10 Most Powerful Credit Cards for Cashback & Rewards in 2025 – Save Big or Miss Out

Discover the top credit cards for cashback and rewards in 2025, featuring powerful perks that maximize every dollar you spend. This expert-reviewed guide highlights ten standout picks that help you save more and miss nothing.

The best credit cards for cashback & rewards in 2025 have transformed from luxury tools into financial essentials. With India’s growing digital economy and record-high online spending, a good cashback or rewards credit card can be the difference between smart spending and wasted potential.

Consumers today face hundreds of options—each claiming unmatched value. Yet, only a few truly deliver consistent cashback, easy redemption, and flexibility.

- The right credit card can return up to 5% of your annual spending as cashback or reward value.

- Focus on your real spending pattern (online, grocery, dining, travel).

- Avoid credit cards that complicate redemption or hide category limits.

$500 Walmart Gift Card

A $500 Walmart gift card may be available to select users. Checking eligibility is quick. You can check if you’re one of them.

What Are the Best Credit Cards for Cashback & Rewards in 2025?

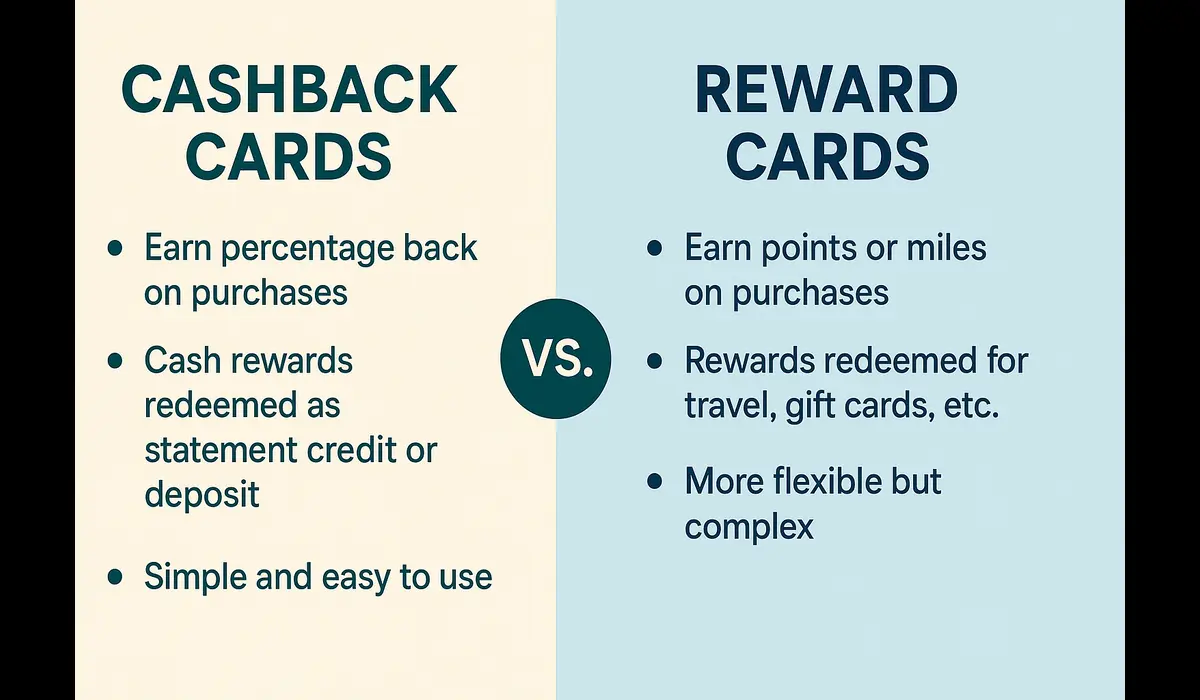

A cashback or rewards credit card gives you value every time you spend. The return comes either as cash credited back to your account or as reward points redeemable for vouchers or travel perks.

