9 Shocking Truths About the Best Budgeting Apps for Americans in 2026 — Which Ones Actually Work?

Uncover the shocking truths about the best budgeting apps for Americans in 2026—and which ones actually deliver results. This data-driven guide breaks down real performance, hidden drawbacks, and the apps truly worth trusting with your money.

The best budgeting apps for Americans in 2026 are more powerful and data-driven than ever. As living costs in the U.S. rise by 3.7% year-over-year (U.S. Bureau of Labor Statistics, 2025), millions of Americans are turning to digital tools to gain control over their finances.

Modern budgeting apps now use AI, behavioral insights, and automatic categorization to track spending, cut debt, and increase savings efficiency. From free trackers to premium investment-linked tools, choosing the right app can make the difference between monthly overspending and long-term stability.

- Budgeting apps in 2026 integrate AI-based automation, real-time insights, and multi-account syncing.

- Popular choices like YNAB, Monarch Money, and Rocket Money dominate the market for their accuracy and usability.

- Americans save 15–25% more on average after consistent app-based budgeting.

What Are Budgeting Apps and How Do They Work?

A budgeting app is a digital financial tool designed to help individuals track income, expenses, and savings goals through mobile or web-based platforms.

$500 PayPal Gift Card$500 PayPal Gift Card

Not everyone qualifies for this $500 PayPal gift card. Checking only takes a moment. You can check if you’re eligible.

Background

The first-generation budgeting apps (like Mint, launched in 2006) focused on simple expense tracking. By 2026, tools leverage AI-powered forecasting and bank-level security to create a holistic personal finance experience.

How They Work

- Sync Accounts: Connect bank, credit card, and investment accounts.

- Track Transactions: Automatically categorize spending (e.g., groceries, bills, subscriptions).

- Set Budgets: Create monthly or category-based spending limits.

- Get Insights: Receive alerts and suggestions based on spending patterns.

- Plan Goals: Track debt payoff, retirement, or emergency funds.

Why Budgeting Apps Matter in 2026

1. Rising Cost of Living

With inflation outpacing wage growth, apps give Americans a data-driven approach to financial discipline.

2. Shift Toward Digital Finance

According to Pew Research (2025), 78% of Americans now manage finances through digital apps rather than spreadsheets or paper budgets.

3. Automation = Consistency

Unlike manual tracking, AI-driven automation ensures accuracy, motivation, and habit formation.

4. Financial Literacy

Apps now include educational dashboards that teach credit management, debt reduction, and tax efficiency—vital in a volatile economy.

Top 10 Best Budgeting Apps for Americans (2026 Edition)

Here’s the updated 2026 ranking based on functionality, data security, value for money, and user reviews.

1. YNAB (You Need A Budget)

Best For: Goal-oriented savers and zero-based budgeting enthusiasts.

Monthly Fee: $14.99

Key Features:

- Rule-based budgeting (assign every dollar a job)

- Real-time syncing with multiple accounts

- Goal tracking and debt payoff tools

Pros:

- Excellent user community

- Proactive approach encourages discipline

Cons:

- Learning curve for beginners

Expected Savings Impact: 25% higher success in monthly savings goals (source: YNAB User Survey 2025).

2. Monarch Money

Best For: Family budgeting and joint financial planning.

Monthly Fee: $9.99

Features:

- Shared budgets for families or couples

- AI insights on cash flow

- Net worth tracking

Pros:

- Clean interface, perfect for households

- Robust collaboration features

Cons:

