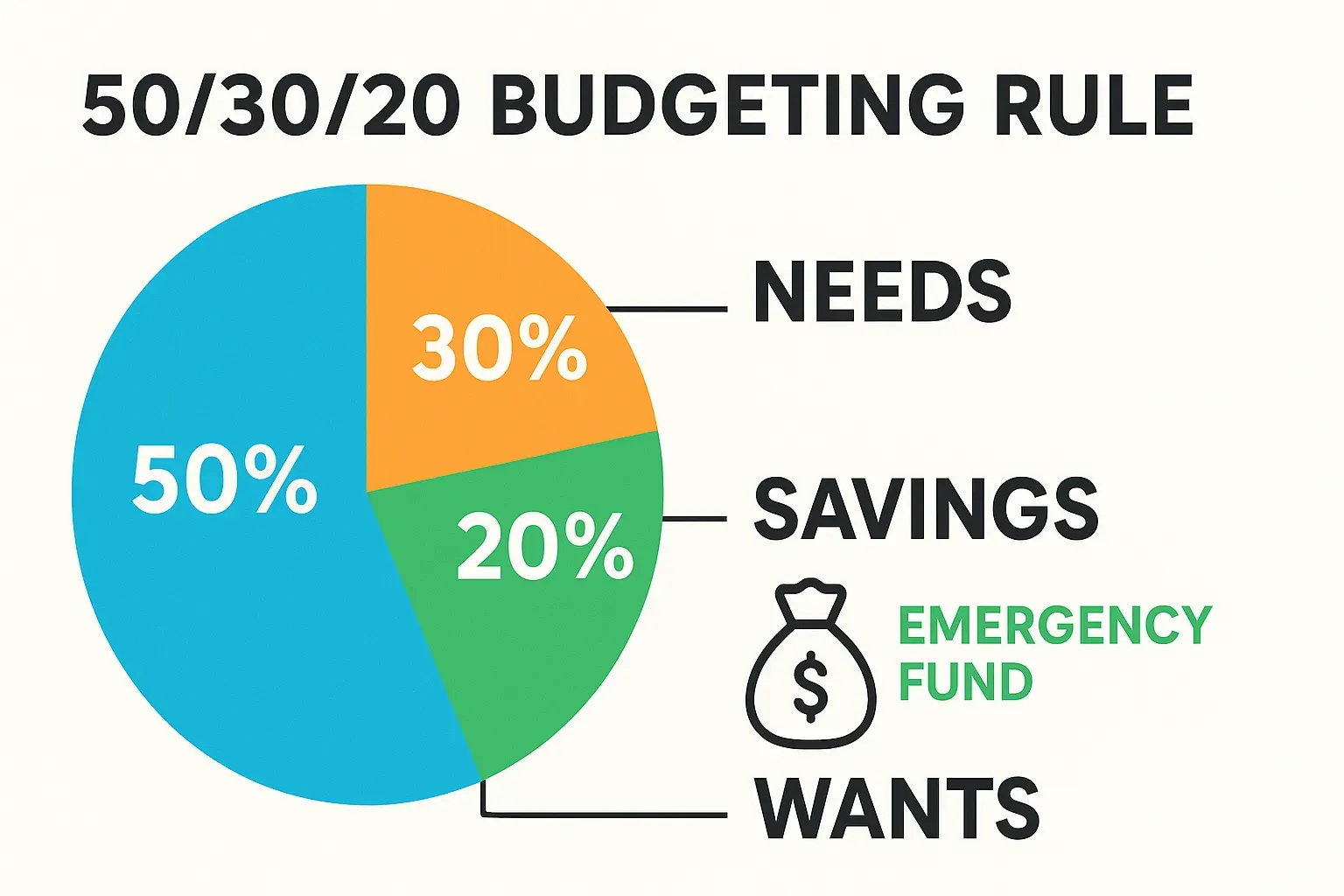

Use the 50/30/20 Budget Rule

The 50/30/20 rule is simple:

50% of income → necessities

30% → wants/discretionary spending

20% → savings (including emergency fund)

This balance ensures consistent savings without neglecting other needs.

Track Your Progress

Motivation grows when you see results.

Set milestones ($500, $1,000, etc.) and celebrate when you hit them. Use charts or trackers to visualize your progress—it makes saving more rewarding.

Avoid Common Budgeting Mistakes

Some budgeting mistakes can sabotage your goals:

Ignoring irregular expenses (insurance, holidays).