In 2025, the definition of “best” is evolving. It no longer means the highest advertised rate but rather the best effective reward rate after accounting for fees, redemption ease, and category alignment.

Types of cards dominating 2025:

- Flat Cashback Cards: Fixed cashback (e.g., 2%–5%) on every spend.

- Category-Specific Cards: High rewards in selected areas (online, fuel, groceries).

- Co-Branded Cards: Partner benefits with online platforms or travel apps.

- Hybrid Reward Cards: Cashback + travel perks.

- Lifetime-Free Cards: Zero annual fee options for moderate users.

Why the Best Cashback & Rewards Cards Matter

- Inflation Offset: Cashback can offset rising prices and recurring subscription costs.

- Digital Payment Growth: More spending is shifting online—perfect for high cashback categories.

- Lifestyle Integration: Rewards are linked with daily habits—shopping, food, entertainment.

- Smart Budgeting: Users consciously track spending to meet fee-waiver thresholds.

- Financial Discipline: Redemption and caps encourage controlled use, reducing impulsive debt.

In 2025, with average annual household credit-card spending surpassing ₹5 lakh, optimizing even a 2% return can save ₹10,000–₹20,000 yearly.

Top 10 Best Credit Cards for Cashback & Rewards in 2025

1. SBI Cashback Credit Card

Why It Wins: Flat cashback on nearly all online spends.

- Cashback: 5% online, 1% offline

- Annual Fee: ₹999 (waived on ₹2 lakh annual spend)

- Redemption: Automatic statement credit

- Best For: Online shoppers, e-commerce buyers

2. HDFC Millennia Credit Card

Why It Wins: Balanced benefits across top categories.

- Cashback: 5% on partner merchants, 1% elsewhere

- Annual Fee: ₹1,000 (waived on ₹1 lakh spend)

- Reward Rate: Effective 3.5%–4%

- Best For: Digital-first millennials

3. Axis Ace Credit Card

Why It Wins: Highest flat cashback rate for UPI + online.

- Cashback: 5% on bill payments, 2% on others

- Annual Fee: ₹500

- Redemption: Direct credit, no expiry

- Best For: Utility bills, recharges, daily transactions

4. Amazon Pay ICICI Credit Card

Why It Wins: Ideal for Amazon ecosystem users.

- Cashback: 5% on Amazon Prime, 3% on others

- Fee: Free for life

- Redemption: Auto applied to Amazon Pay balance

- Best For: Regular Amazon shoppers

5. Flipkart Axis Bank Credit Card

Why It Wins: Consistent partner discounts and cashback.

- Cashback: 5% Flipkart, 4% Swiggy/Zomato, 1.5% others

- Fee: ₹500 (first year free)

- Reward Value: Up to 5% effective return

- Best For: Lifestyle and e-commerce users

6. HDFC MoneyBack+ Credit Card

Why It Wins: Simplified rewards and broad coverage.

- Cashback: 2%–4% on online spends

- Annual Fee: ₹500

- Redemption: Points convertible to vouchers

- Best For: First-time users or low spenders

7. Axis SELECT Credit Card

Why It Wins: Premium lifestyle card with milestone perks.

- Cashback Equivalent: 2%–3% value via points

- Fee: ₹3,000 (waived at ₹6 lakh spend)

- Perks: Lounge access, dining, golf

- Best For: High spenders and travellers

8. IDFC First Millennia Credit Card

Why It Wins: No annual fee + solid reward rate.

- Rewards: 3×–10× points based on spending tier

- Redemption: Easy portal conversion

- Fee: Free for life

- Best For: Young professionals

9. HSBC Cashback Credit Card

Why It Wins: Simple cashback structure and international reach.

- Cashback: 1.5%–10% depending on category

- Fee: ₹750

- Redemption: Auto credit to statement

- Best For: Global online shoppers

10. Tata Neu Infinity HDFC Credit Card

Why It Wins: Co-branded with integrated ecosystem rewards.