- Limited free trial period

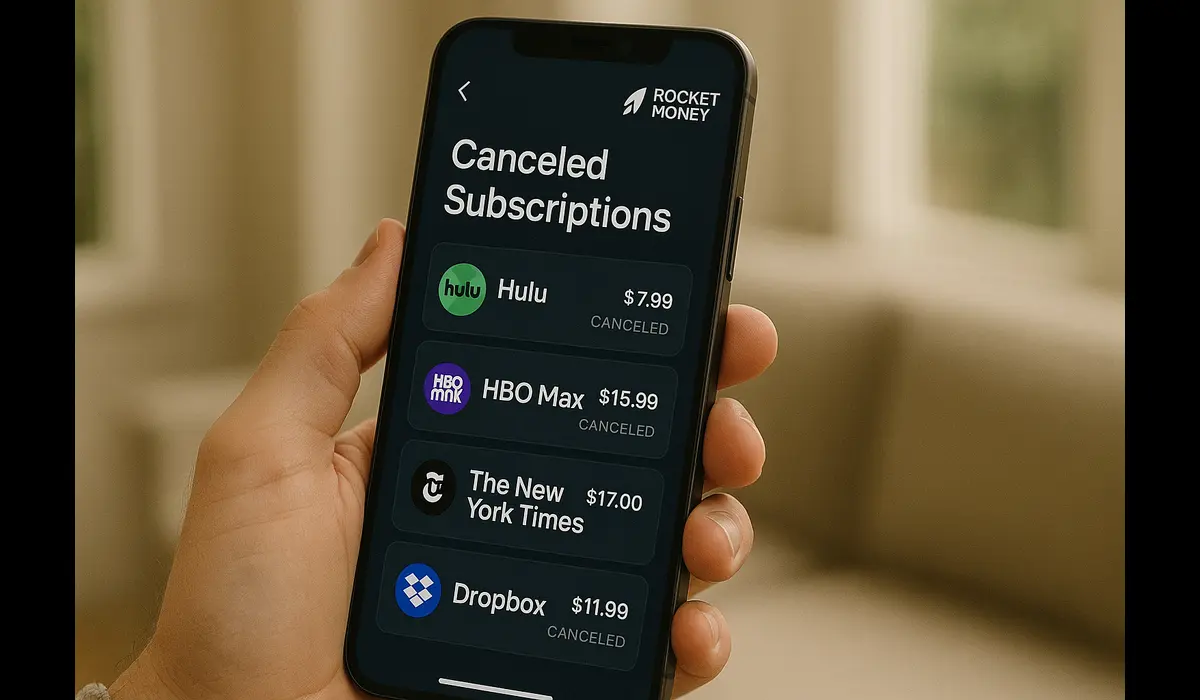

3. Rocket Money (formerly Truebill)

Best For: Subscription tracking and expense reduction.

Monthly Fee: Free basic plan, premium at $7/month.

Features:

- Subscription cancellation automation

- Bill negotiation services

- Expense categorization

Pros:

- Excellent for managing recurring payments

- Saves users $200–$600 annually on average

Cons:

- Premium tier required for negotiation services

4. PocketGuard

Best For: Simple, hands-off budgeting.

Monthly Fee: Free / Premium $7.99

Features:

- “In My Pocket” feature shows safe-to-spend balance

- Secure connection with major U.S. banks

- Automated spending analysis

Pros:

- Great for minimalists

- Strong data security protocols

Cons:

- Fewer custom categories compared to YNAB

5. Goodbudget

Best For: Manual envelope budgeting traditionalists.

Monthly Fee: Free / Plus $8/month

Features:

- Envelope-based budgeting system

- Expense tracking and debt repayment tools

Pros:

- Transparent, simple interface

- Ideal for teaching financial habits

Cons:

- Manual entry can be time-consuming

6. Simplifi by Quicken

Best For: Tech-savvy professionals seeking automation.

Monthly Fee: $3.99 (annual plan)

Features:

- Customizable spending goals

- Real-time expense categorization

- Investment and cash flow analysis

Pros:

- Reliable data sync, minimal glitches

- Bank-grade encryption

Cons:

- No free version available

7. Empower (formerly Personal Capital)

Best For: Investors seeking holistic financial tracking.

Monthly Fee: Free core features

Features:

- Tracks investments, retirement accounts, and budgets

- Net worth tracking with AI analysis

Pros:

- Ideal for high-net-worth users

- Free investment dashboard

Cons:

- Focused more on wealth management than micro budgeting

8. Honeydue

Best For: Couples and shared financial goals.