Treating wants as emergencies (smartphone, vacation).

Setting unrealistic budgets.

Not updating budget after life changes.

Ignoring debt payments.

Relying only on credit cards.

Tips for Growing and Protecting Your Emergency Fund

What Assets Are Best for an Emergency Fund?

When it comes to storing your emergency fund, liquidity is key. Your emergency savings should be easily accessible in case you need it immediately. The best options include:

– High-Yield Savings Accounts: These accounts offer easy access to your funds while earning more interest than a regular checking account.

– Money Market Accounts: Similar to savings accounts, but often with higher interest rates and withdrawal limits.

– Certificates of Deposit (CDs): While CDs offer higher interest rates, they lock in your money for a set period. Consider only using short-term CDs for emergency savings to ensure access when needed.

What is the most appropriate investment for emergency funds? The focus should be on liquidity and safety. Stocks or other volatile investments are not ideal for emergency funds due to the risk of losing value when you need the money.

How to Raise Money Fast for Emergencies

In a financial pinch, there are ways to quickly build up an emergency fund. Here are a few strategies:

– Sell unused items: Go through your belongings and sell anything you no longer need. Websites like eBay, Craigslist, or local Facebook Marketplace groups can help you offload items quickly.

– Take on a side gig: Whether it’s freelance work, driving for a rideshare service, or offering your skills on platforms like Upwork, these gigs can provide a fast influx of cash.

– Cut back aggressively for one month: Temporarily slashing your budget to the bare essentials can give you a quick savings boost.

Tailoring Your Emergency Fund to Your Situation

How Much Should You Have Saved by 30?

By the age of 30, a general guideline is to have at least six months’ worth of living expenses in an emergency fund. Of course, this amount can vary depending on your individual circumstances, such as whether you have dependents, own a home, or work in a stable industry.

Building a solid emergency fund early on sets a strong financial foundation and helps you avoid debt during unexpected life events. It’s also crucial to continuously reassess your financial situation as you grow older to ensure your savings remain adequate.

What Expenses Shouldn’t Be Considered for an Emergency Fund?

Not every expense should be covered by your emergency fund. Items like routine bills, regular maintenance (e.g., oil changes for your car), and planned purchases (e.g., vacations or new appliances) should not come out of this fund. These expenses should be part of your regular budget.

Your emergency fund is strictly for the unforeseen—events that truly catch you off guard, such as medical emergencies, job loss, or critical home repairs.

FAQs on Building an Emergency Fund

1. How to quickly start building an emergency fund?

Start small by saving a portion of each paycheck, automate your savings, and consider cutting back on non-essential expenses to free up more money. Side gigs and selling unused items can also give a fast boost to your fund.

2. What is the best practice for building an emergency fund?

The best practice is to save enough to cover at least three to six months of living expenses. Keep the money in a liquid, easily accessible account, and only use it for true emergencies.

3. What is a realistic emergency fund amount?

A realistic emergency fund amount depends on your living expenses. For most people, having $1,000 initially and working up to three to six months’ worth of expenses is a practical goal.

4. What assets are best for emergency fund?

High-yield savings accounts, money market accounts, and short-term certificates of deposit (CDs) are the best options for emergency funds because they provide liquidity and security.

5. How much should you have saved by 30?

By age 30, a common recommendation is to have an emergency fund that covers at least six months’ worth of living expenses. This ensures a safety net for unforeseen circumstances.

6. Which expense should not be considered when making an emergency fund?

Regular bills, planned expenses (like vacations), and routine maintenance costs should not come from your emergency fund. It’s reserved for unexpected financial crises, such as job loss or medical emergencies.

7. How do I get an immediate fund?

In urgent situations, selling unused items, picking up a side gig, or cutting back on discretionary spending can help you quickly gather emergency cash.

The 50/30/20 rule suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings (including your emergency fund). It’s a balanced approach to budgeting that ensures consistent savings.

Conclusion: Secure Your Financial Future with an Emergency Fund

By focusing on building an emergency fund today, you secure peace of mind for tomorrow.

But for many, the idea of saving a large amount of money for ‘just in case’ moments can feel daunting.

Where do you start? How much is enough? And how do you ensure you don’t dip into that fund unnecessarily?

Remember, emergencies are inevitable—but financial stress doesn’t have to be. By planning ahead and maintaining an emergency fund, you’re giving yourself peace of mind and the ability to handle life’s surprises with confidence. Start today, and watch your financial safety net grow.