- Cashback (NeuCoins): 5%–10% on Tata brands

- Fee: ₹1,499

- Redemption: Across Tata brands

- Best For: Users of Tata brands (Croma, Air India, BigBasket)

How Do Cashback & Reward Credit Cards Work?

- You Spend – Each eligible transaction earns cashback or points.

- Bank Tracks Categories – Bonus rates apply to online, dining, or partner merchants.

- Reward Accumulation – Tracked monthly, redeemable after billing cycle.

- Redemption – Automatic cashback or manual point conversion.

- Annual Fee Offset – Achieve fee waiver through milestone spending.

Pro Tip: Effective reward = (Reward Value – Annual Fee) ÷ Annual Spend.

How to Choose the Best Credit Card for Cashback & Rewards in 2025

Step 1: Track last 3 months of spending by category.

Step 2: Identify top 2 spending types (e.g., online, travel).

Step 3: Match with category-reward card.

Step 4: Calculate real reward rate after caps and fees.

Step 5: Redeem regularly—don’t hoard points.

Common Mistakes and Myths

Mistakes:

- Ignoring category caps.

- Missing annual fee waiver thresholds.

- Delaying redemption—points expire.

- Paying interest (nullifies cashback benefits).

- Over-applying for multiple cards—hurts credit score.

Myths:

- High fee = best rewards (false).

- Cashback always better than points (depends on redemption).

- All online spends qualify (some categories excluded).

Expert Insights and Case Examples

- Frequent Online Spender: Earns ~₹24,000 cashback yearly using a 5% card.

- Mixed Spender (Dining + Groceries): Earns 3% effective rate with dual cards.

- Premium Traveller: Uses Axis SELECT; gains lounge access + ₹30,000 in annual rewards.

Insight: Combining one flat-rate cashback card with one category-specific card gives the optimal mix of simplicity and maximized value.

Future of Cashback & Rewards in 2025 and Beyond

- UPI-linked credit cards Use: Seamless cashback through UPI transactions.

- AI-driven Offers: Personalized category rates based on usage.

- Co-Branded Ecosystem Cards: Partnerships with retail and OTT brands.

- Real-Time Redemption: Instant credit after transaction.

- Gamified Rewards: Spend milestones unlocking bonuses or tiers.

By 2026, over 70% of urban cardholders are expected to hold at least one reward-optimized card.

$750 Cash App Gift Card

Not everyone qualifies for this $750 Cash App gift card. Checking only takes a moment. You can check if you’re eligible.

FAQs

1. What is the best credit card for cashback & rewards in 2025?

It depends on your spending pattern. For broad online spending, the SBI Cashback Card offers the best return.

2. Which card gives the highest cashback in 2025?

The Axis Ace and Flipkart Axis cards consistently rank high with up to 5% cashback.

3. Are cashback cards better than reward points cards?

Cashback is direct and simple. Points cards offer flexibility but may require effort in redemption.

4. Can I use two cashback cards together?

Yes. Use one for online and another for offline categories to maximize total returns.

5. Do cashback cards have hidden charges?

Read terms carefully—watch for caps, exclusions, and transaction fees.

6. How to redeem rewards effectively?

Opt for statement credit or gift vouchers with maximum rupee value conversion.

7. Does using reward cards affect credit score?

No, unless you delay payments. Timely repayments improve your score.

Key Takeaways

- The best credit cards for cashback & rewards in 2025 can yield effective returns of 2–5%.

- Choose based on actual spending pattern, not brand appeal.

- Prefer cards with automatic cashback or easy redemption.

- Combine two cards for balanced coverage.

- Avoid annual fees that erode net benefit.

- Review offers quarterly; terms evolve fast.

Conclusion

Selecting from the best credit cards for cashback & rewards in 2025 is not just about prestige—it’s about optimizing every rupee spent. A wisely chosen card can act as an income booster through consistent cashback and reward points.