Monthly Fee: Free

Features:

- Joint expense tracking

- Chat-based transaction notes

- Bill reminders for shared accounts

Pros:

- Promotes transparency between partners

- 100% free

Cons:

- Limited for single users

9. EveryDollar

Best For: Faith-based zero-based budgeting.

Monthly Fee: Free / Plus $13.99

Features:

- Guided budgeting following Dave Ramsey’s principles

- Debt snowball calculator

Pros:

- Trusted methodology

- Strong educational content

Cons:

- Premium version needed for account syncing

10. Wally

Best For: Customizable expense tracking.

Monthly Fee: Free

Features:

- Multi-currency and multi-account support

- Expense visualization

Pros:

- Clean and modern design

- Supports global currencies

Cons:

- Occasional app sync delays

How to Choose the Best Budgeting App

Step 1: Identify Your Needs

Are you budgeting as a single user, couple, or family? Apps like Monarch or Honeydue suit joint users.

Step 2: Prioritize Security

Ensure the app uses 256-bit encryption and two-factor authentication (2FA).

Step 3: Check Sync Capability

Multi-bank syncing saves time and increases accuracy.

Step 4: Compare Costs vs Features

Free tools like Rocket Money may suffice, but premium apps offer deeper insights.

Step 5: Trial and Track

Use free trials to assess usability and fit before committing.

Common Mistakes When Using Budgeting Apps

- Ignoring Categorization Errors: Always review automatic labels for accuracy.

- Over-Reliance on Automation: Insights work best with active goal updates.

- Not Reviewing Weekly: Failing to check progress reduces awareness.

- Skipping Security Updates: Use official app stores only.

Expert Insights and Case Studies

Case Study 1: The Family Saver

A family of four in Texas used Monarch Money for six months, reducing unnecessary spending by 18%.

Case Study 2: The Solo Professional

A Chicago freelancer using YNAB increased annual savings from $4,500 to $6,200 through zero-based budgeting.

Expert Opinion:

Dr. Emily Rhodes, Financial Literacy Advisor at the University of Michigan, notes:

“Budgeting apps in 2026 bridge the psychological gap between intention and execution. They create accountability with behavioral nudges.”

Future Trends in Budgeting Technology

- AI Financial Coaching: Personalized insights and chatbots replacing static dashboards.

- Crypto & Investment Integration: Apps will include wallets and investment forecasting.

- Voice-Activated Budgeting: Integration with Alexa and Google Assistant.

- Smart Spending Rewards: Budgeting tied with cash-back and loyalty ecosystems.

$750 Amazon Gift Card$750 Amazon Gift Card

Some users qualify for a $750 Amazon gift card. You can check if you qualify.

FAQs

1. What are the best budgeting apps for Americans in 2026?

YNAB, Monarch Money, and Rocket Money lead in accuracy, security, and usability.

2. Are budgeting apps safe to use?

Yes, top apps use bank-level 256-bit encryption and two-factor authentication.

3. Which app is best for couples?

Honeydue and Monarch Money offer joint budgeting and shared expense tracking.

4. Are free budgeting apps worth it?

Yes, tools like Rocket Money and Wally provide solid free-tier options for most users.

5. Which app offers AI-based insights?

Simplifi and Monarch Money are leading AI-integrated budgeting platforms.

Key Takeaways

- The best budgeting apps for Americans are increasingly AI-powered and user-centric.

- YNAB and Monarch Money dominate for serious users; Rocket Money and Honeydue shine for accessibility.

- Always assess security, usability, and ROI before subscribing.

- Smart budgeting saves Americans thousands annually when used consistently.

Conclusion

The best budgeting apps for Americans in 2026 reflect the new era of financial self-awareness—where automation meets accountability. Whether you’re a single professional managing subscriptions or a family tracking joint goals, today’s apps can transform your finances in months.In a world where every dollar matters, the best budgeting app isn’t just a tool—it’s your daily financial partner.